Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Decoding the new Indian EV policy: opportunities for Tesla and beyond (Part 2)

The blog explores the current state of the global electric vehicle (EV) market, highlighting factors impacting EV demand and the opportunities presented in untapped markets like India. Focusing on Tesla's strategies and challenges in entering the Indian market under new EV policies, the blog underscores the significance of early investments and partnerships in establishing a strong foothold for long-term success and market expansion.

Global demand for EVs is experiencing a slowdown in major markets. The reduction in subsidies and larger price parity among EVs compared to ICEs are among the significant contributors. This led to the launch of a price war among leading brands such as Tesla and BYD globally, but it significantly hit automakers’ profits. The need for expansion into viable markets for growth has become essential for EV makers. On the other hand, the Rest of Asia (excluding China) remains a relatively untapped market with currently less EV penetration but has significant potential.

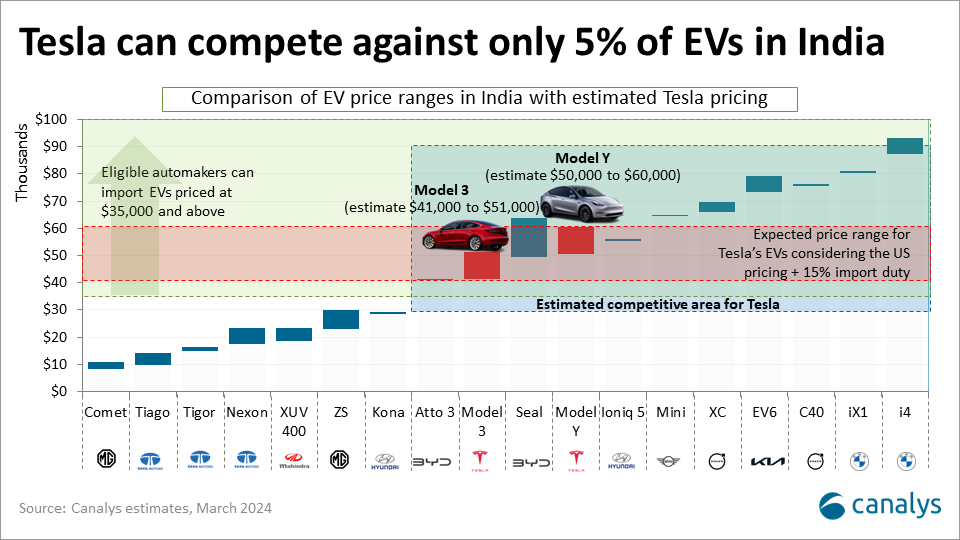

India’s light vehicle market is the world’s fourth largest and is growing strongly. EV penetration was just over 2.2% of the total vehicles sold in 2023. India’s light vehicle demand is skewed toward mass-market vehicles costing between US$7,000 and US$20,000, with SUVs and crossover vehicles increasing in popularity. But a growing niche exists for high-end vehicles, driven by sales to tech-savvy professionals with increased disposable incomes. However, only a small number adopted EVs over high-end ICE vehicles at similar prices. Significant price disparity, range anxiety and lack of affordable choices limit the EV buying decision.

The recent unveiling of India’s new EV policy signals a pivotal moment, particularly for global automakers looking for market expansion. With the implementation of the new policy, the government could facilitate the entry of global carmakers such as Tesla and incentivize India’s plans for companies like VinFast, Jaguar Land Rover and Foxconn. Tesla is the most attractive electric vehicle maker for India due to its large appetite for investment in global expansion appetite and its ability to develop the EV production ecosystems.

The new Indian EV policy offers increasing incentives, making it a prime opportunity for Tesla to establish a strong position in the country. Tesla can begin building infrastructure and value chains to attract early adopters until it establishes domestic manufacturing. By investing early, Tesla can gain a significant first-mover advantage in the Indian EV market, which can lead to brand loyalty and a larger market share as the market expands.

Tesla’s initial offerings, likely the Model 3 and Model Y, would position them competitively against premium EVs and luxury car brands already present in India. It can launch Model 3 with an estimated price range of US$41,000 to US$51,000 and Model Y with US$50,000 to US$60,000 calculations based on US pricing with 15% import duty. This will cater to a niche segment of the market that has a strong preference for high-end electric vehicles and is looking for alternatives to SUVs and sedans from established manufacturers.

After establishing successful manufacturing operations in India, Tesla could access Production-Linked Incentives (PLIs) under the new policy. While other automakers will also vie for the same PLI benefits, Tesla is poised to capitalize on subsidies from the National Programme on Advanced Chemistry Cell (ACC) Battery Storage more effectively. Tesla's battery technology experience, vertically integrated manufacturing and economies of scale position the company to maximize government subsidies, especially when India auctions critical minerals for battery production. This will ensure a reliable source of raw materials for battery production in India, reducing dependence on external suppliers.

Despite the positive outlook, Tesla can face some risks. The success of its Indian venture hinges on establishing a well-defined strategy that requires upfront investment to establish both manufacturing and charging infrastructure. Its initial import prices, even after factoring in reduced taxes, might remain high compared to domestic options. This could limit its customer base in a cost-sensitive market like India. Tesla needs to be mindful of competition from domestic players like Tata and Mahindra & Mahindra, who are ramping up their own EV production. These companies have the advantage of existing infrastructure, potentially lower production costs and a strong understanding of local market dynamics. Successfully navigating these challenges will be crucial for Tesla’s long-term success in India.

Tier-one suppliers have a vital role to play

Attracting carmakers to India is crucial for the country's automotive industry, but building a robust supply chain ecosystem is equally vital for sustainable growth. The recent policy initiatives incentivize EV manufacturers and benefit the automotive components sector by mandating local production. This presents a significant opportunity for collaboration between EV firms and Indian ancillary businesses, fostering the development of local R&D facilities. However, to realize the full potential of the EV ecosystem, tier-one suppliers and technology vendors need to ramp up investment and collaborative efforts, with an urgent need to develop and attract skilled workers in this sector. This not only addresses the future needs of carmakers but also underscores India's burgeoning capabilities in producing EV software, hardware and systems beyond automotive components.

Overall, EV manufacturers' potential expansion in India not only amplifies their global presence but also enables them to tap into previously untapped customer demographics. India’s strategic location makes it an ideal hub for exporting EVs to other South Asian and Southeast Asian markets. India’s new EV policy heralds a significant milestone in the country’s journey towards sustainable mobility and economic growth. By leveraging the potential of EVs, India not only addresses pressing environmental concerns but also emerges as a frontrunner in the global automotive industry. As the policy unfolds, it is imperative for stakeholders to collaborate closely, navigate challenges effectively and seize opportunities to realize India’s vision of a greener, more prosperous future.

Link back to - Decoding the new Indian EV policy: a global stage beckons (Part 1)