Valve bets on surging interest in gaming with Steam Deck

17 August 2021

Hyperscaler cloud marketplaces are growing rapidly as a channel for software and cybersecurity as consumption of cloud infrastructure services expands, but can their impact be overestimated?

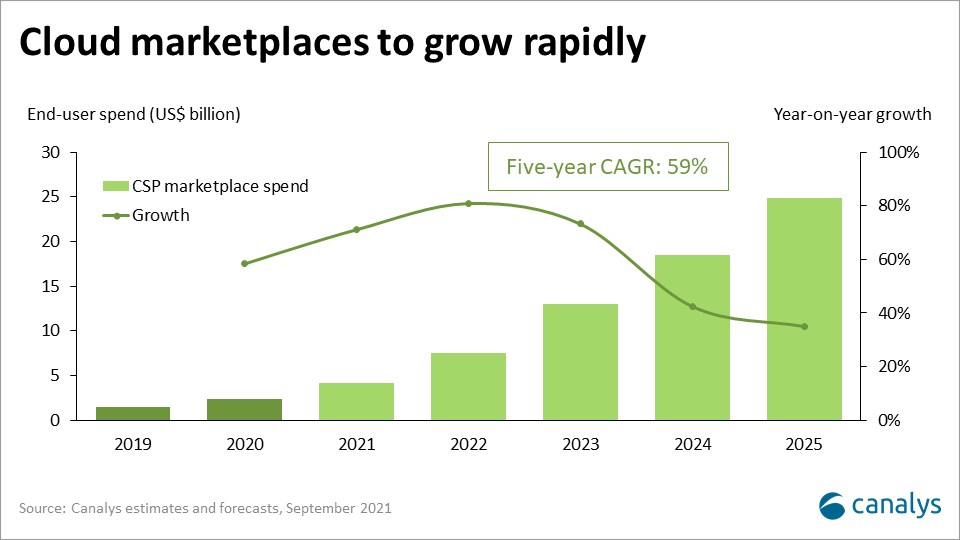

Cloud marketplaces have been a hype topic in the IT industry for several years. But the continuing surge in public cloud adoption during the pandemic has spurred the rise of hyperscaler cloud marketplaces, led by AWS, Microsoft and Google Cloud, and created one of the fastest growing routes to market for software and cybersecurity. A relatively small yet rapidly expanding share of software and software-defined technologies is now being purchased by businesses via these three cloud marketplaces, across storage, backup, data analytics, AI/ML, networking, cybersecurity and a wide range of applications. Canalys estimates that in 2021, US$4.1 billion of sales will flow through these cloud marketplaces, up 71% on 2020. By 2025 they will account for approximately US$25 billion, 59% CAGR from 2020. In specific software segments and geographies this growth will be even higher.

Cloud growth has been a key stimulant. In Q2 2021 alone, worldwide cloud infrastructure services grew by over a third to US$47 billion, a value increase of over US$12 billion on the same period last year. That’s massively expanding the number of enterprise buyers and cloud users, who are turning to cloud marketplaces, attracted by the promise of simple purchasing processes, consolidated billing, increasingly sophisticated management functions, technologies that are pre-integrated with their cloud stack, and access to new cloud applications and technologies as they digitalize their businesses. A critical accelerant has been the availability of committed cloud credits as enterprises commit to billions of dollars of upfront cloud investment to access discounts with the hyperscalers. All three hyperscalers allow these credits to be used against marketplace purchases (either partially or completely). That is driving a boom in transactions, by opening up lucrative new lines of budget for enterprise buyers. At the same time, hyperscalers are aggressively attracting new customers to their marketplaces, often seeking to convert them from offline purchasing, and investing heavily in demand generation, co-sell resources and financial incentives for vendors to sell via their marketplaces.

These trends are proving hard for vendors to ignore. Growing numbers are waking up to this opportunity, and building strategies to engage with one or more of these marketplaces as a route to market. With marketplaces removing procurement friction for customers, vendors are reporting faster time to market and shorter sales cycles via this channel. Yet technically, this can also prove extremely challenging. Integrating with each different marketplace can be costly and resource intensive, as can aligning billing, pricing and invoicing, and processes (especially when selling across multiple marketplaces). The other big challenge for vendors with established channels is the growing competition that hyperscaler marketplaces represent to existing partners including distribution. As a result, many vendors are still at an experimental stage in their marketplace strategies.

Most supporters of cloud marketplace models failed to anticipate one key factor: the critical role that channel partners will play in their success. The vision of marketplaces as self-service discovery and click-to-buy platforms has largely not materialized. Many customers still want to negotiate contracts, access discounts and integrate technologies. As end-user organizations embrace multicloud models, and seek to source increasingly complex technologies via marketplaces, they are turning to trusted channel partners to simplify, manage, secure and support their ongoing marketplace use. The hyperscalers themselves are rapidly recognizing the importance of indirect partners, particularly as they seek to expand global reach. They are actively recruiting and developing growth plans with channel players across the globe, as well as building features within their marketplaces to support indirect models. As the focus of the hyperscalers shifts to ISVs, this is allowing them to position their marketplaces as full-service channels-to-market for these ISVs to help them expand globally, including connecting them to channel partners. Equally, vendors selling through marketplaces will need channel partners to deliver professional services, and manage and support their end users.

At the same time, resellers, SIs and MSPs are now recognizing the opportunity to expand their reach to customers by creating their own marketplace offers (tailored solutions, subscriptions or services) within the hyperscaler marketplaces. By 2025, Canalys predicts that nearly a third of all marketplace purchases will flow through partners.

Vendors should not ignore this burgeoning channel and should develop strategies to capitalize on its rapid growth, along with other emerging channels to market. Yet despite strong momentum, hyperscaler cloud marketplaces will still account for less than 5% of total software spend by 2025. Over-rotating towards this channel brings its own risks and challenges. Current drivers, such as availability of cloud credits, could quickly disappear. An over-dependence on the top hyperscalers is a threat. Canalys has published a major report on this topic to our Cloud Channels Analysis clients called 'Now and Next: Cloud marketplaces as a channel to market'. This has insights and recommendations for vendors, cloud providers and channel partners. If you're interested in reading it, then please get in touch with me.