Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Global tier-one suppliers reshaping competitiveness in the Chinese ADAS market

In 2024, the ADAS market in China is undergoing a restructuring phase with intense competition among carmakers and tier-one suppliers. As the industry evolves, global tier-one suppliers are adapting their strategies to stay competitive, focusing on integrated convergence and system safety to maintain a competitive edge in the evolving market landscape.

In 2024, the advanced driver assistance system (ADAS) market in China will enter a restructuring phase. Looking back at 2023, according to Canalys estimates, penetration rates for L2 and L2+ ADAS in China exceeded 50%, with integrated driving-parking solutions achieving close to 100% growth. As OEMs balance enhancing intelligent driving capabilities with cost-effectiveness, the market shows a trend in which L2 and L2+ ADAS functions are moving towards both the mid-to-low-end and mid-to-high-end markets, priced between CNY100,000 to CNY150,000 and above CNY150,000, respectively.

At the beginning of 2024, the price war waged by carmakers, accompanied by waves of business consolidation and layoffs among tier-one suppliers in China, shows the increasingly intense competition. The strategic rivalry extended into vehicle technologies. Notably, following Tesla's lead, NIO announced all its 2024 model-year vehicles would upgrade to a central computing platform; Neta also declared collaboration with Jingwei Hirain on the central domain controller. These trends indicate a gradual shift towards integrated convergence in ADAS technologies.

Global tier-one suppliers adapt to meet new demands

The diversification of ADAS features has prompted global tier-one suppliers, who missed driving-parking integrated solution market opportunities, to adjust their strategies and explore possibilities to outmaneuver the competition in the new competitive environment.

Continental Group restructured its ADAS business line in China, redirecting its R&D personnel to the joint venture with Horizon Robotics to enhance its competitiveness by reducing R&D overlaps and optimizing the use of resources.

Bosch and Aptiv are actively promoting their respective localization strategies, aiming to enhance the capabilities of their Chinese teams. They have restructured their organizations to address previous shortcomings such as technology gaps and slow market responsiveness. The successful launch of cockpit and ADAS integrated controllers by Bosch and Aptiv at CES 2024, demonstrates their ability to respond to market changes and implement effective localization strategies.

A competitive edge for established global tier-one suppliers

As the implementation of ADAS accelerates, the market is placing greater emphasis on system safety, stability, and real-time responsiveness. Tier-one suppliers who possess a comprehensive mastery of capabilities across key domains such as drivetrain, chassis, body, and others will be better positioned to compete. This is because strong know-how in key vehicle operation mechanisms, combined with tight integration with ADAS perception and decision-making systems, will assist tier-one suppliers in meeting the diverse demands of OEMs for driving pleasure and comfort while also achieving goals of system simplification and cost reduction.

Compared to tier-one partners which only focused on individual domains, traditional global tier-one suppliers leverage their accumulated expertise across all domain capabilities, giving them an advantage in rapid transformation in the new round of industrial value chain restructuring.

Simultaneously, traditional global tier-one suppliers hold certain advantages in cockpit-driving integration as they have made early strides in the digital cockpit domain and have accumulated substantial production experience in hardware integration. Nonetheless, they will still face various internal and external challenges, and they should prepare in the following areas:

- Clarifying the inherent requirements for cockpit-driving integration

This involves not only reducing development costs and shortening development cycles but also consolidating two computing units to facilitate software and hardware integration, thereby supporting the introduction of differentiated features and OTA capabilities. This means tier-one suppliers need to improve the collaboration among departments responsible for various functional areas, breaking down internal departmental barriers, and driving profound organization integration. - Developing product plans aligned with market progression

Cockpit-driving integration is a direct outcome of the evolution of the E/E architecture. However, developing a "single-chip solution" still poses considerable uncertainty. Therefore, tier-one suppliers must design their product planning based on the technological strategies and cost-effectiveness requirements of OEMs. It is also essential to establish a clear product portfolio for "single-box," "single-board," and "single-chip" solutions. - Addressing challenges during the implementation of cockpit-driving integration

There are disparities in the safety and real-time requirements between the ADAS and digital cockpit systems. Therefore, tier-one suppliers may face challenges allocating computing resources effectively, ensuring safety isolation, and verifying functionalities during design and mass production.

As ADAS SoCs and related technologies are highly important, it may be useful for traditional global tier 1 suppliers to consider vertically integrating ADAS SoCs. However, due to the significant investment and longer research and development cycles required for SoCs, the comparatively limited market size as compared to traditional automotive-grade chips, and the persistent adherence of traditional global tier 1 suppliers to the economies of scale to achieve profitability, their tendency to develop ADAS SoCs in-house is relatively low.

