Canalys recognizes 2023 vendor Champions in the Mainland China Cloud Channel Leadership Matrix

20 October 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

The Canalys Forums are back for 2023! This year’s series of events kicked off in sunny Barcelona with our EMEA Forum, featuring a diverse range of Expert Hubs covering key business areas for channel partners. Managed services continues to be one of the fastest-growing areas in the channel and the importance of understanding one’s own business model was discussed at the Alpha MSPs Expert Hub. Canalys host: Robin Ody, Principal Analyst, MSP Analysis Partner participants: ColabIT, Pax8, Xtravirt Vendor participants: Auvik, Cradlepoint, Trend Micro

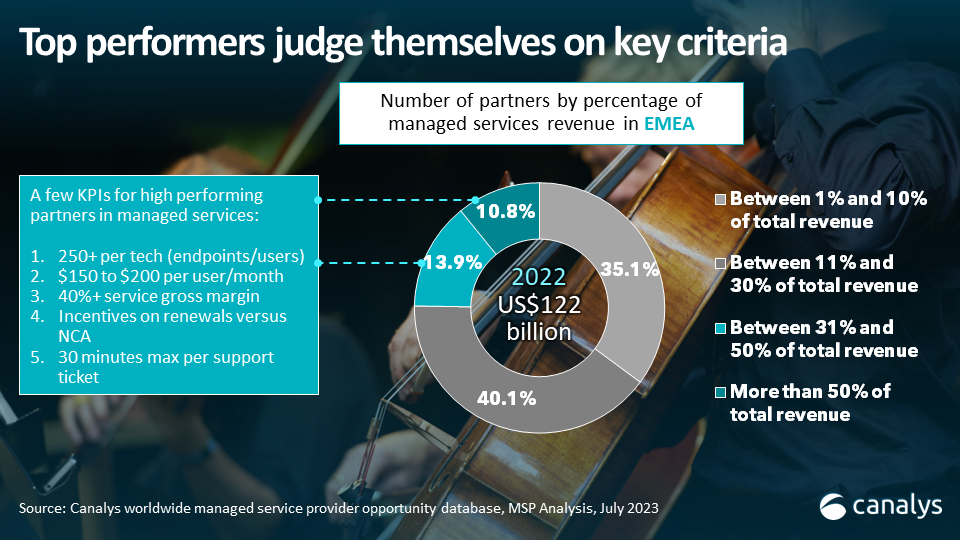

What is in a name? Canalys classifies MSP as a channel partner that derives over 50% of its revenue from IT-managed services. Canalys estimates there were over 16,000 MSPs in EMEA in 2022. However, more than 148,000 channel partners were delivering managed services in the region during the same time period.

Many partners are witnessing their managed services revenue grow faster than the rest of their business, which is leading to a greater number of partners in the top three revenue bands (as shown in the slide above). Particularly for those partners delivering between 11 to 30% of their revenue from managed services, there is a need to develop a deeper understanding of the structure of the MSP business model as it can inform how they view the health of this growing revenue stream.

Not all partners need to become MSPs, or even copy the MSP model, but with greater pressure to deliver recurring revenue and to shift the structure of their sales teams’ compensation models, it is important for them to at least be aware of some industry benchmarks that exist. Specialists tend to have clear financial metrics for how they deliver managed services, though these are certainly not the only ways to build a practice.

Service gross margin - a common benchmark that is subject to some debate among MSPs is the service gross margin of each deal they strike for managed services. Typically, the highest performing MSPs, regardless of revenue, are looking to achieve 40% or above though it is common for this to drop for larger MSPs as their revenue increases and they deliver a broader set of services. Even for these partners, it is generally viewed that at least 25% is necessary to be sustainably profitable.

Resource efficiency - it is a challenge for all partners, but perhaps none more so than small partners with fewer than 25 employees. Many MSPs fit into this category and the investment decisions they make have an even greater impact on their businesses. Knowing how to allocate a certain number of users to each technical support employee is a skill that is learned over time, but the general view from smaller MSPs is they are looking at 250+ end users for each technical resource allocation. While no end user or company is the same, with some requiring more support than others, it is generally agreed that a technical support employee should spend an average of half an hour per end user per month on support tickets.

The number of partners running hybrid models for managed services tells us that while metrics can be useful to guide us it is important not to chase numbers without a strategy. For example, a reseller with an endpoint cybersecurity licensing business should not structure itself like an MSSP. But if it is looking to grow its managed security practice toward greater managed detection and response (MDR) offerings, and perhaps even ultimately building a small security operations center (SOC), it can learn a lot from the tools and customer experience strategy an MSSP uses.

That reseller may not need to implement some of those approaches for five or ten years, but it could keep a list of things to bear in mind as it evolves. Some of these might include charging for vulnerability assessments on new customers rather than providing these for free. It may want to set out a defined compliance and response plan for a customer’s disaster recovery strategy, even if today it prefers to resell third-party MDR services from a vendor and would not be involved in the incident response for some time to come.

Metrics for managed services are very useful, not least because it can be hard to really understand our own businesses until we compare ourselves with others, but it is important to understand our own strategies and stick to a plan of action (even if the way we deliver that strategy changes over time). Alpha MSPs can come in many forms. Not all have to hit the benchmarks listed above. Some will operate in the enterprise sector and sell very different services with different margins, and have different ways of allocating employee time, but whatever the approach, it is always helpful to lift our heads and look around from time to time.