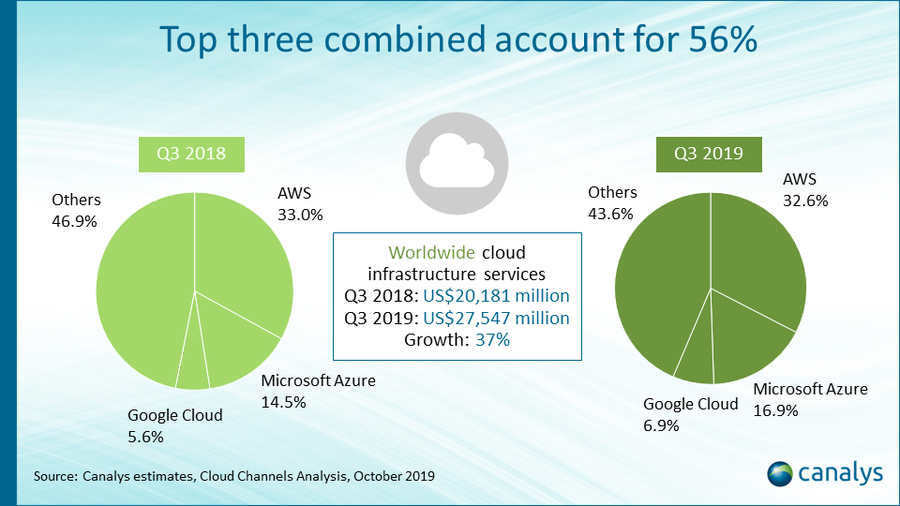

Canalys: Global cloud market up 37%, with channels creating new growth engine

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Wednesday, 30 October 2019

The worldwide cloud infrastructure services market grew 37% in Q3 2019 to reach US$27.5 billion. Market leader Amazon Web Services (AWS) retained its dominant position, with growth of US$2.3 billion equal to the year-on-year increase of the next three players combined. But AWS’ rise of 35% represented another consecutive quarter of slowing growth, and it was outpaced significantly by second-place Microsoft Azure, which grew 59%. AWS’ market share slipped, taking it below 33%, while Azure’s rose to 17%. Google Cloud also accelerated, up 69% at US$1.9 billion. This secured its position as one of the frontrunners in the global cloud race.

The global cloud providers are reaching a critical point in their growth strategies, as enterprises of all sizes adopt multi-cloud and hybrid IT models. End-user organizations pursuing cloud-centric initiatives for digital transformation are seeking the best cloud platforms to run specific applications, AI, analytics or general-purpose compute. Many are also keen to balance their investments across more than one cloud provider to spread risk. Microsoft’s highly publicized win over AWS to secure the JEDI cloud contract with the US Defense Department, worth US$10 billion over 10 years, partly reflects the US government’s strategy to spread risk across multiple providers, an approach now adopted by many enterprises. “This balancing creates a huge demand for channel partners to provide consulting, migration, integration and management services across multiple platforms,” said Daniel Liu, Canalys Research Analyst. “The channel is becoming a new catalyst for continued growth for hyperscale cloud service providers, particularly as competition intensifies.”

“Success will increasingly be defined by the technology alliances forged by the cloud providers, as well as developing relationships with key channel categories,” added Alastair Edwards, Chief Analyst at Canalys. “Microsoft has built new partnerships with Oracle, VMware and most recently SAP, which give it greater credibility with enterprises as core applications are migrated to the cloud.”

Google’s strategy to focus on specific applications and verticals, combined with a major investment in internal sales and partner resources, is similarly designed to make it more relevant to enterprise customers and partners, particularly vertically aligned systems integrators. Google has continued to open new cloud data center regions around the world. “The largest systems integrators are investing in partnerships and building business practices with all three of the top cloud providers – AWS, Microsoft and more recently Google Cloud – recognizing that their customers want support across all the major platforms. Other channel partners are increasingly doing the same,” said Edwards.

AWS remains a formidable leader, and the launch of its Outposts server by the end of 2019 – extending AWS into customer data centers and edge environments for the first time – gives it a powerful weapon in the battle for enterprise awareness in 2020, and for partner attention. At this month’s Canalys Channels Forum in Barcelona, Canalys predicted that AWS will be a top four on-premises server vendor in the US and Western Europe within three years. Partners will play a critical role in sizing and deploying Outposts for hybrid IT customers.

While Microsoft and Google have established partnerships with VMware to allow VMs to migrate to their cloud platforms, AWS retains a firm lead with VMware on AWS, a lucrative solution for partners. With number four global cloud provider Alibaba extending its reach into distribution around the world, and IBM strengthening its multi-cloud management proposition for partners with Red Hat, 2020 will be a critical year for cloud channels.

Canalys tracks the key global developments of the cloud channel to market through its unique advisory service, Cloud Channels Analysis.

For more information, please contact:

Canalys EMEA

Matthew Ball: matthew_ball@canalys.com +44 7887 950 505

Alastair Edwards: alastair_edwards@canalys.com +44 7901 915 991

Canalys APAC (India)

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Canalys APAC (Shanghai)

Daniel Liu: daniel_liu@canalys.com +86 158 0075 6471

Canalys APAC (Singapore)

Sharon Hiu: sharon_hiu@canalys.com +65 9777 9015

Canalys USA

Alex Smith: alex_smith@canalys.com +1 650 799 4483

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

China: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China

India: 43 Residency Road, Bengaluru, Karnataka 560025, India

Singapore: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535

UK: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK

USA: 319 SW Washington #1175, Portland, OR 97204 USA

email: contact@canalys.com | web: www.canalys.com