Expanded Scale and Leadership in B2B: From R&D to ROI

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

Ecosystem revenue to reshape the future of Middle Eastern consumer technology

This is part of the “In Conversation with Omdia at GITEX 2025” series, which explores how ecosystem revenue will define the next wave of profitability in the Middle East’s consumer technology market. With hardware shipments stagnating, the focus is shifting toward connected devices, services, and subscriptions that raise ARPU, deepen brand loyalty, and create new revenue streams across vendors, telcos, retailers, and service providers.

After a surge in post-pandemic demand, smartphone and PC shipments in the Middle East have plateaued. According to Omdia, smartphone shipments grew from 35.6 million units in 2020 to 58.7 million in 2024, while consumer PCs (including notebooks and tablets) rose to just over 9 million. Shipments are forecast to grow only 3% in 2025, signaling stalled momentum. Between 2025 and 2029, smartphones are projected to expand at a modest 2% CAGR, while PCs will stay nearly flat at under 1% CAGR.

While hardware profitability remains sustainable, future growth will depend on connected devices and services. In premium Gulf markets, penetration is already intense, and consumers are stretching replacement cycles as devices stay powerful for longer. Today’s Android IoT portfolio is not profitable, with shares often built through bundles and giveaways — turning IoT into a marketing cost rather than a margin driver. This lifts attach rates but is unsustainable. The urgent reality for OEMs, telcos, distributors, and e-commerce players is that hardware alone will no longer fuel growth. Sustained momentum requires monetizing the installed base through services and diversifying into connected devices – cross-selling wearables, tablets, and AI PCs to raise ARPU, deepen loyalty, and offset stagnation.

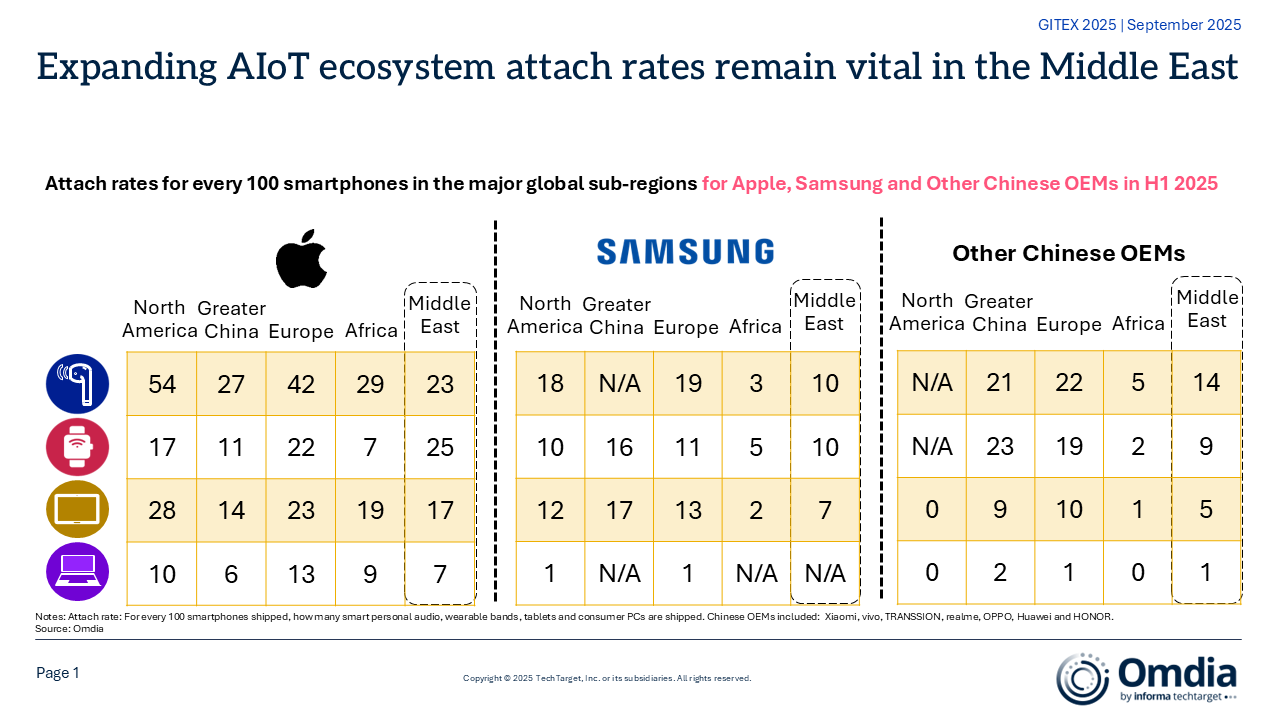

A revenue gap waiting to be closed as attachment rates lag global trends: Attachment rates in the Middle East show both progress and missed opportunities. Apple retains the broadest attach base. Even as AirPods per 100 iPhones softened from 31 in 2021 to 23 in H1 2025, the Apple Watch attach rate rose from 14 to 25, and iPads and Macs crept upward, sustaining monetization despite longer iPhone lifecycles. Crucially, Apple’s ecosystem products, such as AirPods and Watch, generate profitable revenue as standalone purchases, not giveaways — a structural advantage rivals lack.

