Can Samsung maintain its lead in the Android premium foldable segment?

17 December 2021

Spain, Western Europe's fifth largest market by population, had a smartphone shipment CAGR of 4% between 2013 and 2020, with no regression in historic data, following Canalys estimates. In Q3 2021 three million smartphones were shipped, a decline of 35%, for a value of USD$ 1.35 billion, a decline of 16%. 2021 is potentially going to be the first year Spain's market will shrink in terms of shipments. This is because consumers prioritized connectivity and many renewed smartphones in 2020, but it is also due to the component shortages. So why is now a good time for Android smartphone vendors to enter the Spanish market?

Spain, Western Europe's fifth largest market by population, had a smartphone shipment CAGR of 4% between 2013 and 2020, with no regression in historic data, following Canalys estimates. In Q3 2021 three million smartphones were shipped, a decline of 35%, for a value of USD$1.35 billion, a decline of 16%. 2021 is potentially going to be the first year Spain's market will shrink in terms of shipments. This is because consumers prioritized connectivity and many renewed smartphones in 2020, but it is also due to the component shortage.

So why is now a good time for Android smartphone vendors to enter the Spanish market?

The days when mobile operators ruled the Spanish smartphone market, selling more than 50% of devices, are gone, given the rise in sales through the retail and e-retail channel during the pandemic (especially during Q1 and Q2 2020). While operators recently recovered some share, retail and e-retail kept their momentum with a combined unit share of 54% and 55% in Q2 and Q3 2021 respectively, following Canalys quarterly estimates by channel. A more diversified channel landscape will facilitate new smartphone vendors to reach consumers. In addition, the operator market is getting more competitive with a number of emerging MVNO (Mobile Virtual Network Operator) players, some of which are low-cost players growing market share by appealing to price sensitive consumers in a market with high inflation, low consumer confidence and economic uncertainty. This has forced big brands to reduce margins and the number of subscribers, and revise their business models to offer more competitive prices in an unprecedented inflationary landscape.

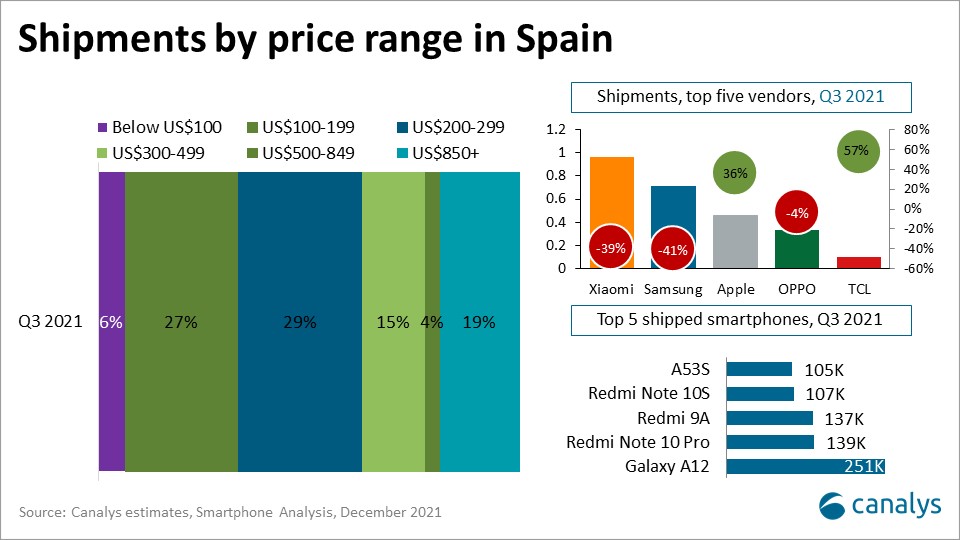

Spain is the only Western European market dominated by a smartphone vendor other than Apple or Samsung. Xiaomi, the market leader, has been number one in terms of shipments since Q1 2020. The reputation it has earned locally could also pave the way for other Chinese vendors that want to grow in the Spanish market. However, in Q3 2021 smartphone shipments of Xiaomi and Samsung declined 39% and 41% respectively, and they shipped approximately a million fewer devices than in the same quarter in 2020, resulting in overall shipments down in Q3 by 33% Y-o-Y. However, the impact of the component shortage is an opportunity for companies with the capacity to allocate further units to Spain to invest and develop a market that is not so attached to a specific brand and is part of the world's second largest consumer market. That could be the case for Realme, a vendor that owned 4% of shipments in Italy in Q3 2021 and grew an outstanding 1344% Y-o-Y. Presently it is under-represented in Spain with 1.6% of the unit share in Q3 2021, especially considering it's a good market fit and the similarities between the Italian and Spanish markets. TCL is one of the vendors taking advantage of the situation, growing its shipments 57% in Q3 2021 Y-o-Y, reaching a unit share of 3%. It was able to double shipments both in retail and e-retail while keeping its position with operators. Vivo is also experiencing some favorable tradewinds and shipped 70K units in Q3 2021, when no units were shipped in the same quarter in 2020. Vivo has grown in all channels, though its Telco growth,at 2357%, was outstanding when compared to Q2 2021.

Under the context of perfect competition in the Spanish Telco sector, an era of consolidations and new regulations will come into place to preserve the previous status quo: oligopoly. Large smartphone vendors are likely to recover their dominant positions once the component shortage and international supply chain bottlenecks ease, expected towards Q3 2022. In the meantime, emerging smartphone vendors should enter the Spanish market, and growing vendors have the opportunity to expand share. Considering the continuous transformation of consumers' preferences and fluctuations of Southern European markets, we encourage vendors to keep tuned in with the most accurate and up-to-date information.