Competing to control the in-vehicle user experience

9 August 2022

Vendors have traditionally made the most effort to recruit high-revenue-driving partners. These “mega” partners often demand a lot of attention, time and resources. With ongoing macroeconomic issues, such as inflation and the talent shortage, it is a good time for vendors to consider another method to grow their partner bases.

Vendors have traditionally made the most effort to recruit high-revenue-driving partners. These “mega” partners often demand a lot of attention, time and resources. With ongoing macroeconomic issues, such as inflation and the talent shortage, it is a good time for vendors to consider another method to grow their partner bases.

As seasoned channel leaders, the choices you make can define the success or failure of your organizations’ indirect sales performance. There is a near infinite number of combinations of possible decisions that you are tasked to make to find the correct mix of channel go-to-market strategies for your respective organizations. These options are often difficult, and the uncertainties often make the process daunting.

The hard truth is that there is no one-size-fits-all approach.

But there are basically two approaches. The first is the “top-down” (quality-over-quantity) approach. This is when vendors focus on targeting the titans of the partnership world – those with the greatest reach and capabilities. These might include global systems integrators, such as Accenture, Capgemini, Deloitte or Tata, or large-scale resellers, such as CDW, Computacenter, SHI or WWT. These large partners often require lots of attention and motivation to convince and, as a vendor, you need to invest to capture mindshare within these companies. For example, to recruit CDW, your company must often fly a contingent of your channel professionals to Chicago to discuss the mutual benefits of the potential partnership. The downside of this method is that it requires a lot of resources, whether human capital or budget.

With the ongoing “Great Resignation” and global recession, many channel organizations are set to face resource scarcity. This makes the top-down approach less viable than in the past. Furthermore, growth in this community is limited. The 20 largest global systems integrators grew a combined 4% in 2021, while the 20 largest resellers grew a combined 12% during that period. For vendors looking to outpace that performance, they will need to take mindshare (and revenue) away from other vendors in those accounts.

During this turbulent period, vendors should look to at second approach, the “bottom-up” (quantity-over-quality) approach. This is when vendors look to recruit the “long tail” of the channel ecosystem world. Consider the diverse ecosystem of small partners (companies with 10 to 50 employees and less than US$2million in annual revenue) that most vendors seem to ignore. Worldwide, there are half a million of these types of resellers and managed service providers alone. This should motivate any channel organization to take a look.

So what do you do? Use the bottom-up strategy, a “community” approach and aim to thrive with limited budget and human capital. Do not try to recruit each of these partners individually, but use the power of the masses to acquire many simultaneously. Find common areas where these types of companies go to read, watch, listen, learn and identify the respective communities they belong to.

How do you execute the bottom-up approach? Consider following these three steps:

One of the most important drivers of bottom-up channel success is finding the correct position in the correct market to be able to boost partner recruitment. This must be niche enough to establish differentiation while simultaneously being large enough for high earning potential. To start the process, consider the following six factors and then choose the combination of three that is most important when identifying the right partners for you and your business:

The problem with choosing a combination of fewer than three is that the competition will be too fierce and the market too big to own (for example, global reseller partners with customers of all sizes). Conversely, the pitfall of choosing too many will severely limit earning opportunities (for example, regional managed service providers focused on customers of sub-100-seat SMB-segment regional banks in Buffalo, New York).

The possibilities are almost endless (circa 114 billion combinations when you multiply all six factors). Determining the right combination is the inherent challenge. This requires a broad understanding of market demand and the total addressable market.

To quantify the validity of the market you have pinpointed, the next step is to identify the “watering holes” these partners spend time in.

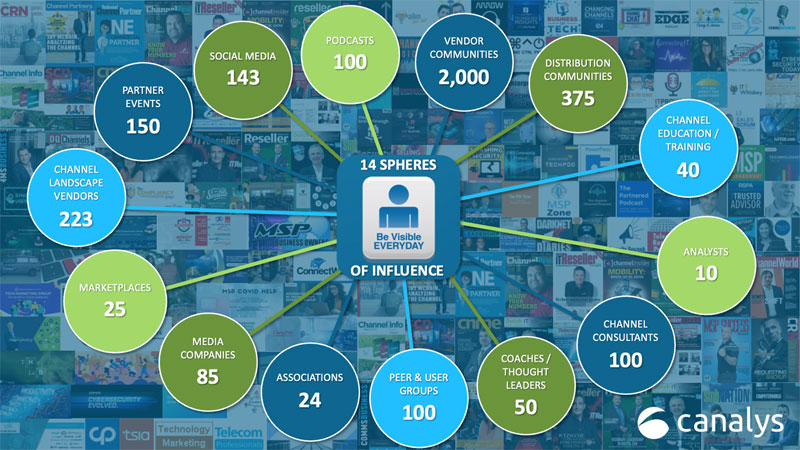

During your investigation, you will more than likely run into the 14 spheres of influence:

These 14 watering holes are going to be vital to the viability of your company’s bottom-up channel strategy. At times, it may be beneficial for you to either create a chart (as a visual individual) or a spreadsheet (as an analytical individual). Here is an example:

Once you dig into each of the 14 spheres of influence in step 2 (following your choices in step 1), you will start to notice a pattern. You’re going to see the same names and faces pop up quite frequently – the leaders of these communities. We call these “influencers”. These are the people that have a huge impact on the decision-making processes of the long tails. These individuals often wear many hats – as speakers, writers, executives, analysts, admins and board members, among others.

It might be easy to be overwhelmed by the breadth of these influencers, which are available at the click of a button. Consider developing a process to quantify the value of each of these individuals to narrow the list.

For example:

A scoring system can help identify the influencers worth pursuing.

Once you place numerical values next to the names of these influencers and tally up their respective scores, you should see that about a top 100 or so of them have separated themselves from the pack. These are your “super-connectors”. These super-connectors are the people that you need to develop close relationships with as they are the ones that have the greatest reach. The more seals of approval you receive from them, the further your channel organization’s opportunities will expand.

To reiterate the points made earlier, make sure you develop a scalable method to objectively target the right influencers for your organization.

Want to learn out more about the steps? Let’s set up a call.

More channel reading: