Half a billion PCs to ship in 2013 as tablet sales rocket

Shanghai, Palo Alto, Singapore and Reading – Tuesday, 11 June 2013

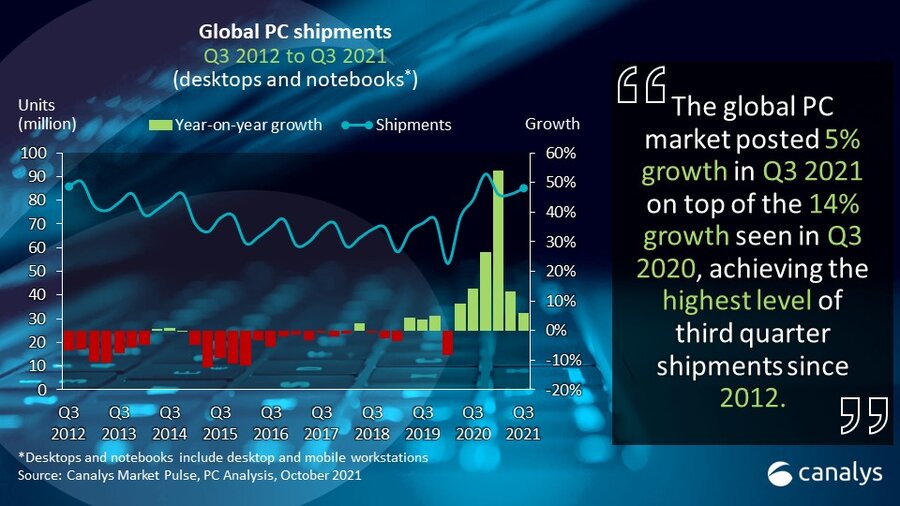

Canalys’ latest forecasts for the PC market (desktops, notebooks and tablets) predict that 493.1 million units will ship in 2013, representing 7% year-on-year growth. The key driver behind this growth will be tablets, which will account for 37% of the market, up from a quarter in 2012. Looking ahead to 2017, Canalys expects that 713.8 million PCs will ship worldwide (a CAGR of 9.7%), with 64% being tablets and 25% notebooks.

Worldwide demand for tablets has gone from strength to strength, while that for desktops and notebooks has waned. In the first quarter of 2013, the desktop market fell 10.3% and the notebook market declined 13.1%. The size of the tablet market, however, more than doubled in Q1 2013, with a 106.1% increase in shipments to 41.9 million units. Shipments show no sign of slowing and Canalys forecasts that in 2013 tablet shipments will reach 182.5 million units, with global tablet shipments surpassing those of notebooks in the final quarter of the year.

The reception to Windows 8 has not reinvigorated demand for Microsoft-based PCs but there is a glimmer of hope for OEMs with Microsoft’s plan to release Windows 8.1 as a free upgrade. ‘Microsoft will continue to innovate. New versions will come and its OS release cycle will gain speed. But it must address some of the criticisms that have been directed at the OS’s user interface or it risks losing even more ground to iOS and Android in the PC space,’ said Tim Coulling, Senior Analyst at Canalys.

A plethora of PC vendors have now come to market with cheaper Android devices, notably Acer, Asus and HP, but these vendors are joining a crowded market. ‘Shipment numbers can be high but absolute margins on these products are expected to be small. Low-priced tablets will not be lucrative but it is necessary to compete or a vendor will simply lose relevance and scale. In fact, accessories, particularly cases, as well as the new generation of high-tech ‘appcessories’ will likely provide higher margins than the products themselves,’ said Pin-Chen Tang, Research Analyst. ‘This new influx of Android devices will provide a boost to the platform and Canalys therefore expects Android to take a 45% share this year, behind Apple at 49%. The iPad mini is expected to continue selling well, becoming more significant in terms of the product mix and spawning a further increase in consumer demand for smaller tablets.’

The great hope for Windows 8 was that it would unleash new PC form factors, combining the best of both PCs and tablets. But James Wang, an Analyst at Canalys, noted, ‘These convertible products have disappointed so far. Convertibles are too heavy in tablet form and too expensive when compared with clamshell products. Canalys therefore expects that, for at least the next 18 months, consumers will buy separate products, rather than compromise on a Windows 8 convertible or hybrid PC. Even for Android products, alternative form factors are not expected to grow rapidly due to the category being sandwiched between low-cost slates and more familiar Windows-based clamshell notebooks.’ Out of the 388.1 million mobile PCs (notebooks and tablets) that Canalys forecasts will ship in 2013, it estimates that less than 2% will be hybrids or convertibles.

Another ray of light for PC vendors is that PC sales to businesses are, and will continue to be, far stronger than those to consumers. This trend favors the likes of HP and Lenovo, though competition will increase as others shift resources toward the commercial channels to maximize their opportunity.

Appcessories: Products that connect to applications on smart devices (smart phones, tablets and notebook PCs).

Clamshell: A notebook with keyboard/second screen fixed with a one-directional hinge only enabling movement up to 180⁰.

Convertible: A notebook with keyboard/second screen that can be converted to a tablet form factor.

Slate: A tablet that is not designed by its manufacturer to be fixed to a keyboard accessory with a hinge.

Hybrid: A tablet that is designed by its manufacturer to be fixed to a keyboard accessory with a hinge.

Canalys is an independent analyst firm that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. Our customer-driven analysis and consulting services empower businesses to make informed decisions and generate sales. We stake our reputation on the quality of our data, our innovative use of technology, and our high level of customer service.

To receive press releases directly, or for more information about our events, services or custom research and consulting capabilities, please complete the contact form on our web site.