'Chinese smartphone vendors take a record 32% market share in Europe in 2018' Canalys says

Palo Alto, Shanghai, Singapore and Reading (UK) – Thursday, February 13 2019

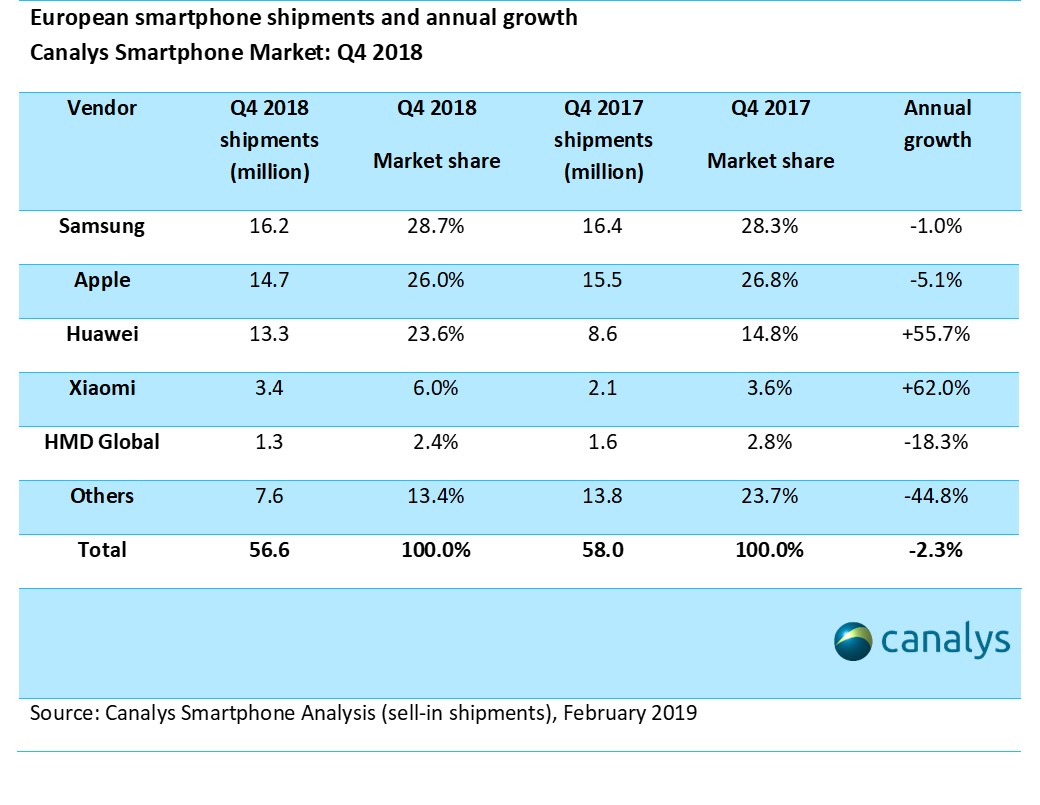

Canalys estimates show that European smartphone shipments fell 4% in 2018 to 197 million units. In Q4 2018, shipments fell 2% to 57 million, though Chinese vendors gained significantly. Samsung remained the largest vendor in 2018 but its shipments were down over 10% at 61.6 million units. Apple was down 6% but clung onto second place with 42.8 million units shipped. Huawei was the stand-out vendor, growing 54% with 42.5 million shipments. Relative newcomers Xiaomi and HMD Global grew strongly and were fourth and fifth respectively.

“The political situation between Chinese companies and the US government has benefited European consumers,” said Senior Analyst Ben Stanton. “The US administration is causing Chinese companies to invest in Europe over the US. The European market is mature, and replacement rates have lengthened, but there is an opportunity for Chinese brands to displace the market incumbents. The likes of Huawei and Xiaomi bring price competition that has stunned their rivals as they use their size against the smaller brands in Europe.”

Western European smartphone shipments fell 8%, the biggest decline of the sub-regions, to 128 million units in 2018, the lowest level since 2013. An increase in average selling prices, caused by an uplift in flagship pricing by Apple, Samsung and Huawei, offset some of the declines. Central and Eastern Europe continued to grow in 2018, up 5% to 68 million units. Many countries in CEE have now reached maturity, but Russia remains a strong grower, up 14% year on year in 2018.

“There are interesting country-level differences in Western Europe,” said Stanton. “The markets with the highest ASPs, such as the UK, Germany and the Nordics, have suffered the sharpest declines. There hasn’t been innovation in the flagship smartphone space to entice customers to upgrade. But in countries with lower ASPs, such as Italy and Spain, there was growth in 2018. This reflects a transformation in the mid-range segment in 2018, with notch displays and dual cameras coming down to aggressive price points. Unlike at the high end, the caliber of smartphones available for US$300 changed significantly between 2017 and 2018, which helped facilitate upgrades. Smartphones priced between US$200 and US$350 grew over 20% in Western Europe in 2018. Canalys expects Chinese vendors will continue growing across all price segments in 2019.”

For more information, please contact:

Canalys EMEA: +44 118 984 0520

Ben Stanton: ben_stanton@canalys.com +44 118 984 0525

Kelly Wheeler: kelly_wheeler@canalys.com +44 118 984 0529

Canalys APAC (Shanghai): +86 21 2225 2888

Nicole Peng: nicole_peng@canalys.com +86 21 2225 2815

Mo Jia: mo_jia@canalys.com +86 21 2225 2812

Canalys APAC (Singapore): +65 6671 9399

Rushabh Doshi: rushabh_doshi@canalys.com +65 6671 9387

Shengtao Jin: shengtao_jin@canalys.com +65 6657 9303

Canalys Americas: +1 650 681 4488

Vincent Thielke: vincent_thielke@canalys.com +1 650 656 9016

Marcy Ryan: marcy_ryan@canalys.com +1 650 681 4487

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).