Global smartphone market kicked off 2024 with a robust 10% growth in Q1

Tuesday, 30 April 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

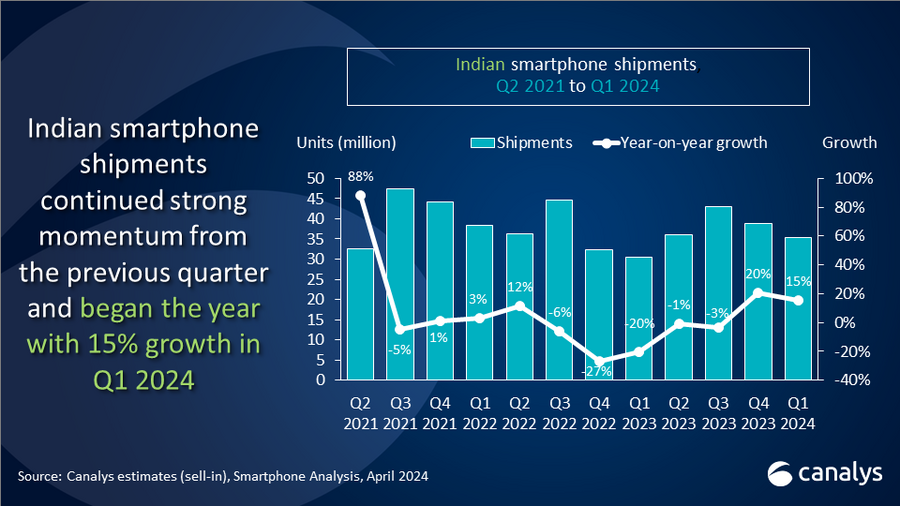

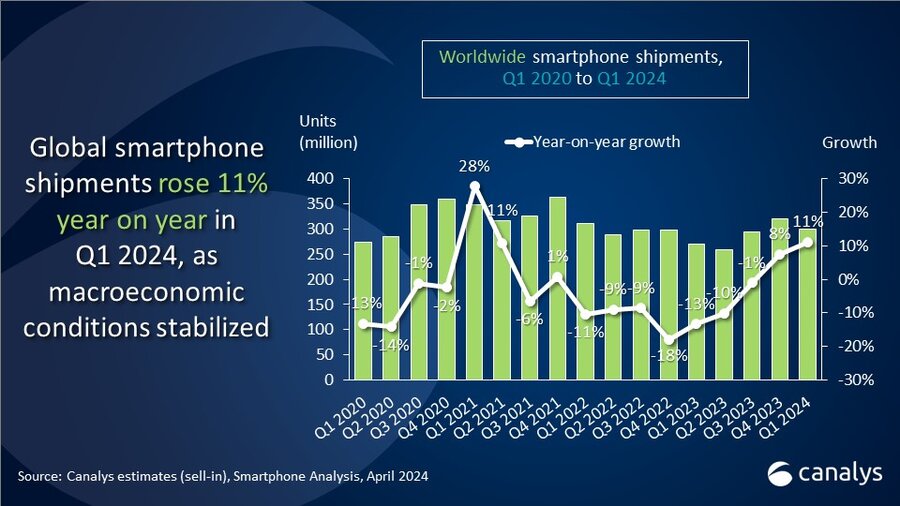

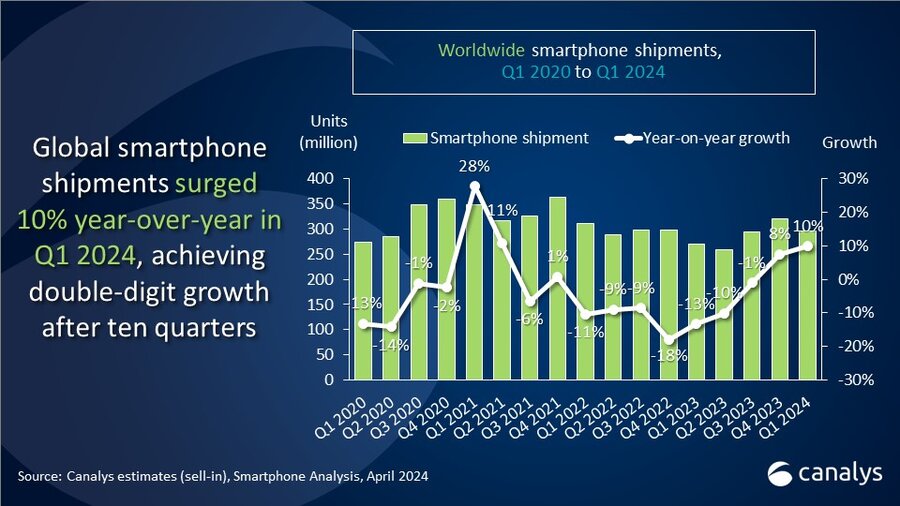

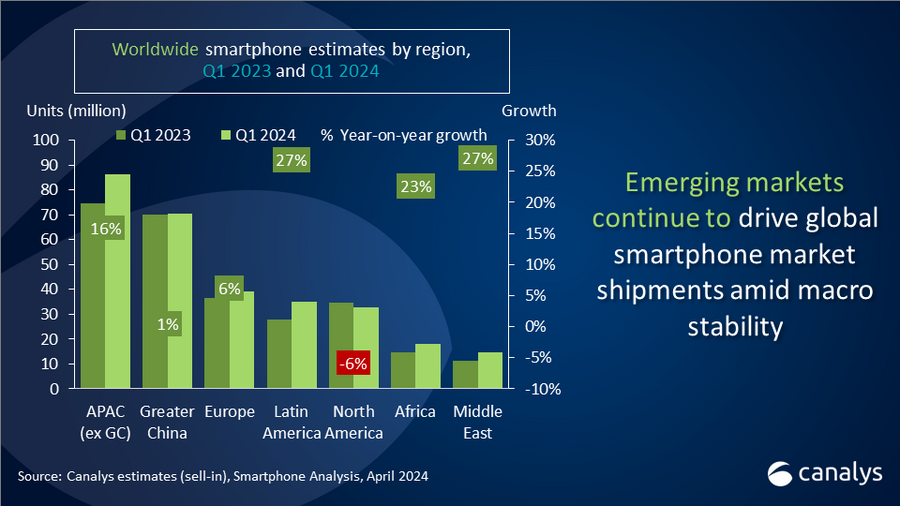

According to Canalys research, the worldwide smartphone market experienced a 10% year-on-year growth in Q1 2024, reaching 296.2 million units. The market performed better than expected, reaching double-digit growth after ten difficult quarters. The surge was primarily fueled by vendors introducing refreshed portfolios and macroeconomic stabilization in emerging market economies. Samsung regained the lead position, shipping 60.0 million units, buoyed by updates to its A-series and early premium offerings. Apple slipped to second spot, shipping 48.7 million units, as it experienced a double-digit decline amid headwinds in its core markets. Xiaomi maintained third place with 40.7 million shipments and a 14% market share. TRANSSION and OPPO rounded out the top five, shipping 28.6 million and 25.0 million units respectively, securing 10% and 8% market share.

“Samsung’s S24 launch reflects a pivotal moment in its AI and premium strategy, with the potential to reshape the industry,” commented Canalys Senior Analyst Sanyam Chaurasia. “Compared to last year’s S23 release, Samsung launched the Galaxy S24 a month earlier and shipped 13.5 million units, a 35% year-over-year shipment growth vs its predecessor in Q1. The pull factor from Galaxy AI, the large scale of retail points elevating the customer experience, and a better time-to-market strategy, drove the strong performance of the Galaxy S24. Beyond empowering Samsung's premium positioning, it also signals a broader shift in the smartphone industry towards AI-driven innovation. Samsung will look to leverage its early momentum by crafting compelling value propositions for users with Galaxy AI; solidifying premium competitiveness and fostering brand stickiness.”

