Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Rising demand for refurbished smartphones in the Middle East and Africa (part 1)

The adoption of smartphones in the Middle East and Africa (MEA) has seen a significant increase, driven by factors such as enhanced affordability, expanding digitalization and growing consumer demand for technology. Consequently, there is a thriving market for used and refurbished smartphones.

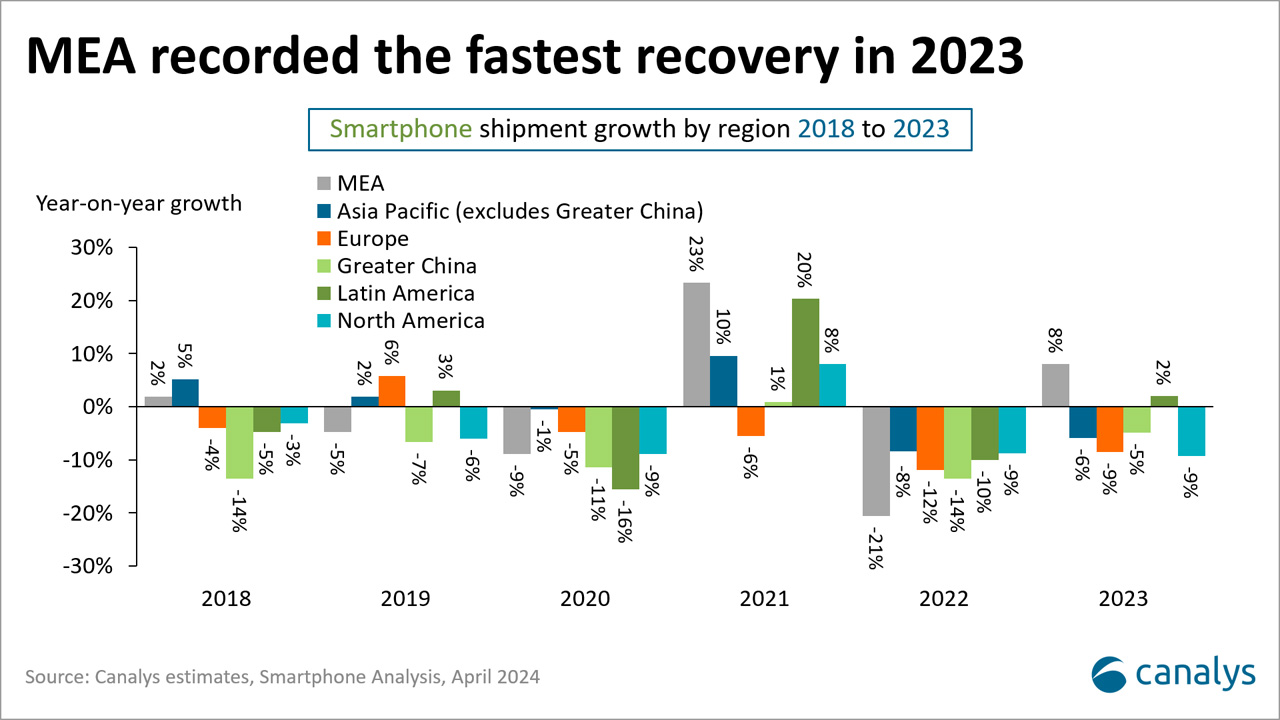

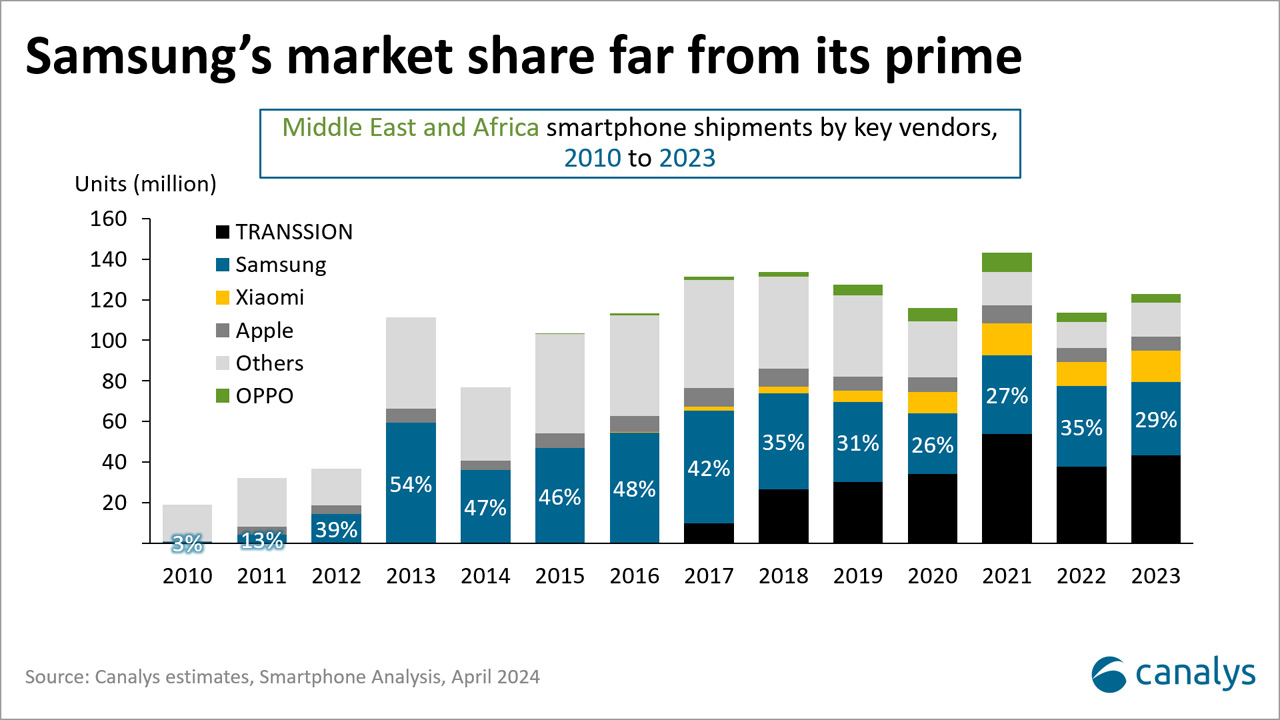

The Middle Eastern and African market has had a rollercoaster ride in recent years. Rapid market recovery has led it to become the hottest emerging market for technology investment. While the MEA smartphone market was the fastest growing in 2023 at 8%, the incumbents, Samsung and Apple, have not benefited from the rebound. Samsung’s market share was down 45% in 2023 from its peak in 2013, while its shipments were down 39%. For Samsung, low-end competition from Chinese vendors was one of the biggest challenges across most of the emerging markets, forcing it to cut its low-end portfolio and divert focus to high-end profitable growth. Another looming factor affecting Samsung and Apple’s new device shipments is the fast-growing refurbished and used phone market.

Market drivers for refurbished devices

The main drivers behind the growth of the refurbished smartphone market in the Middle East and Africa are primarily similar to what developed markets are experiencing:

- Increasing new device prices driven by inflation and material costs, especially premium devices from Samsung and Apple creeping past the US$1,000 mark.

- Consumers’ willingness to upgrade is low, given that hardware specification upgrades have not sparked the desire to pay.

- Inflation-driven living expenses reaching sky-high levels have reduced consumers’ purchasing power, delaying the purchase of non-essential items.

- Governments and corporations are pushing the ESG theme, forcing vendors to provide more extended warranties, device repair and after-sales services to extend devices’ lifespans.

But there are some factors unique to the Middle East and Africa:

- Affordability and availability of financial plans and The high popularity of sub-US$100 devices in African markets, where only a few brands can offer new devices in this price bracket. Meanwhile, despite the growing availability of financing options, buying new smartphones is still out of reach for most mass-market consumers.

- High import taxes and smartphone duties have been raising retail prices in addition to the fluctuation of local currencies, curtailing smartphone demand, especially for high-end smartphones in countries such as Egypt and Turkey.

- Availability of some highly sought-after device brands. There is insufficient supply, or vendors do not have official distribution networks, such as Apple.

- Association of brand and quality. Consumers place a lot of trust in brands such as Samsung, making refurbished Samsung devices highly popular compared with new devices from other Android brands.

- Improved warranty programs from local channel players have given consumers the trust to buy refurbished smartphones.

The supply landscape in the Middle East and Africa

