Global PC shipments pass 340 million in 2021 and 2022 is set to be even stronger

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Wednesday, 12 January 2022

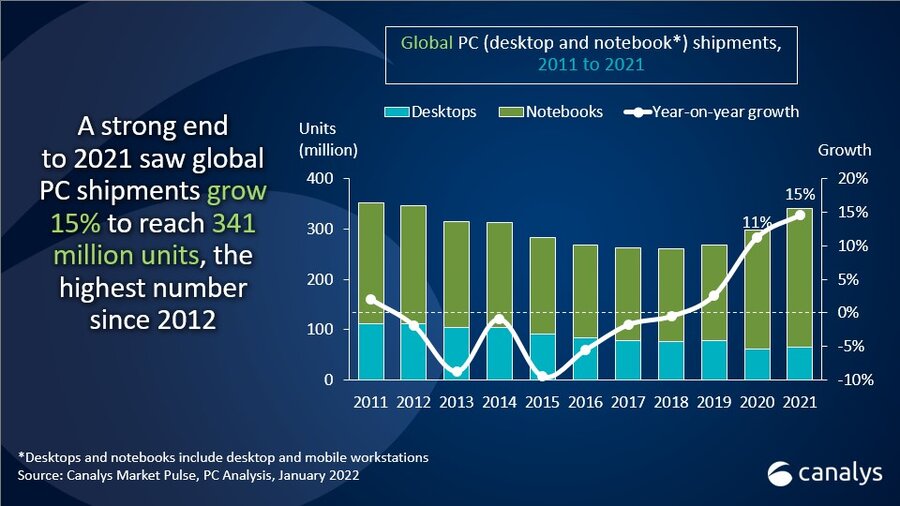

The PC market ended 2021 with a bang, as fourth-quarter shipments exceeded 90 million for the second year in a row. The latest Canalys data shows that worldwide shipments of desktops, notebooks and workstations grew 1% year on year to 92 million units over 91 million a year ago. This pulled up total shipments for full-year 2021 to 341 million units, 15% higher than last year, 27% higher than 2019 and the largest shipment total since 2012. Furthermore, the industry saw strong revenue gains, with the total value of Q4 shipments estimated at US$70 billion, an annual increase of 11% over Q4 2020. For the full year, revenue passed US$250 billion in 2021 against US$220 billion in 2020, up 15%, highlighting the seismic transformation in the industry.

The two-year compound annual growth rate of 13% from 2019 emphasizes how dramatically the importance of PCs has grown since the onset of the COVID-19 pandemic. Notebooks and mobile workstations continued to lead the charge, with shipments of these devices growing 16% in 2021 to reach 275 million units. Desktop and desktop workstation shipments increased 7% in 2021 to reach 66 million units.

“2021 was a watershed year in the history of the PC market, with the PC’s place at the center of work, learning and leisure truly cemented,” said Ishan Dutt, Senior Analyst at Canalys. “For the market to post double-digit growth over an impressive 2020, despite the constant cloud of supply constraints, speaks volumes about how strong PC demand has been over the last 12 months. Taking a long-term view, the most important developments in 2021 were the large increases in PC penetration and usage rates. PCs are now in the hands of both young students and older family members, while ownership of two or more PCs per person has become more common in developed markets. Since the onset of the pandemic, a larger than normal proportion of PCs shipped have been new additions to the installed base rather than replacement devices, especially in areas such as education and remote work. This has set the stage for continued success for the PC industry as there is no turning back from how embedded they are in our day-to-day lives.”

Lenovo took first place in the PC market in Q4 with total shipments of 21.7 million units, an annual decline of 6.5%. It was also the biggest-shipping vendor for full-year 2021, hitting a record 82.1 million units, a 13.1% increase on 2020. HP ranked second, with Q4 shipments of 18.7 million units helping it reach 74.1 million units in 2021, growth of 9.5% over 2020. Third-placed Dell posted stellar growth of 8.9% in Q4 to reach 17.2 million units and increased its market share by over 1%. Dell ended 2021 with total shipments of 59.3 million units for the year. Apple came fourth with Q4 growth of 9.0% and full-year growth of 28.3%, making it the best-performing vendor in the top five. It shipped 7.8 million units in Q4 and 29.0 million units in full-year 2021. Acer rounded out the top five for both Q4 and the full year, posting shipments of 6.6 million in Q4 and 24.4 million units in 2021.

|

Worldwide desktop, notebook and workstation shipments (market share and |

|||||

|

Vendor (company) |

Q4 2021 |

Q4 2021 |

Q4 2020 |

Q4 2020 |

Annual |

|

Lenovo |

21,701 |

23.7% |

23,220 |

25.5% |

-6.5% |

|

HP |

18,645 |

20.3% |

19,225 |

21.1% |

-3.0% |

|

Dell |

17,195 |

18.7% |

15,794 |

17.4% |

8.9% |

|

Apple |

7,810 |

8.5% |

7,163 |

7.9% |

9.0% |

|

Acer |

6,582 |

7.2% |

6,166 |

6.8% |

6.7% |

|

Others |

19,802 |

21.6% |

19,431 |

20.7% |

1.9% |

|

Total |

91,736 |

100.0% |

90,999 |

100.0% |

0.8% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

Worldwide desktop, notebook and workstation shipments (market share and annual growth) |

|||||

|

Vendor (company) |

2021 |

2021 |

2020 |

2020 |

Annual |

|

Lenovo |

82,142 |

24.1% |

72,646 |

24.4% |

13.1% |

|

HP |

74,072 |

21.7% |

67,688 |

22.7% |

9.5% |

|

Dell |

59,300 |

17.4% |

50,273 |

16.9% |

18.0% |

|

Apple |

28,958 |

8.5% |

22,574 |

7.6% |

28.3% |

|

Acer |

24,383 |

7.1% |

20,023 |

6.7% |

21.8% |

|

Others |

72,198 |

21.2% |

64,430 |

21.6% |

12.1% |

|

Total |

341,053 |

100.0% |

297,614 |

100.0% |

14.6% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

“While 2021 was the year of digital transformation, 2022 will be the year of digital acceleration,” said Canalys Principal Analyst Rushabh Doshi. “Demand for technology has boomed in the past two years, the effects of which continue to disrupt the supply chain, affecting not just availability of PCs, but also smartphones, automobiles and servers. As PC vendors navigate an ever more complicated situation, consumer spending patterns are shifting. We will see revenue growth in the industry from spending on premium PCs, monitors, accessories and other technology products that enable us to work from anywhere, collaborate around the world and remain ultra-productive. The importance of faster, better, more resilient and more secure PCs has never been greater, and the industry is willing to innovate and push the boundaries to keep this momentum going.”

From a market standpoint, the US continued to see shipments fall for a second consecutive quarter, primarily due to a strong fourth quarter for Chromebooks in 2020. EMEA and Asia Pacific (excluding Japan) were bright spots, as shipments grew by double digits over last year.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

For more information, please contact:

Rushabh Doshi (India): rushabh_doshi@canalys.com +91 99728 54174

Ishan Dutt (Singapore): ishan_dutt@canalys.com +65 8399 0487

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.