Huawei overtakes Apple to become number two smartphone vendor in Q2 2018

Palo Alto, Shanghai, Singapore and Reading (UK) – Tuesday, 31 July 2018

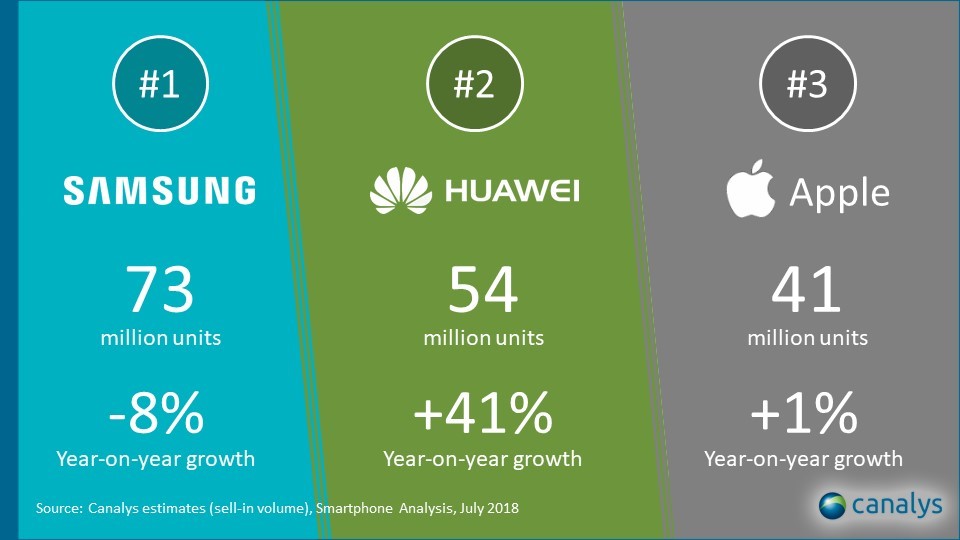

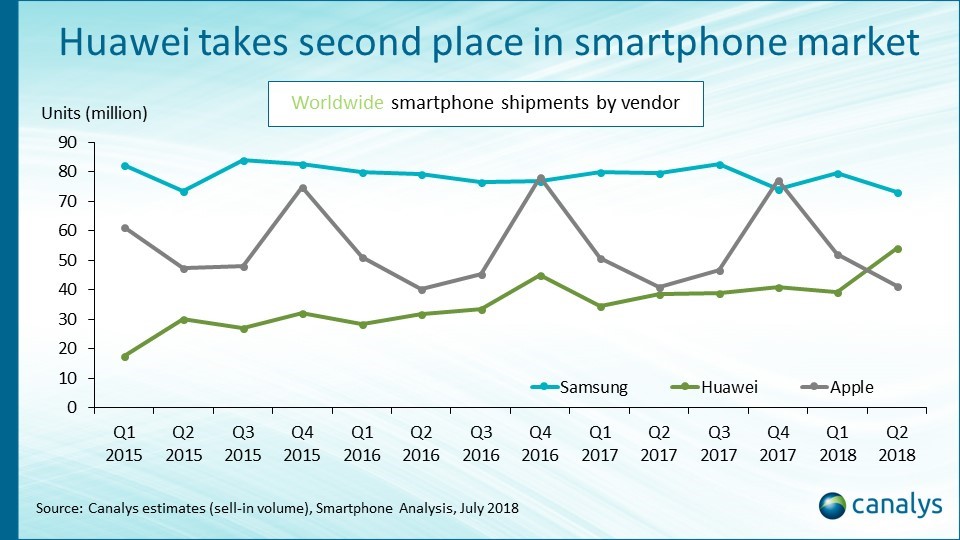

Huawei achieved a major milestone in Q2 2018, becoming the world’s number two smartphone vendor. It shipped 54 million handsets, up 41% year on year. This performance is partly due to strong sell-in of its latest flagship, the P20, which exceeded launch quarter sell-in of both the P10 and P9. Another big reason for Huawei’s success is its Honor sub-brand, which accounted for two thirds of the near 16 million jump that Huawei made this quarter. Samsung remained the top vendor in Q2, but felt the impact of Huawei and others, slipping 8% to 73 million shipments. Apple fell to third, shipping 41 million iPhones, a 1% year-on-year growth.