Like other developed regions, Apple iPhones have a significant presence in channels selling used smartphones in the Middle East, closely followed by Samsung’s premium series and select Chinese brands, such as OPPO. But consumer demand in Africa can vary greatly between countries. The ASP of the most popular refurbished devices is much lower, at around US$45, in markets such as Kenya, with nearly 80% of refurbished smartphones under US$100. The dominant brand is Samsung instead of Apple, which explains Samsung’s declining position in the new phone market.

The Middle East and Africa’s used phone supply primarily relies on the influx from diverse international markets, encompassing the US, Europe and Hong Kong. Particularly prevalent in the US and Europe, trade-in programs significantly contribute to the availability of used phones. Acting as a central hub, the Dubai Airport Free Zone plays a pivotal role in distributing stocks from various parts of the world, subsequently disseminating across the UAE and throughout the Middle East and Africa. In Dubai’s dynamic market, approximately 60% or more of imported products are earmarked for re-export to diverse Middle Eastern and African countries.

Many channels capitalize on the surge in demand for refurbished smartphones in MEA. Online players, such as Badili, a Kenyan re-commerce platform, are facilitating smartphone trade-ins. Badili’s partnerships with major vendors, such as OPPO and Samsung, offer access to the latest devices. In Egypt, MobileMasr leads in refurbished smartphone sales with a 30-day warranty. This shift, driven by online platforms and strategic partnerships, reflects a growing demand for sustainable and accessible choices in the used phone market. South African telecoms operator Vodacom drives trade-ins under the theme of “RedLovesGreen”, with trade-in options for used and old phones, giving consumers a chance to upgrade. Vodacom South Africa is selling good-as-new used devices.

While online platforms remain the primary avenue for reaching potential buyers of used/certified refurbished phones, many offline retailers, especially in the mass market sector (independent retail), depend on informal recommendations and use social media platforms such as TikTok, Facebook and Instagram. In locations such as the UAE, specific stores achieve significant profitability, prompting them to collaborate with local influencers to highlight attractive deals. On the contrary, in Iraq, many wholesalers and retailers of refurbished phones opt for traditional bricks-and-mortar stores, targeting younger consumers influenced by peer pressure who aspire to own premium Apple or earlier-generation Samsung Galaxy devices.

There are big implications for the growing used and refurbished smartphone market, as demand for affordable, high-quality devices continues to rise. To navigate challenges related to trust, sustainability and operational efficiency, collaboration among the device value chain, regulatory bodies and consumers is vital for the industry’s future trajectory. More importantly, it presents a double-edged sword for device vendors predominantly incentivized by greater new device sales. They will potentially lose their foothold even more quickly if they do not have a strategy to join with local channels and ecosystems to capitalize on the smartphone trend. Canalys will address these key topics in an upcoming blog post and client-only report.