Generative AI integrated voice assistants are the lifeline smart speakers need

30 June 2023

The success of the first-generation Vision Pro is vital for Apple to showcase its ability to innovate and drive high growth, given the current market climate negatively affecting its full portfolio.

Apple desperately needed the launch of the Vision Pro headset, as the company must break the mold of its key money makers – the iPhone, iPad and Mac – to showcase innovation, create new hype to fight consumers’ waning interest in smart devices, and ultimately to drive higher levels of revenue and profit. The first generation of Vision Pro, like Apple’s other products, such as the iPod and iPad, at launch, blew their competition in their respective product categories out of the water in terms of design, experience and price. Given the limited production numbers, it will be flying off the shelves, preordered by Apple’s loyal fans and high net-worth users in the US.

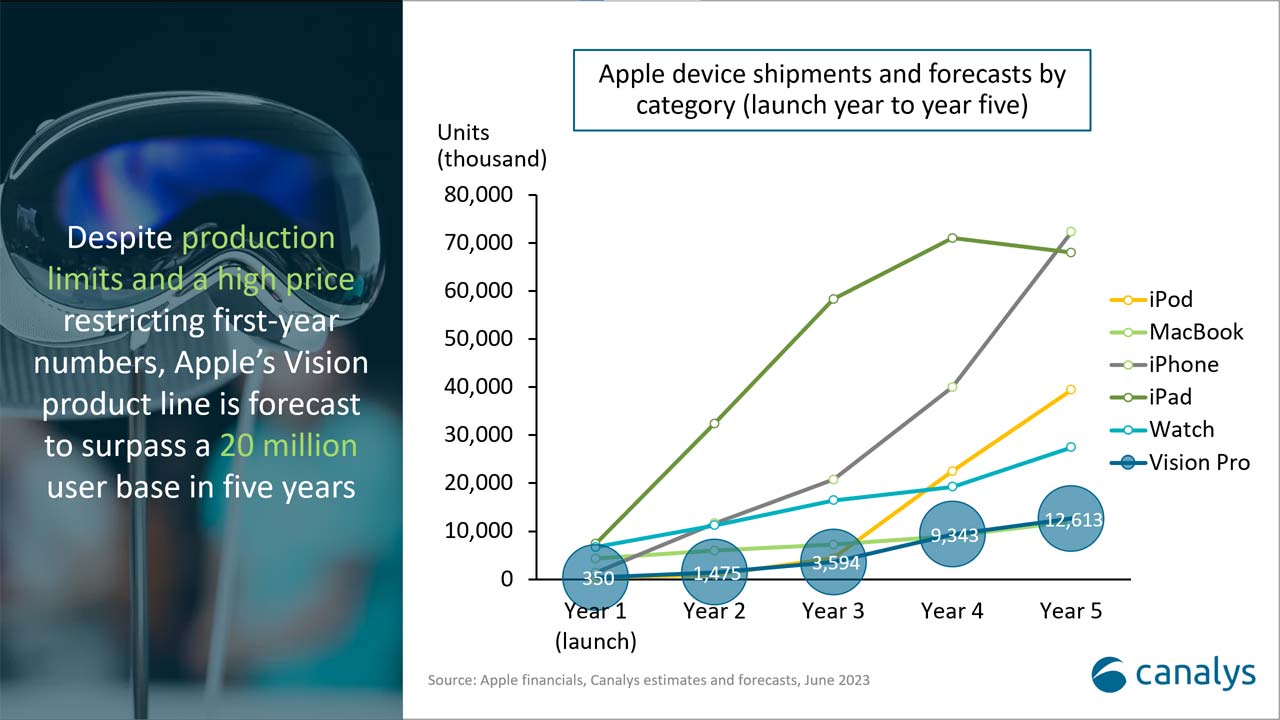

The success of the first generation will give Apple and its supply chain precious feedback on product improvements. Meanwhile, industry players will accelerate investment, and cost-efficient solutions will emerge to increase Apple’s margin on the device. In years two and three, the second Vision Pro will likely hit the market, achieving high growth from a low base. With a steady building up of the user base to a new computing platform and distribution channel, it will surpass 10 million annual shipments in years four and five, which is around 1% of the iPhone’s current installed base.

The Vision Pro headset is best placed to showcase the advanced technology that Apple has bestowed on its other devices but limited due to form factor or original use case of the existing devices. For example, Apple had the luxury of relying on its in-house M series processors for optimal performance, which most headset vendors did not. Beyond chipsets, Apple expanded and integrated some of its technologies, such as:

Getting the basics right is crucial, but Apple wants to over-engineer in this regard to ensure it can stand out and establish what its headset can do that competitors’ cannot. Some design decisions point toward the direction of lowering user friction and increasing the consumer appeal of the device. These features include:

