Android on 80% of smart phones shipped in 2013

Palo Alto, Shanghai, Singapore and Reading – Thursday, 30 January 2014

Canalys has published its final smart phone shipment estimates for the 50-plus countries that it tracks. Just shy of 1 billion handsets (998 million) shipped in full year 2013, a 44% increase on 2012. Android’s dominance grew with the platform running on 79% (785 million) of the devices shipped in 2013, up from 68% in 2012. Conversely, Apple’s iOS share fell from 20% to 15%, despite shipments increasing to 154 million. Microsoft saw a percentage point share rise to 3% as shipments increased 90% in 2013 to 32.1 million, driven by Nokia’s Lumia devices, and putting it ahead of BlackBerry, at 19.8 million. Samsung also performed strongly in 2013 and strengthened its position as the world’s leading smart phone vendor. Its market share jumped from 30% in 2012 to 32% in 2013. With Apple in second place, Huawei edged past Lenovo to claim third place, albeit by fewer than 5 million units.

Some 292.8 million smart phones shipped in the fourth quarter of 2013. Contrary to what it achieved in 2013 as a whole, Apple gained market share in Q4, rising from 13% to 17% sequentially, chiefly at Samsung’s expense. Samsung itself achieved a market share that was flat on Q4 a year ago at 29%, but down from 34% sequentially. Huawei held third place in Q4, as it did in Q3, which helped it take third place for the full year too. While China continues to account for the vast majority of its shipments, growth has been helped by success in the Middle East and Africa.

Lenovo’s recent Motorola deal will increase competition. The acquisition will bring challenges, but Lenovo’s management credibility and global brand recognition give it a head start. ‘A strengthened Lenovo will affect all the other Android partners. Asus, LG and Samsung have enjoyed high-profile partnerships with Google for the supply of its Nexus phones and tablets. Nexus supply will now presumably pass to Lenovo, which also gains an immediate entry into the US, Motorola’s major market, as well as key markets in Western Europe and Latin America,’ said Palo Alto-based Canalys VP and Principal Analyst, Chris Jones. Lenovo, Motorola and Google combined accounted for 6% of worldwide Q4 smart phone shipments. ‘Lenovo must continue with Motorola’s speed-of-update strategy and ensure it can create pull for its smart phones through the carrier channel in mature markets when up against the might of Apple and Samsung. We expect Lenovo to double its worldwide smart phone market share within two years and achieve double-digit market share by 2015 at the latest,’ Jones added.

In OS terms, Windows Phone saw the fastest year-on-year growth among the major platforms, at 69%, despite a modest sequential decline of 6% from Q3 2013. This compares favorably with Android shipments, which grew 54% and iOS shipments, which grew just 7%.

‘The soft end to the year stopped Microsoft from achieving still more positive growth,’ said Shanghai-based Canalys Analyst, Jingwen Wang. ‘Market uncertainty and caution affected Nokia’s performance in Q4, with Microsoft’s acquisition of its devices business yet to complete, as did arguably insufficient marketing, as Nokia and Microsoft failed to stimulate sufficient demand for the latest Lumia products to deliver a seasonal sales boost. With Lumia accounting for such a dominant portion of Windows Phone shipments, the growth of the OS faltered too. It will be vital that on completion of the acquisition, integration takes place quickly and thoughtfully. Microsoft has much to do if it is to continue carving out a growing share of the smart phone market, not least driving the platform down to new entry-level price points, delivering innovation and new features, particularly at the high-end, and proactively working with, supporting and encouraging developers to commit to building compelling apps, and bring its app story closer to parity with its competitors. It cannot afford lengthy delays or distractions, and the combined Windows Phone devices team needs to hit the ground running.’

To view this chart and more from this service or other services that Canalys offers download the new Insight @Canalys app today from Apple App Store, Google Play store or as an HTML 5 web app

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. Our customer-driven analysis and consulting services empower businesses to make informed decisions and generate sales. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive press releases directly, or for more information about our events, services or custom research and consulting capabilities, please complete the contact form on our web site.

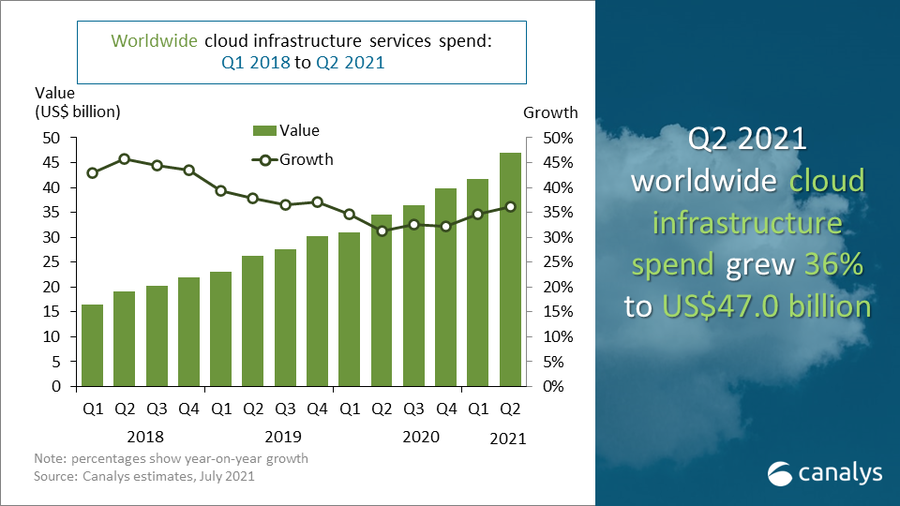

Global cloud services spending exceeded US$47 billion in Q2 2021