Apple’s WWDC 2021: Focus and Control

8 June 2021

A look at OPPO’s successful strategy in the Latin American region.

In a previous blog post, Canalys mentioned that there was one Android smartphone vendor in Latin America that has taken a different approach in recent quarters, deciding not to fight a price war with other vendors in the region. That vendor is OPPO, still a new arrival in Latin America and not that well known. In this post we will look in more detail at OPPO’s successful strategy in the region.

OPPO grew rapidly to become the world’s fourth largest smartphone vendor with a market share of 9% in Q4 2021, according to Canalys’ preliminary estimates. The current merger between OPPO and OnePlus will reinforce its market position and boost its R&D capabilities.

OPPO’s typical customer profile is a more senior and higher-income individual than that of vivo or Xiaomi, hence its presence on social media and its go-to-market strategy have been quite different. Its most high-profile marketing move was its sponsorship of the 2021 Wimbledon Championships, the global “Grand Slam” tennis tournament, typically sponsored by luxury brands, such as Jaguar and Rolex. It was the first Asian company to sponsor the British tournament and one of a few brands to appear in the stadia to a global TV and online audience.

OPPO’s history in Latin America is quite recent, as it only entered the market in 2020. But it has set itself high targets in the region, such as to become the best-selling smartphone vendor in Mexico in 2022, according to its regional spokesperson. Its ambitious marketing plan for Latin America in 2022 has commenced with the recent announcement that Reggaeton megastar Maluma will be the brand ambassador for the Reno smartphone series in the region.

2020: OPPO’s arrival

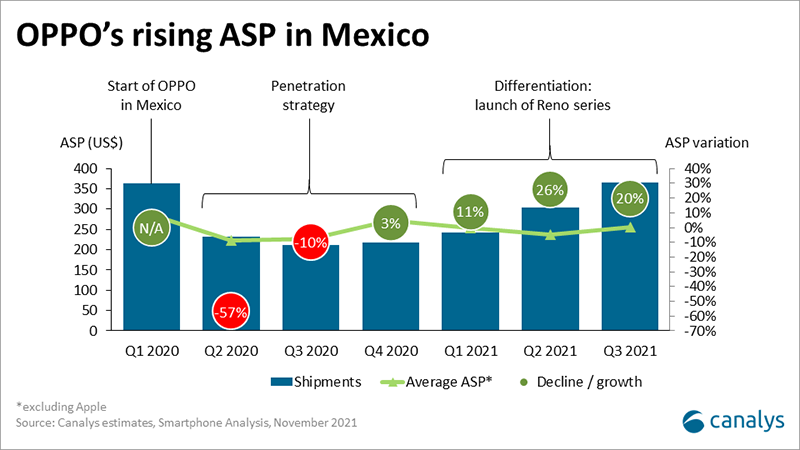

Unlike vivo, which first entered Latin America in Chile and Colombia, OPPO first arrived in the larger Mexican market in Q1 2020. It was followed by the creation of the LATAM business unit in its People’s Republic of China headquarters in October 2020. At the time, OPPO was importing mostly entry-level and mid-range smartphones, such as the A12, A31, A53 and A72, which when combined represented 86% of its shipments in 2020. This means that, like most smartphone vendors, OPPO was using a penetration market strategy to kickstart growth and build share faster than the competition.

It built a solid foundation for future success with two important agreements sealed in the second half of 2020 with the two largest carriers in México, Telcel (América Móvil) and AT&T. This helped it increase shipments significantly by 1,035% and 107% in Q3 and Q4 2020 respectively.

2021: Time to show the real OPPO: Reno

OPPO’s Latin American expansion continued in 2021. It opened its first regional office in Mexico City in March 2021 to support the Mexican market and its partners, and then expanded into new markets, such as Colombia and Chile in Q2 2021.

Apart from OPPO’s geographical expansion, it also quickly expanded its portfolio. The launch of the Reno5 Lite in Q1 2021, the Reno5 Z 5G in Q2 2021 and the Reno6 5G in Q3 2021 increased OPPO’s ASP in subsequent quarters. This also helped consolidate its more premium global brand image.

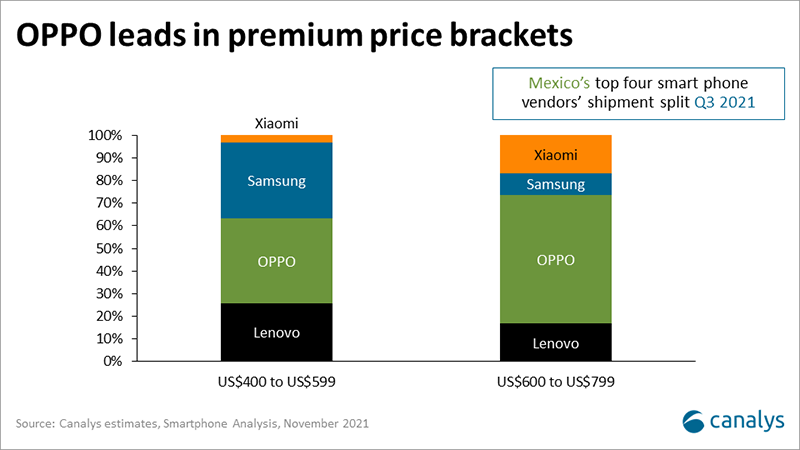

By Q3 2021, OPPO had become the fourth best-selling smartphone vendor in Mexico with a 12% market share and annual shipment growth of over 6000%. With its Reno series, OPPO also became the leading smartphone vendor in Mexico in the US$400-to-US$599 and US$600-to-US$799 price brackets. These price bands had been overlooked by most smartphone vendors, which were instead concentrating on the higher-volume entry-level and mid-range segments.

2022: Challenges ahead

The arrival of HONOR, supported by a strong inherited network of partners, and Motorola’s development of its Moto G and Edge smartphones for the upper mid-range market are two potential competitive threats to OPPO. OPPO must keep building brand awareness and strengthening partner relationships in its existing markets and keep expanding its reach across the region before others do. Customer satisfaction and approval ratings are also vital. Happy OPPO customers can be OPPO’s most effective voice.

The volatility of the Latin American economies and local currency fluctuations won´t help OPPO’s prospects in the high-end and upper-middle price ranges in 2022, so it is important for the company to keep exploring new price ranges and buyer types to continue differentiating and growing its portfolio and market share.

Only time will tell us how OPPO will perform in Mexico and the Latin American region in general in the coming months. At Canalys, we will be monitoring shipments from all smartphone vendors in Colombia, Chile, Mexico and Peru on a monthly basis to keep identifying new trends and generating insights about the smartphone market.