Apple and Qualcomm are bringing Arm-based PC processors to the next level

On 24 October, Qualcomm took the wraps off its latest foray into the PC processor space, the Snapdragon X Elite. This cutting-edge chip is strategically positioned to challenge the premier offerings of competing silicon providers, boasting integrated AI capabilities that set a new benchmark. Just six days later, Apple, the dominant force in Arm-based PCs, introduced its M3 series chips for MacBooks and iMacs.

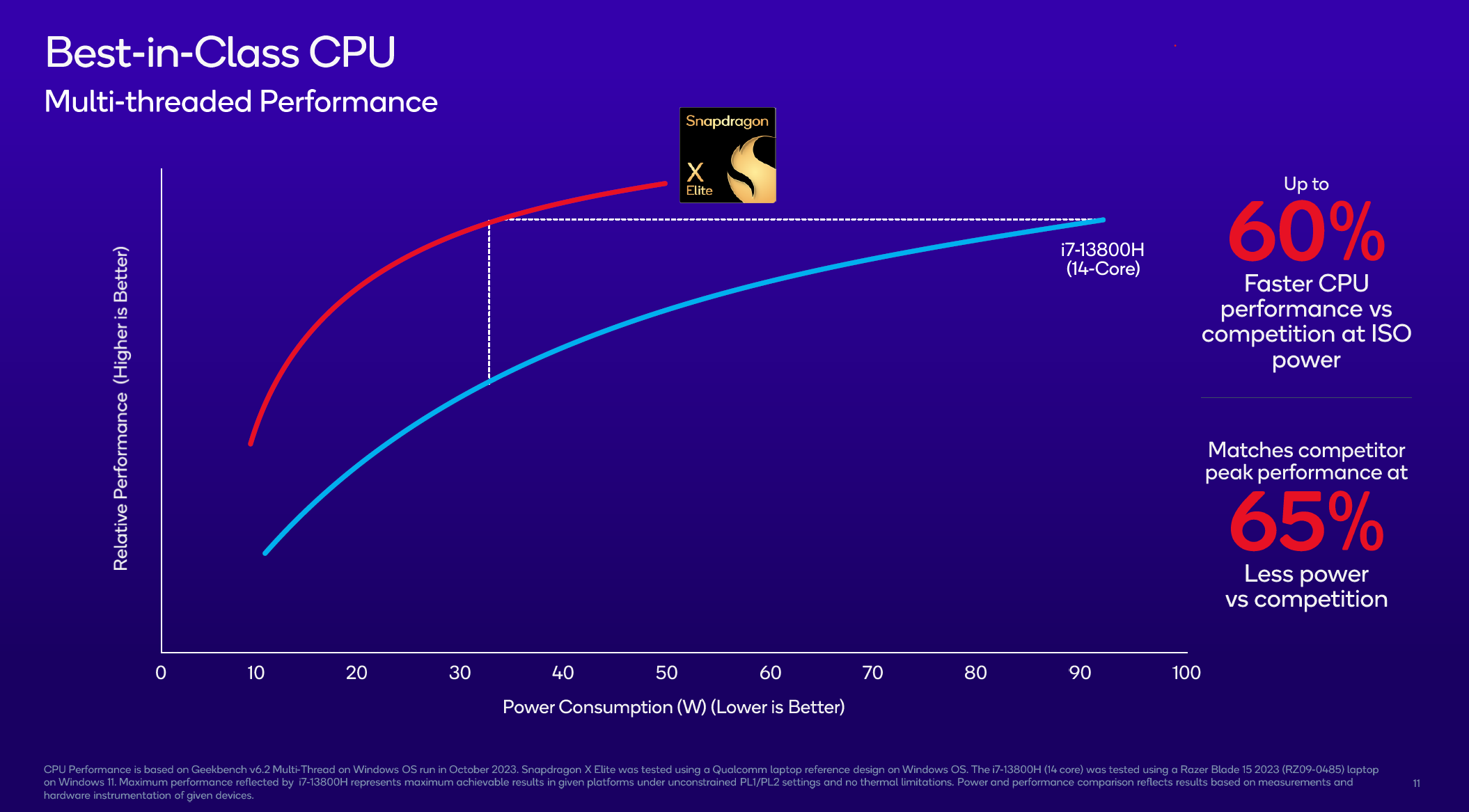

Based on the official benchmarking claims, both vendors’ new chips have undergone significant enhancements in performance and energy efficiency. These advancements enable both to compete robustly with Intel and AMD in the most performance-intensive segments of the market.

