Canalys: Vivo ships 5.8 million smartphones to India in Q2 2019; breaks its own record

Shanghai, Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Monday, 29 July2019

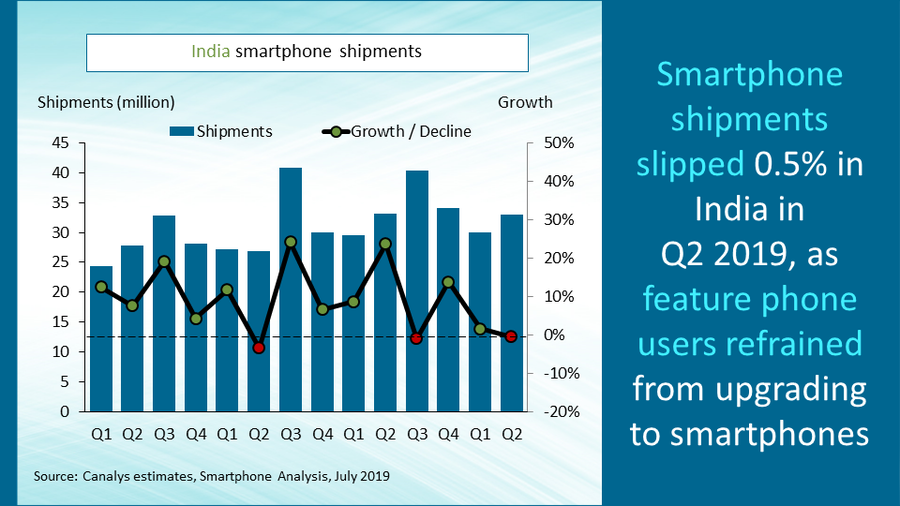

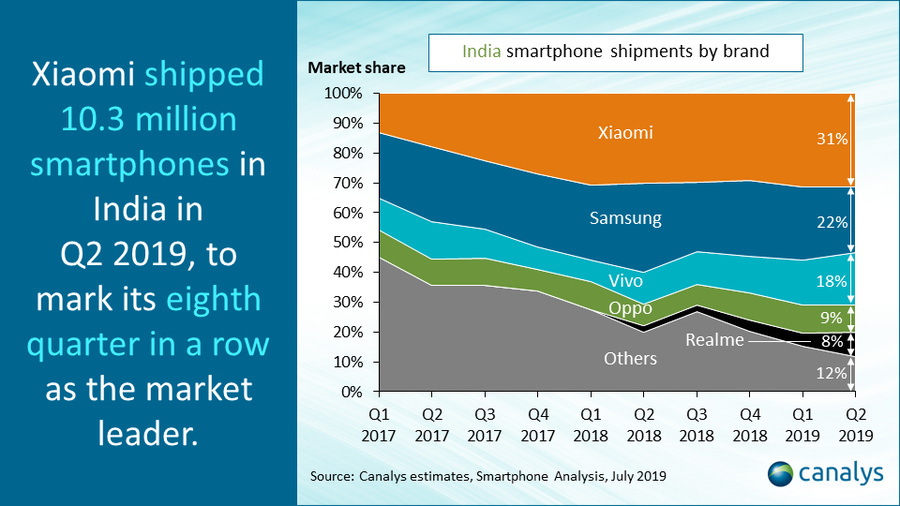

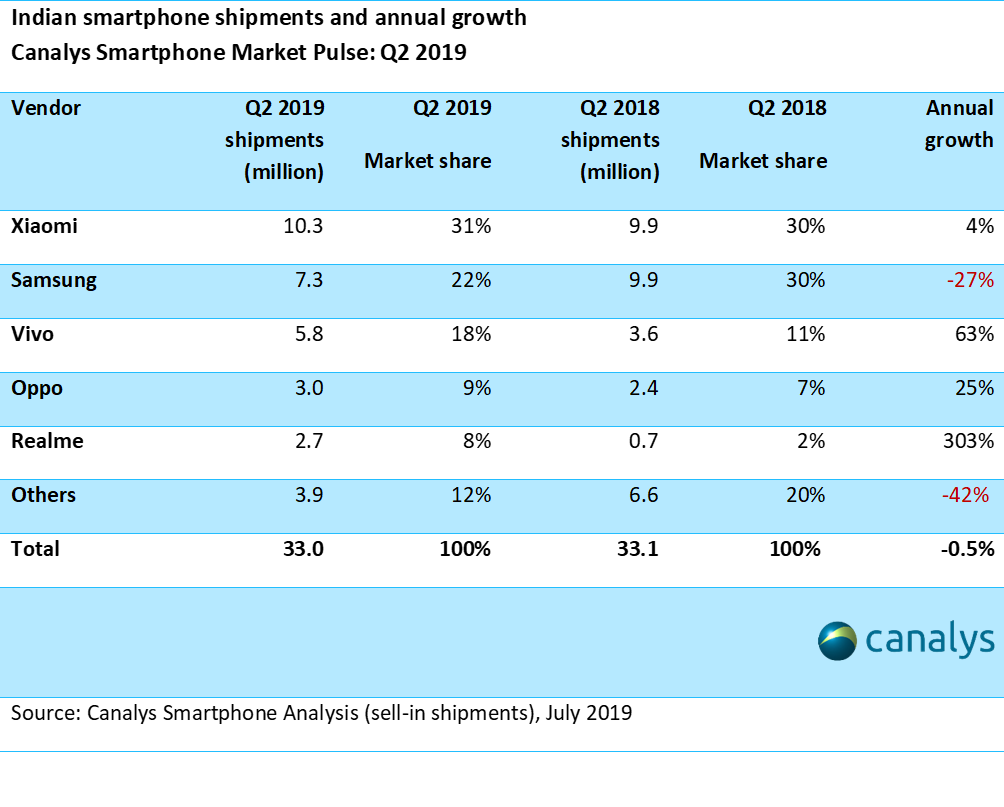

Chinese smartphone maker Vivo is on a roll in India, smashing its previous record of 4.5 million units to ship 5.8 million smartphones in Q2 2019. Its market share hit 18%, up from 10% a year ago and 15% in Q1 2019. Its performance streak is particularly impressive against an overall smartphone market which declined slightly in India, to 33.0 million units. Xiaomi, the Indian market leader, extended its reign to eight consecutive quarters as it shipped 10.3 million smartphones and achieved more than 30% share for the second quarter in a row. Second-placed Samsung, the only vendor in the top five that declined, saw shipments fall by 27% to 7.3 million units. Vivo was placed third, followed by Oppo and Realme, in fourth and fifth place respectively.

“Vivo’s growth-stamina is commendable,” said Canalys Analyst Shengtao Jin. “Its current trajectory would see it displace Samsung by the end of 2019, dealing a major blow to the Korean vendor. However, Samsung has now completed a disruptive portfolio refresh, which has positioned it to fight harder for share with tight margins.”

Vivo focuses on the market for smartphones priced in the range of INR 10,000 to INR 15,000. Its top shipping smartphones this quarter were the Vivo Y17 and the Vivo Y91, which shipped over

1.5 million units in Q2 2019.