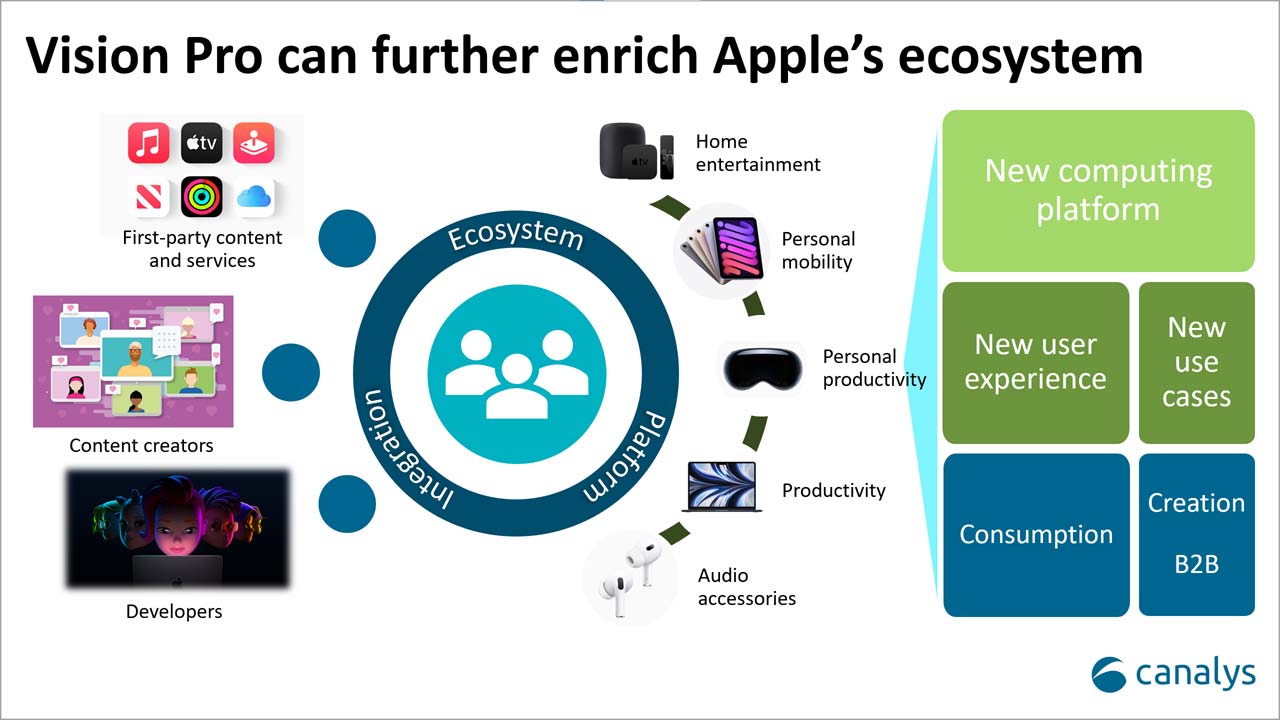

We remember the moment when Apple first removed the headphone jack from the iPhone 7 while releasing its AirPods, and users did not go back to wired devices once going wireless. Apple is trying to recreate this impact with the Vision Pro by breaking the boundaries of MacBook displays, offering new ways of interacting with the Apple elements that users are very familiar with, going beyond mouse and touch input. All the integrated technologies aim to create a user experience that should avoid motion sickness and fatigue and allow users to interact with spatial digital and real objects seamlessly, creating new use cases that the current ecosystem cannot achieve.

By calling the Vision Pro a spatial computing device, Apple positions the headset as the next computing platform rather than just an accessory related to the mobile or PC ecosystem. The term “spatial” is also well in line with Apple’s other spatial technologies, namely spatial audio, which it lauded in its AirPods and HomePod devices to showcase the multidimensional qualities of sound produced. Typically, Apple, being late to the market, allowed itself time to observe and avoid the major pitfalls plaguing XR headsets while investing in the right areas, such as designing its unique visionOS and building high-performance tracking systems for a seamless user experience.

The Vision Pro is still a consumer-first device, despite its high price and the impression that it is mainly aimed at creators and businesses. The visionOS will likely be the key selling point for early adopters who are highly familiar with and depend on Apple’s ecosystem for their daily life, covering work and play. Like the early iPhone adoption in business, the Vision Pro is likely to be a highly sought item for CxOs, whether they want to manipulate a large spreadsheet in their hotel room or simulate a movie theater while traveling on a plane.

Apple is one of the few smart device vendors that creates and distributes content via its first-party stores and services. It is no stranger to creating proprietary formats that only work well with its ecosystem devices to create entirely new user experiences. The Vision Pro being a consumer consumption and productivity device means Apple must rely on its existing ecosystem to generate use cases unique to it. With content quality and user experience upgrades to match the capabilities of the Vision Pro, Apple’s content and services business flywheel is expected to grow stronger, making it challenging for competitors, especially those relying on third parties for content and services, to replicate what it is doing.

Apple has not addressed a couple of things right off the bat: AI and the metaverse. While arguably creating or developing the metaverse isn’t something Apple is interested in, the future of VR somehow points in that direction. On the other hand, Apple’s careful approach to leveraging AI is more deliberate for creating consumer-centric tools, but this gives the market the impression that the company is not at the forefront of actively deploying generative AI features to benefit its users within the Apple ecosystem. Generative AI could potentially be a powerful tool that can be used alongside the Vision Pro. It will be a missed opportunity if Apple continues to avoid addressing generative AI, especially after the initial launch of the Vision Pro.

Meanwhile, the Vision Pro is a new approach to tackling MR by Apple. In its keynote and demonstration sessions, Apple actively avoided using any words associated with AR, VR or the metaverse while highlighting spatial computing to distance itself from the failing XR industry.

Despite the differentiated positioning, it is ultimately an XR headset, which still comes with the same drawbacks and challenges that all the other vendors, such as Meta, HTC, Microsoft and Pico, have faced. Such compromises include:

Even so, Canalys believes Apple will surpass all other players in the XR field. Canalys forecasts that the Vision Pro and the related device lineup will reach a 20 million user base by the fifth year after the product launch in 2024. With the Vision Pro, Apple will once again show that a late market entry is no barrier to success, and Apple will own yet another new category. By focusing on making the goggles a better MacBook, rather than trying to invent a new universe, Apple has shown that it understands the wants and needs of its next generation of customers. For comparison, 20 million users by the end of year five represents 15% of the MacBook installed base (Canalys estimates a MacBook installed base of 127 million at the end of 2022), and just 2% of the iPhone’s installed base.