IT vendors need to approach MSPs with a different philosophy

22 April 2022

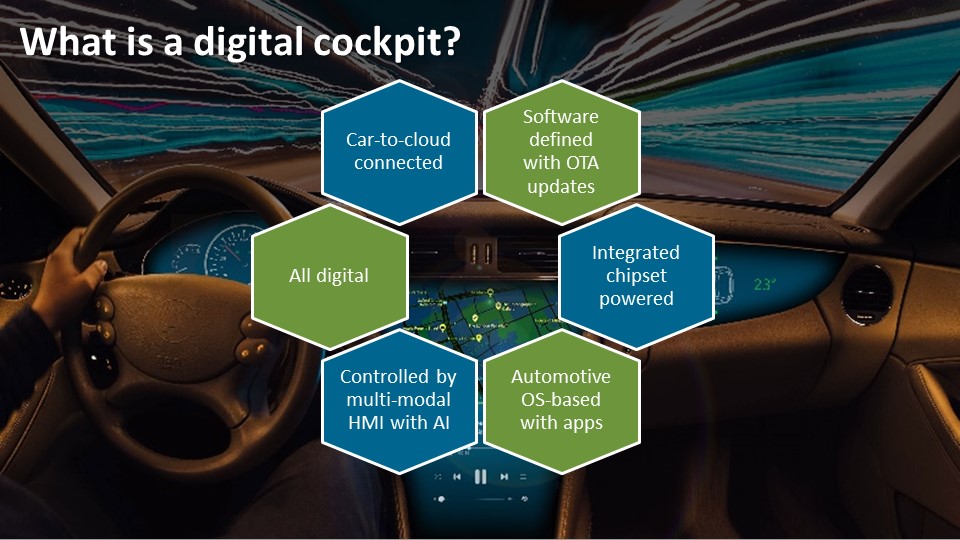

The digital cockpit is an all-digital, software-defined, in-vehicle dashboard system to aid drivers and passengers perform crucial driving functions. Canalys has launched the Digital Cockpit Analysis service to analyze this emerging trend.

Passenger cars are being transformed. The next generation of cars will be increasingly autonomous, connected, electric and software dependent. The in-car experience in new vehicles is being reimagined – built around a digital cockpit and an automotive OS. The digital cockpit is an all-digital, software-defined, in-vehicle dashboard system to aid drivers and passengers perform crucial driving functions. The digital cockpit incorporates instrument clusters, infotainment, navigation, ADAS, proactive AI, comfort controls and more, using multi-modal interfaces, in one platform.

By their very nature, digital cockpit platforms are flexible and scalable – car makers can customize solutions to create unique, differentiated solutions. Owners, and even multiple drivers of the same vehicle, can further personalize those solutions. Features and functions can improve and evolve with software and firmware delivered via OTA updates via the car-to-cloud connection, increasingly over 5G in the future. Drivers and passengers will have access to app stores with potentially thousands of apps built specifically for in-vehicle use and larger, multiple displays that make up the digital cockpits. The solutions will become more proactive, contextually aware and intelligent in providing information and warnings to drivers to help them make timely and accurate decisions for a safer, more comfortable drive, and intervene when required.

The rapid development of innovative, digital cockpit platforms gives automotive OEMs an excellent opportunity to differentiate, create new revenue streams, improve the in-vehicle experience for drivers and passengers and strengthen customer loyalty. But cars and their digital cockpits must also fit into the broader ecosystem. The digital cockpit needs connectivity, a software ecosystem, cloud access, multiple displays, an operating system, OTA updates, a smart assistant, navigation, and a high-performance system on chip with everything secure and automotive safety-certified. As with their other smart devices, drivers can expect, and will demand, their software-defined connected vehicle to be continuously updated, ubiquitously connected, intelligent, always learning with new and improved features arriving over time, and to have access to the consumer ecosystem of apps and their media in the car and on its multiple displays. Infotainment is a dominant feature of the first digital cockpits, however, with the evolution of ADAS features that now include hands-off driving and hands-off/eyes-off driving, the integration of the displays, AI, driver monitoring and notification system and driving functionality will be crucial elements to the platform.

Major technology companies are heavily involved in the creation of digital cockpit platforms or as a supplier or integrator of a major component of the solutions. Alibaba, Baidu, Google and Tencent will bring their OS, extensive application ecosystem and content assets into the cockpit; long-term automotive infotainment software suppliers BlackBerry QNX, Harman (a Samsung company) and TomTom must leverage their OEM customer base and partnerships; Huawei, Nvidia and Qualcomm bring a multitude of technologies to what has become a hugely important sector to them all.

Several smartphone vendors are evaluating the automotive opportunity, most famously Apple, although it has not announced its strategy. Its smartphone mirroring solution Apple CarPlay, which launched in 2014, is available in most new cars, but will lose relevance as operating systems such as Android Automotive get built-in to more vehicles. Samsung acquired Harman and drivers can control Samsung Smartthings smart home devices from their car via Android Auto. Xiaomi announced it will launch EVs in 2024. OPPO demonstrated in-car connectivity technologies in 2021. And Honor is partnering with Li Auto. The smartphone can already be used as a digital key or for remote vehicle parking. From a smartphone app, drivers can manage the vehicle’s HVAC controls, check the EV’s battery status and more. In-vehicle flash charging and wireless charging is increasingly available.

Typically, latest technology starts in premium vehicles and filters down the range over time. However, low, mid and high-end digital cockpit platforms with pre-integrated reference implementations can all be incorporated. A growing list of car models now include a digital cockpit, or will at their next major refresh. These connected cars will be one of the fastest-growing mobile device categories in the next decade, with every vehicle turning into a node in a much larger network and ecosystem. Automotive OEMs have partnered with cloud providers including AWS, Ericsson and Microsoft to build automotive cloud platforms to manage these data centers on wheels. New revenue streams will be sought, and new business models tried. OEMs have already started with subscription-based ownership and subscriptions, often free for a period of time, for connectivity, remote diagnostics, streaming or concierge services. With so much in new vehicles being software-defined, many more features will be available on a subscription basis, on-demand or later as an upgrade when the feature is launched. This opportunity can push the lifetime revenue (LTR) potential of a vehicle into the thousands of dollars.

The newly launched Canalys Digital Cockpit Analysis service provides insights into the digital cockpit and automotive operating system markets. It guides technology companies and automotive OEMs to make the right decisions on their solutions’ features, choose the right channel partners and sell on the appropriate platforms to engage in different markets around the world. Do get in touch with us to discuss the market opportunity and outlook, and clients can learn more about our defintions in our latest report.