“Huawei’s strategy has evolved significantly over the last six months,” said Mo Jia, Canalys Analyst based in Shanghai. “Despite its failure to strike a US carrier partnership earlier this year, the company has turned around quickly, moving away from its drive for profitability and focusing instead on finding volume growth at the low end. Honor, which has long been a major brand in China but relatively small overseas, has taken a pivotal role in this strategy.” Honor’s share of Huawei smartphone shipments increased from 24% in Q2 2017 to 36% this quarter. Huawei shipped close to 4 million Honor-branded smartphones outside of China in Q2, representing 150% year-on-year growth, albeit from a small base. “Honor is quickly building and deploying an independent sales force, parallel to Huawei’s, driving the brand into new markets, and consequently democratizing Huawei’s flagship technology. Its focus on an open-market strategy has made it particularly potent in Russia, India and Western European markets.

Huawei’s own performance, aside from Honor, has also been strong. It shipped 7 million of its latest flagships, the P20 and P20 Pro. “Huawei has accelerated its adoption of new technologies this year, focusing on AI with its NPU chipsets and on imaging with its triple-camera setup,” said Jia. “Its efforts have paid off. The P20 and P20 Pro sold faster than their predecessors in their launch quarter. Outside of China, the P20 and P20 Pro more than doubled the shipments of the P10 and P10 Plus.”

Apple’s iPhone sell-in of 41 million units for Q2 is within its typical range for the second quarter. “Q2 has always been seasonally weak for Apple,” said Canalys UK-based Senior Analyst Ben Stanton. “While the iPhone X succeeded in generating volume in the previous quarters despite its hefty price tag, it has been unable to sustain that volume this quarter. But for an Apple flagship, this is normal. In addition to this, models such as the iPhone 7 and 7 Plus are also losing steam, given a high sell-in in Q1. But an uptick in iPhone 8 and 8 Plus, helped in part by the Product Red campaign, was enough to offset this trend.” Canalys estimates that Apple shipped over 8 million iPhone Xs in Q2, down from 14 million in the previous quarter.

“The importance of Huawei overtaking Apple this quarter cannot be overstated,” said Stanton. “It is the first time in seven years that Samsung and Apple have not held the top two positions. Huawei’s exclusion from the US has forced it to work harder in Asia and Europe to achieve its goals. Further momentum in Huawei’s Honor and Nova sub-brands is likely to sustain its rate of growth. Huawei’s momentum will obviously concern Samsung, but it should also serve as a warning to Apple, which needs to ship volume to support its growing Services division. If Apple and Samsung want to maintain their market positions, they must make their portfolios more competitive.”

Smartphone quarterly estimates, market share information and forecast data is taken from Canalys’ Smartphone Analysis service.

For more information, please contact:

Canalys EMEA: +44 118 984 0520

Ben Stanton: ben_stanton@canalys.com +44 118 984 0525

Canalys APAC (Shanghai): +86 21 2225 2888

Mo Jia: mo_jia@canalys.com +86 21 2225 2812

Hattie He: hattie_he@canalys.com +86 21 2225 2814

Canalys APAC (Singapore): +65 6671 9399

Rushabh Doshi: rushabh_doshi@canalys.com +65 6671 9387

TuanAnh Nguyen: tuananh_nguyen@canalys.com +65 6671 9384

Canalys Americas: +1 650 681 4488

Vincent Thielke: vincent_thielke@canalys.com +1 650 656 9016

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please complete the contact form on our web site.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).