“The decline in the market is not a cause of worry,” said Rushabh Doshi, Research Director at Canalys. “However, the lack of growth is against the expectation of several major vendors. Feature phone users are not taking to smartphones as quickly as the industry had expected and the bulk of growth in the Indian smartphone market is now coming from users who are upgrading their devices to a US$200 (~INR 15,000) or even a US$300 (~INR 20,000) smartphone. India must now brace for further sluggish volume growth, as vendors stop focusing on sub-10,000 INR (~US$150) devices and move on to beef up 10,000 INR (~US$150) to 20,000 INR (~US$300) portfolios. However, the silver lining to this shift will be a brisk uptick in ASPs.”

The market continues to consolidate about the top five vendors. They accounted for 88% of the market this quarter, versus 80% a year ago.

For more information, please contact:

Canalys APAC (India)

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Canalys APAC (Singapore): +65 6671 9399

Shengtao Jin: shengtao_jin@canalys.com +65 9113 7976

Matthew Xie: matthew_xie@canalys.com +65 8223 4730

Canalys APAC (Shanghai): +86 21 2225 2888

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Canalys EMEA: +44 118 984 0520

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Mo Jia: mo_jia@canalys.com +36 7 856 837 66

Canalys Americas: +1 650 681 4488

Vincent Thielke: vincent_thielke@canalys.com +1 650 644 9970

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

China: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China

India: 43 Residency Road, Bengaluru, Karnataka 560025, India

Singapore: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535

UK: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK

USA: 319 SW Washington #1175, Portland, OR 97204 USA

email: contact@canalys.com | web: www.canalys.com