Source: Qualcomm

Qualcomm's official performance comparison

Arm-based processors do better in power efficiency and heat management for AI-capable PCs

Canalys expects that by 2027, 60% of PCs shipped will be AI-capable as such integration becomes a pivotal focus for vendors to revolutionize use cases and workflows. This shift demands greater computational power, particularly in neural processing. There are indications that Microsoft is collaborating with PC manufacturers to design products with over 40 TOPS of performance to meet the requirements of the next-gen CoPilot system on Windows, potentially setting a new standard for AI-PCs in the Windows ecosystem.

Arm-based solution providers have long been integral to the smartphone, automotive and tablet markets, where handling a myriad of signals and data types is the norm. Leaders such as Qualcomm, MediaTek, Huawei and Apple have honed their expertise in integrating diverse signal processing units. As a result, their foresight in embedding NPUs into smartphone chips has afforded them a head start in the PC space. Currently, these companies maintain a lead in the computational power of these components compared to x86 vendors, providing an advantage in scenarios that necessitate collaborative processing by CPUs, GPUs and NPUs.

Moreover, as the need for greater computing performance intensifies, concerns about power consumption and heat generation become increasingly critical. AMD's leadership has noted the potential for ongoing thermal challenges with CPU operation. Arm-based processors, favored for their streamlined coding structure, offer superior power efficiency and heat management. This advantage may become decisive as x86-based systems struggle to keep up with the thermal and power supply demands, including battery life.

Qualcomm and AMD lead in AI processors, while Apple competes with integration

Currently, Qualcomm's Hexagon processor unit in the Snapdragon X Elite already delivers an impressive 45 TOPS and Canalys anticipates that AMD's forthcoming product will attempt to match this benchmark. Intel, on the other hand, seems to be playing catch-up, with expectations that it will only reach this performance tier with its Lunar Lake platform launch in 2025. With OEMs keen to kickstart their on-device AI roadmaps, Arm-based PC providers have a chance to carve out market shares in this emerging segment. However, Intel still believes that their current product design is enough to fulfill the needs in AI tasks of users in most use cases.

Apple's M3 chip achieves 18 TOPS, only slightly up from the M2's 15.8 TOPS. While this is lower than the figures from Qualcomm and AMD, Apple's complete control over its hardware and software ecosystem will help Macs offer a comparable AI experience with these lower specifications.

Intel’s competitive barrier remains formidable

Gaining market share from incumbent leaders is always a daunting task. Unlike Apple, which has seamlessly shifted to Arm-based architecture through its total command over hardware and operating system ecosystems, Intel has built longstanding partnerships with PC vendors, Microsoft and distributors. This foundation has solidified its reputation among end-users as the top PC processor choice, presenting a significant hurdle for AMD and Qualcomm as they strive to position themselves as preferable options.

Furthermore, the ecosystem significantly impacts the supply chain, especially as Arm-based IC solutions and integration levels are distinctly different from x86. These variations are noticeable in motherboard designs. Major PC ODMs (Quanta, Compal, Wistron, Inventec and others) generally have limited experience in Arm-based SoC motherboard design due to their minimal involvement in smartphone manufacturing. Despite Qualcomm's extensive investment to provide assistance, kickstarting product development in this area is still not without its challenges.

