Analysis of carmakers’ strategies in making smartphones

4 October 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Channel Data Management (CDM) tools are becoming increasingly important for vendors and their partners in the tech industry. These platforms offer a comprehensive view of partner data, enabling data-driven decision-making, improved partner experiences, and overall optimization of channel operations and revenue growth.

In today’s highly competitive tech landscape, success increasingly depends on a data-driven partner strategy. The key to this is effectively utilizing a Channel Data Management (CDM) platform.

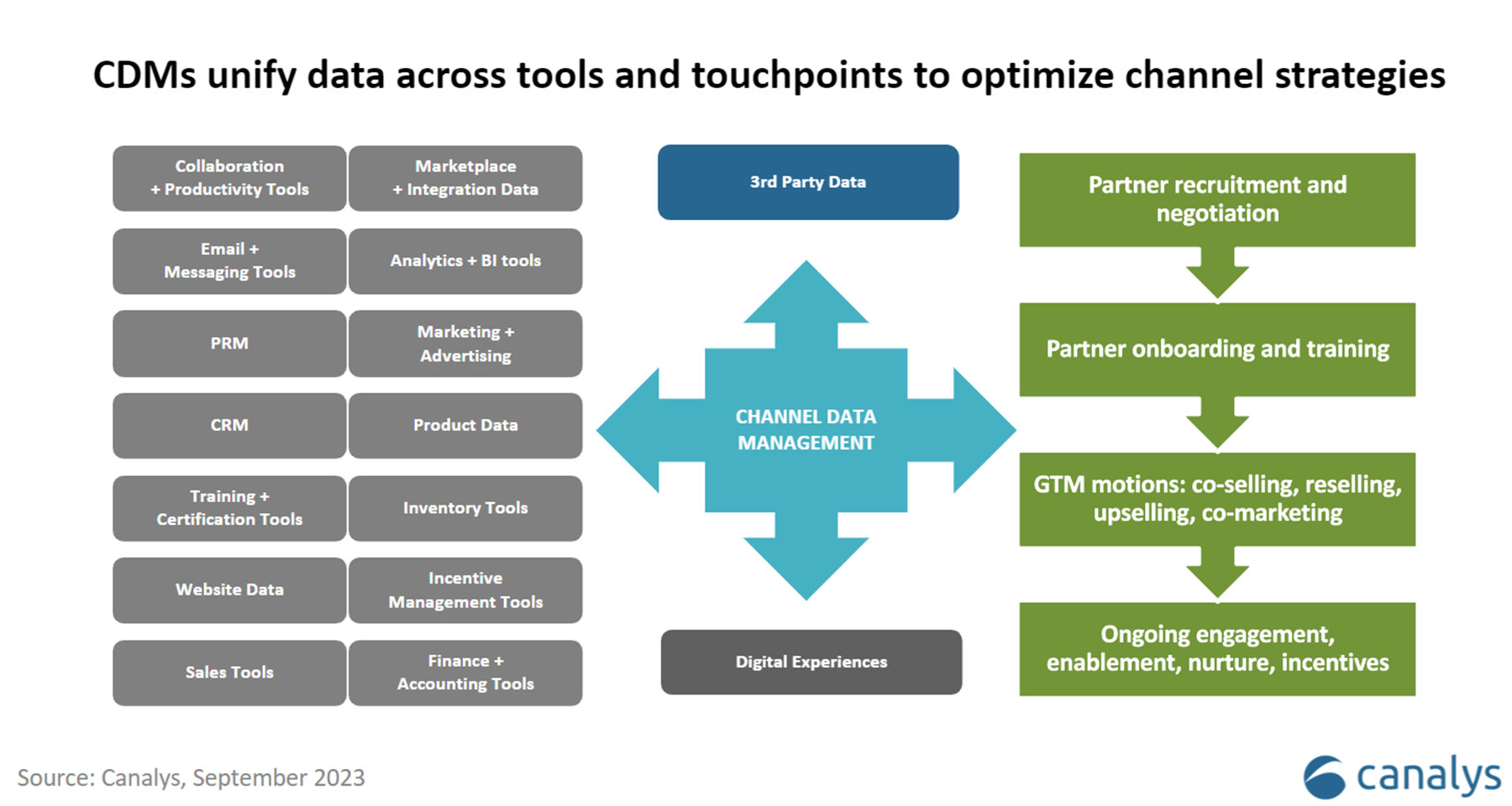

A CDM is a single platform that ingests, manages, and cleans all types of channel partner data across tools and touchpoints. A CDM then synthesizes the data, making it easy for vendors and partners to make data-driven decisions to optimize channel operations and boost revenue.

Historically, partner and channel data has been fragmented across disparate tools and teams. This leads to poor decision-making, reduced productivity, poorly designed partner strategies and channel conflict. A CDM provides a holistic view of the channel business and partners, and utilizes advanced analytics, AI, ML and predictive modeling to help leaders design winning strategies and programs, quantify ROI, and improve partner experiences.

