Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

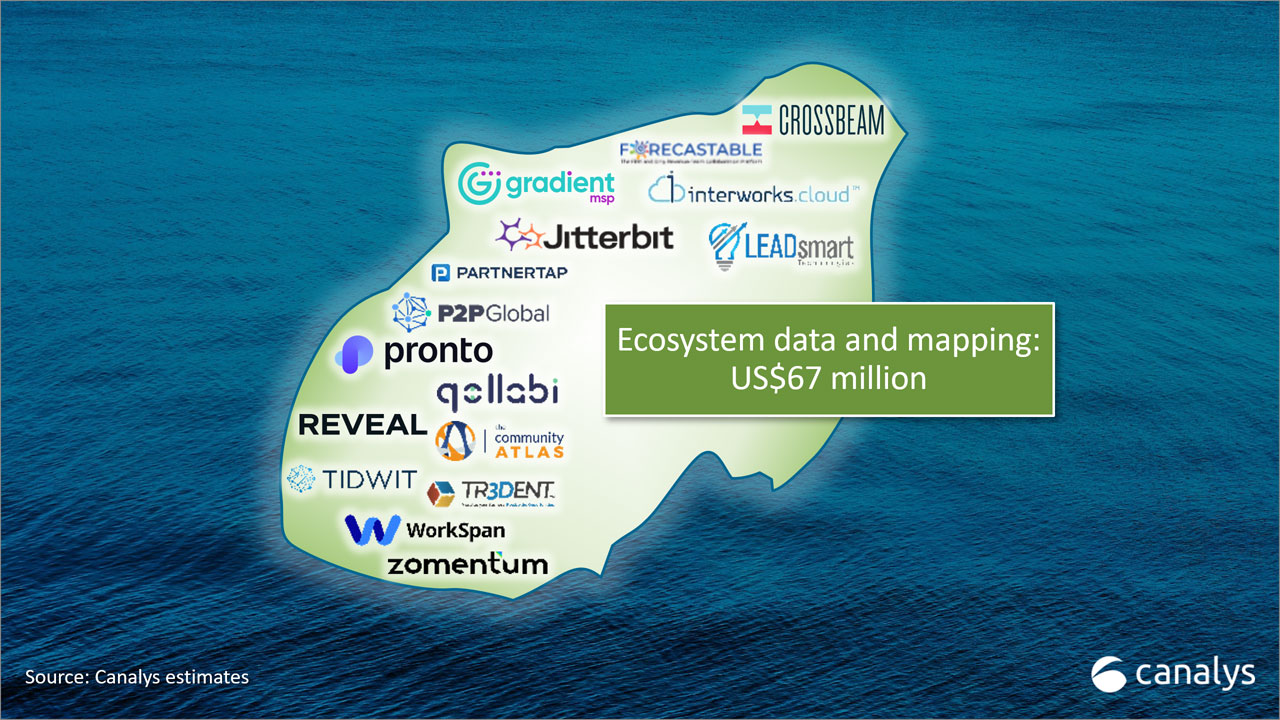

Ecosystem data and mapping tools enable secure and trusted data sharing between partners

Explore how ecosystem data and mapping tools are revolutionizing collaborative partner motions and enabling data-driven go-to-market strategies that optimize revenue and efficiency. Learn about the key players enabling better co-selling, collaboration and ecosystem management, and discover the future trends shaping the rapid growth and evolution of the ecosystem data and mapping landscape.

In the post-cookie era, selling and servicing the modern buyer requires a new, sophisticated approach.

Vendors are turning to ecosystem data and mapping tools to unlock partner-led growth

With the escalating cost of sales and marketing, industry changes like the death of the third-party cookie, and evolving buyer behaviors and customer needs, technology vendors are increasingly turning to partners to help them sustain growth. Today, the average buyer experiences 28 touchpoints pre-sales and works with an average of seven partners, emphasizing the need for companies to invest in collaborative go-to-market motions with their customers’ trusted experts and partners. As a result, vendors are turning to ecosystem data and mapping (EDM) tools to enable collaborative go-to-market strategies with partners that effectively engage today’s well-informed buyers. These tools facilitate secure and trusted data sharing among partners, enabling data-driven strategies and deeper levels of collaboration, and allowing companies to leverage their ecosystems more effectively.

What are EDM tools?

EDM tools are solutions designed to help vendors optimize partner strategies and strengthen collaboration. These solutions offer a secure environment to share and analyze overlapping data between partners, thus enhancing the efficiency, effectiveness and security of joint go-to-market efforts.

There are two core categories of EDM tools: the first category enables co-sell and collaboration use cases, while the second category focuses on ecosystem management use cases. All EDM tools share a core feature set that uses secure data sharing to drive strategic initiatives and efficiencies. EDM tools in the co-selling and collaboration category focus on maximizing co-selling and co-marketing efforts by automating analysis to identify high-potential partners and customer and prospect overlap. This results in more efficient account mapping, account planning, co-selling, co-marketing, co-servicing and customer expansion initiatives. EDMs that focus on ecosystem management simplify and automate data management and data integration to drive efficiencies across business functions, such as billing, invoicing, license reconciliation, enablement and other workflows between partners.

The automated and data-centric approach of EDM tools not only improves operational efficiency, strategy prioritization and collaboration, but also offers measurable insights and ROI that other channel and ecosystem tools often lack. For vendors, EDM tools provide a clear picture of high-value partnerships and streamline tedious processes, enabling data-driven decisions and more efficiency. Partners, in turn, are enabled with better collaboration and easier access to vendor resources. This heightened cooperation opens avenues for revenue growth and fosters stronger, more aligned and more productive partnerships.