Consequently, despite Qualcomm and MediaTek’s solutions demonstrating viability on Chromebooks, they continue to hold only a small portion of the market share. On the Windows front, the concern is heightened. Legacy applications have primarily operated on x86 architecture, a domain where software engineers have traditionally focused on creating and maintaining code. Even with Microsoft partnering with Qualcomm to navigate these complexities, there is still no assurance against potential user issues with unsupported scenarios or bugs, which could hamper PC vendors and the channel from effectively marketing these Arm-based offerings.

A single processor provider is not enough to support the market

As it stands, "Windows-on-Arm" is effectively synonymous with "Windows-on-Snapdragon" due to the absence of meaningful competition. MediaTek, after unveiling its top-tier Dimensity processors, is positioned to potentially match Qualcomm's manufacturing process and performance in this arena. Yet, as of November 2023, MediaTek has not made such a breakthrough, and per Canalys' projected roadmap, their relevant offerings might only surface in the latter half of 2025, potentially hindering the expansion of the product ecosystem.

The growing interest in Arm's potential extends beyond traditional chip manufacturers; it is possible that leading PC vendors might also join the fray, developing their own Arm-based CPU designs which could further diversify the landscape and invigorate competition in this sector.

Rumors also point to AMD and Nvidia's ventures into Arm-based PC chips, with Nvidia's prior experience in crafting Arm-based CPUs “Grace” for servers and dominance in the high-end gaming GPU market, signaling a robust entry capability into the premium PC space. However, due to the lead time required for chip refinement and product strategy development, the arrival of such chips from Nvidia and AMD is not expected before 2025.

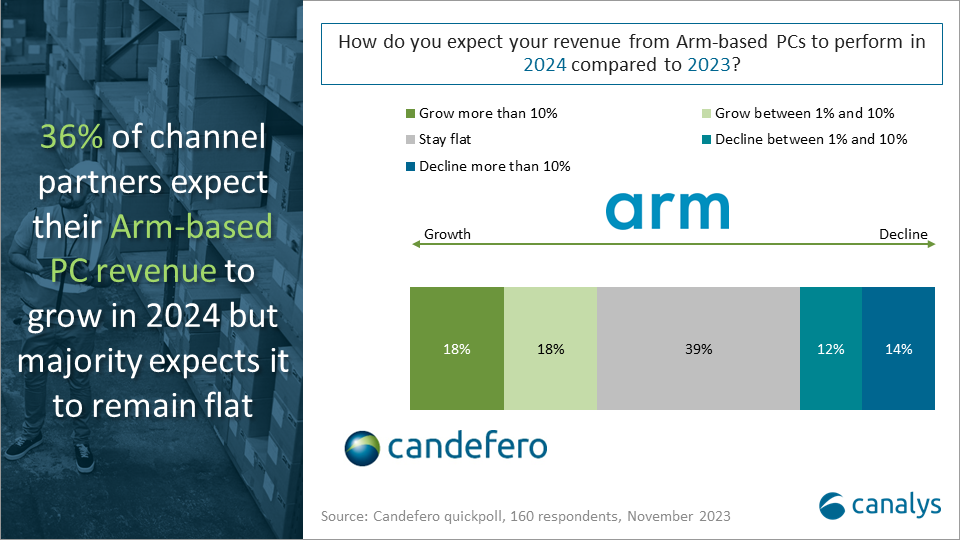

Channel partners’ expectations of Arm-based PCs are conservative

Canalys’ recent channel partner surveys revealed a cautious outlook toward Arm-based PC sales, with around 40% anticipating steady yet unspectacular revenue performance in 2024, which falls behind the growth expectation of the overall PC market. This sentiment underscores the presence of significant barriers, including those previously mentioned, which Qualcomm and other Arm-based solution providers must navigate.

As of Q3 2023, Arm-based PCs (excluding Macs) account for less than 1% of the total PC market, according to Canalys' data. Despite this, the performance and energy efficiency capabilities of current Arm-based processors suggest they have substantial potential to play a more influential role in the evolving landscape of AI-capable PCs.