“Mass-market brands are riding the wave of emerging markets rebounding, while cautiously stocking components,” remarked Canalys Analyst Runar Bjørhovde. “With improved inventory conditions at the outset of 2024, these brands have driven strong performances with their portfolio refreshes. Vendors such as Xiaomi and TRANSSION experienced robust year-over-year growth of 33% and 86% respectively, driven by strong shipments of their latest models into the Middle East, Africa, and Latin America markets. Notably, beyond the ongoing stabilization in emerging markets, these brands are ramping up production and stockpiling raw materials in anticipation of further increases in Bill of Materials (BoM) costs. These brands will closely monitor the demand situation and will look to transfer rising costs to consumers, resulting in higher overall ASPs.”

“In 2024, vendors will maintain a cautious stance, focusing on wallet share, inventory management, and supply chain optimization. Meanwhile, exploring avenues to commercialize the generative AI wave remains critical for all players within the device ecosystem,” said Chaurasia. “The evolution of on-device AI solutions for smartphones depends heavily on strategic alliances among brands, chipset providers, and software firms. Vendors will look for open collaboration with industry leaders to bring unique and personalized AI solutions to end users. In the long-term, vendors will look to bring these AI features to mid-range price bands to add more users to their native AI ecosystems. Additionally, ecosystem expansion via cross-device integration and strategic partnerships boosts revenue potential, highlighting the profound impact of on-device AI on user experiences and brand profitability.”

|

Global smartphone shipments and annual growth |

|||||

|

Vendor |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual |

|

Samsung |

60.0 |

20% |

60.3 |

22% |

-1% |

|

Apple |

48.7 |

16% |

58.0 |

21% |

-16% |

|

Xiaomi |

40.7 |

14% |

30.5 |

11% |

33% |

|

TRANSSION |

28.6 |

10% |

15.4 |

6% |

86% |

|

OPPO |

25.0 |

8% |

26.6 |

10% |

-6% |

|

Others |

93.3 |

31% |

78.9 |

29% |

18% |

|

Total |

296.2 |

100% |

269.8 |

100% |

10% |

|

Note: Xiaomi estimates include sub-brand POCO, and OPPO includes OnePlus. TRANSSION includes Tecno, Infinix and iTel. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Sanyam Chaurasia: sanyam_chaurasia@canalys.com

Runar Bjørhovde: runar_bjorhovde@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.