For tech vendors, CDMs represent a shift in how channel business is operationalized. By unifying fragmented data, these platforms offer a view of the channel landscape that improves and streamlines the partner business. This enables more efficient resource allocation, better go-to-market strategies and programs, and the automation of routine partner management functions enabling a greater focus on revenue-generating activities.

On the partner side, these tools satisfy the increasing demand for better self-service, visibility, quicker onboarding, personalized experiences, incentives, and more effective go-to-market planning. Data accessibility also helps partners measure success, monitor progress towards goals and scale their business and operations more efficiently.

According to Canalys research, the broader ecosystem software industry boasts 233 active companies, generating US$5.3 billion in revenue. This number is projected to jump to $11.8 billion by 2028 as more companies place emphasis on data-driven ecosystem strategies.

The CDM innovation island consists of 26 major players in 2023 and is set to reach nearly a billion dollars in revenue by 2028. The landscape is constantly evolving, as new entrants launch innovative solutions regularly, and incumbents launch more comprehensive platform solutions.

Today, there are a variety of CDMs on the market, from holistic channel management tools to point solutions that offer niche data management to specific subsets of the industry. An example of CDM players include:

Comprehensive Solutions: Companies such as Salesforce offer holistic partner and channel management software with strong data management functionality. Likewise, E2open offers an integrated channel management solution for companies that run more traditional distribution, supply chain and channel businesses. Model N offers revenue, deal and incentive management for the channel with strong data capabilities.

Partner Ecosystem, Collaboration, Mapping and Co-selling Tools: Crossbeam, Reveal and PartnerTap are ecosystem platforms with extensive data management functionality. These tools feature secure partner-to-partner data sharing, account mapping, co-selling tools and analytics.

Financial and Incentive Management Tools: 360insights is a leader in incentive management, ecosystem management and real-time analytics. Zomentum offers revenue management tools catered towards MSPs. Vistex offers channel management tools within their suite of products that optimize costs by offering visibility into channel programs data, incentive effectiveness, like MDF and channel rewards programs, and streamlining partner payments and other revenue processes. Gradient MSP helps MSPs automate billing reconciliation and license management across their portfolio of clients and partners, saving time and improving billing accuracy.

Partner Analytics, Scoring and Intelligence Tools: PartnerOptimizer offers advanced, data-driven partner profiling and partner intelligence. Bain & Company has Partner Sonar, a channel partner database of several hundred thousand channel partners across partner types. IQBlade uses data and intelligence to identify relevant partners for the overall business and individual accounts. PartnerScore uses data to help companies predict and score partnership success to drive mutual ROI. Successful Channels offers their Channel Sales Platform that automates and measures key partner management functions.

CDMs will play an increasingly important role in channel and partner organizations. The CDM landscape will continue to evolve in three primary ways:

The role of AI and machine learning will become more important for technology companies and partner strategies. As tech companies embrace Gen AI internally and as partners seek greater automation and customization, a data-centric channel strategy, powered by AI, will be indispensable. Advanced CDM platforms will provide real-time predictive analytics and cutting-edge automation, redefining channel management standards. CDMs will also roll out more predictive insights and be able to recommend actionable steps to channel leaders, partner managers, and partners to drive growth.

There are more than 800,000 emerging technology companies with strong hardware components including IoT, automation, robotics, Metaverse, self-driving cars, drones, 3D printing, and quantum computing. As this hardware navigates through supply chains and distribution channels, measuring, monitoring, and managing for cost optimization and revenue growth is critical. CDM tools will evolve to keep up with this demand, becoming more agile, insightful, integrated and robust to manage and measure data across the entire supply chain and channel journey.

In the evolving landscape of the channel ecosystem technology market, there's a shift towards comprehensive solutions that address a variety of needs across channel management. Consolidation and growth will likely occur and point solutions will become robust channel data management platforms that fulfill needs across the lifecycle. As channel technologies continue to advance and overlap, integrated platforms with strong CDM functionality will be used by the leaders in the space.

Given the myriad of responsibilities and competing priorities for channel executives, a comprehensive data strategy might initially seem daunting. Partner teams often grapple with issues such as inconsistent data quality, fragmented data sources, system integration complexities and limited resources. Therefore, executives should first prioritize building a data-centric organization by cleaning their data and focusing on deriving actionable insights from their existing tools. Then, as they consider expanding their toolkit, companies should thoughtfully evaluate and implement new CDM tools that align with business priorities and address pressing challenges. For example, if data silos are a significant issue, they might seek CDM solutions known for their robust integration capabilities. Likewise, if building out a particular partner ecosystem is a strategic initiative at the top, a partner collaboration and co-selling tool that enables data sharing with partners should be prioritized. By focusing on being a more data-driven organization and aligning tool adoption with tangible business needs, channel executives can ensure they are investing in solutions that offer meaningful value and drive sustainable growth.

For more insights on the Channel Ecosystem Landscape, refer to our latest research report here.