While EDM tools offer a clear advancement in ecosystem tooling and strategy, the use of EDM tools is not without challenges. These tools necessitate upfront investment, clear ownership and strategic expertise, buy-in from sales and success teams, workflow and systems integrations, and a foundation of trust. Vendors and partners must also have a strong culture of partnering to fully adopt and leverage the potential of EDM tools and navigate potential alignment and communication hurdles with partners. Additionally, security and data privacy concerns currently present adoption obstacles within certain industries and markets. The sharing of databases between partners and vendors introduces security risks and privacy issues, particularly for cybersecurity vendors and enterprises facing intense scrutiny and stringent data policies. Finally, EDM tools must be adopted by both the vendors and their partners to share and map databases. Vendors must select the EDM tool that has been the most widely adopted by their most important ecosystems and within partnerships that represent the largest growth opportunities.

The ecosystem data and mapping landscape

According to Canalys research, the broader ecosystem software industry currently comprises 233 active companies, generating US$5.3 billion in revenue. This figure is projected to more than double to US$11.8 billion by 2028 as more companies emphasize data-driven ecosystem strategies. In 2023, there were 16 players in the ecosystem data and mapping segment that delivered US$67 million in revenue, and the space is rapidly growing.

Key players: co-selling and collaboration

- Crossbeam (Pennsylvania, USA): Crossbeam acts as a data escrow service that finds overlapping customers and prospects with partners while keeping data private and secure. This enables companies to find, close and keep more customers.

- Forecastable (Florida, USA): Forecastable helps companies establish, execute and scale partner co-selling programs, and helps drive partner-sourced revenue by surfacing co-selling opportunities to sales and partners.

- LeadSmart (California, USA): LeadSmart is an AI-enabled CRM, customer intelligence and sales enablement tool for distributors, manufacturers and sales agents. It provides deep insights into businesses and customers, enables partner collaboration and gives a 360-degree view of all prospect and customer activity that is securely accessible by internal teams and channel partners.

- P2P Global (Ohio, USA): P2P Global is an open ecosystem that creates a collaboration marketplace for technology solution providers. It is a skills-based platform that allows members to create opportunities, identify skill gaps and set match criteria that will automatically allow others to respond, letting users select from a pool of top-skilled solution providers for engagements.

- PartnerTap (Washington, USA): PartnerTap offers a platform to automate and enhance partner sales processes and enable effective co-selling. PartnerTap enables companies to securely share data with partners, identify mutual accounts, automate account and opportunity mapping, share and track pipeline, and streamline collaborative sales efforts, making it easier to drive revenue through partnerships.

- Qollabi (New York, USA): Qollabi is on a mission to make indirect sales predictable. Qollabi business relationship management (BRM) software creates shared spaces to develop and collaborate on mutual success plans using the objective and key results (OKR) framework.

- Reveal (Paris, France): Reveal allows customers to connect with partners and securely compare CRM data to generate higher win rates and more revenue through ecosystem partners.

- WorkSpan (California, USA): Designed as a co-sell and co-marketing collaboration platform, WorkSpan helps companies scale their co-sell revenue growth by collaborating with partners on deals, enabling bi-directional opportunity and referral sharing, managing shared pipeline, and tracking performance. It’s built to improve the efficiency, speed, productivity and outcomes of collaborative efforts.

Key players: ecosystem management

- Interworks.cloud: the interworks.cloud platform aims to successfully respond to companies’ problems and needs regarding automated billing, ordering, invoicing and recurring payments for IaaS and SaaS solutions. With more than 15 active and fully functional integrations, including leading products from major cloud vendors, the interworks.cloud platform helps businesses boost their service portfolios and expand their cloud offerings.

- Jitterbit: Jitterbit connects systems, automates workflows and creates new applications to streamline business processes across the enterprise – all via a single low-code integration platform. Rooted in iPaaS and fueled by an ambitious hyper-automation vision, Jitterbit integrates critical business processes and enables innovative application development.

- GradientMSP (Calgary, Canada): GrandientMSP simplifies and automates data management for managed service providers (MSPs), providing solutions to help MSPs manage billing and license reconciliation across vendors.

- TIDWIT (Virginia, USA): TIDWIT scales collaboration, distribution and information exchange across organizations, helping companies better manage and enable partners. TIDWIT can securely push information into partner environments and connect content and processes across partner ecosystems.

- Tr3Dent (Galway, Ireland): Tr3Dent’s intuitive, end-to-end strategic planning platform, Transformation Accelerator, enables cross-organizational productivity and collaboration while simplifying the organization, design and management of the complex information required to enable successful digital transformations.

- Zomentum (California, USA): Specifically designed for MSPs, Zomentum combines sales automation, CRM and quoting systems with e-signatures, payment collection and intelligent insights to help partners and vendors drive efficiencies, accelerate sales processes and secure more wins.

The future of EDM

The future of EDM indicates rapid adoption and growth, with advances in AI set to offer better predictive analytics, insights and automation. A focus on improving security and trust in data sharing will also continue, with the space offering more security and privacy features to address major vendors’ concerns. Functionality will increase and new players will enter the market, and there will likely be acquisitions. Players in this space should continue to invest, innovate quickly and collaborate closely with vendors to create more use cases for collaborative partner solutions.

Conclusion

EDM tools are fundamentally changing the way businesses collaborate and strategize their go-to-market efforts with partners. By facilitating shared data, a data-driven approach to partner strategy and unified tactics to surround the buyer and drive efficiencies for the ecosystem, these tools empower vendors to optimize revenue. Channel chiefs, partner leaders, CROs and CMOs should be actively prioritizing and investing in co-marketing and co-selling strategies. Vendors that have already invested in EDM tools should be optimizing and experimenting with EDM tactics; vendors that have not yet invested in EDM tools should be prioritizing trials and pilot programs with the major players.