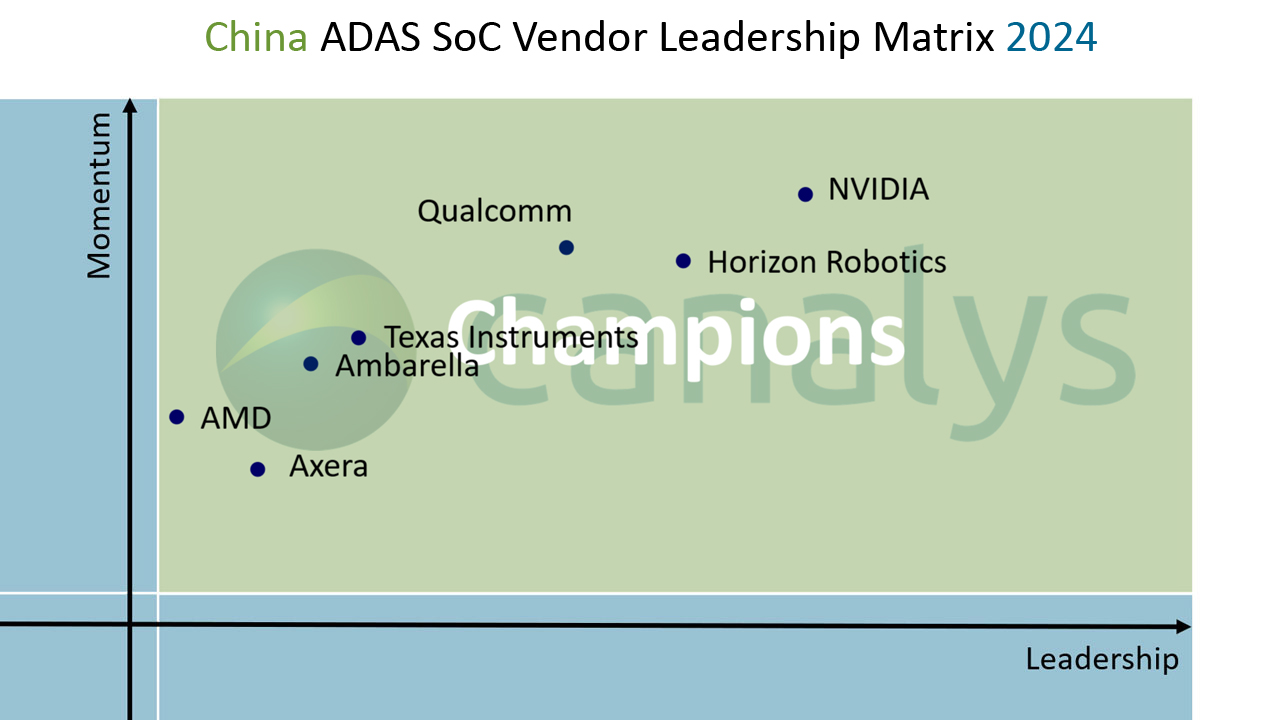

ADAS SoC vendors can seize rising opportunities from tier-one suppliers’ transformation

As automotive OEMs accelerate investments in ADAS, they demand higher capabilities from partners. Despite increasing investment, it is still challenging for tier-one suppliers to secure design wins. In some cases, securing design wins only guarantees a spot as a secondary supplier unable to reap the benefits of a primary supplier. Additionally, market concentration among select OEMs has led many SoC vendors, despite efforts to form solutions with multiple tier-one suppliers, failing to achieve the desired market performance.

Nevertheless, SoC vendors with the following capabilities stand a better chance of capturing partners attention and seizing opportunities amid tier-one suppliers’ transformation:

- Providing support for perception and decision-making algorithms through ecosystem partners to ease development.

- Demonstrating strong capabilities and support for customized SoCs.

- Leveraging product seriation concepts to create a series of controllers with strong upgradability and compatibility.

The global tier-one suppliers' accumulation of all-around capabilities in powertrain, chassis, steering, and others forms an entry barrier for emerging tier-one suppliers. At the same time, the advantages of a robust R&D procedure established through sustained development efforts will be further amplified under the demand of Chinese OEMs expanding overseas. The OEMs' demand for comprehensive, all-rounded capabilities of partners has increased the difficulty for SoC vendors with strong vertical integration capabilities, to transform themselves into tier-one suppliers. Thus, close collaboration between SoC vendors and tier-one suppliers is still necessary to drive sustained development in the ADAS market.