Samsung, by contrast, has only modest traction. The Galaxy Watch attach rate has reached 10 per 100 smartphones, concentrated among high-end users, while Galaxy Fit bands cover the mass-market. Tablets remain flat, and audio adoption shows limited momentum. Much of Samsung’s attach volume has been built on subsidized bundles — Galaxy Buds or Watches tied to smartphones in operator promotions. These defend share but hurt margins, effectively “buying” market share. Huawei follows a similar playbook, often backing operators to offer free or heavily discounted TWS.

The result is that Android vendors have won volume share, but not profitability. Attach rates are inflated by promotions rather than natural demand, making hardware a marketing cost instead of a margin driver. The next phase is clear: turning volume share into services revenue. To justify ecosystem investment, Samsung and its peers must now monetize their installed bases with AI-driven personalization, premium software, and service bundles — otherwise attach remains a cost center, not a growth engine.

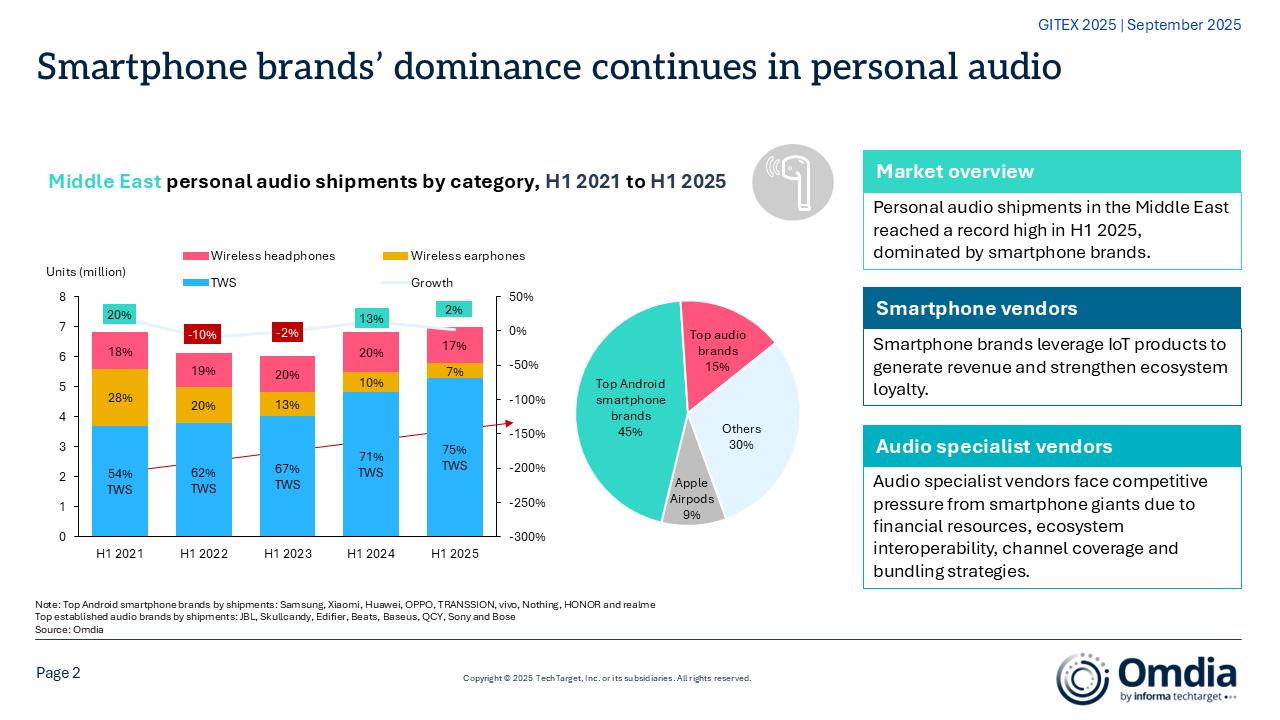

Smartphone vendors dominate the personal audio space: Personal audio is the clearest attach success in the region. By H1 2025, top Android brands held 45% and Apple 9% via AirPods, putting over half the category under smartphone ecosystems. TWS now accounts for 75% of shipments. For premium vendors, audio is a lifestyle anchor.

Apple treats AirPods as a profitable standalone unit, limiting promotions to purchase-with-purchase offers, never free giveaways. Even when bundled, the cost is usually carried by operators subsidizing via data margins, not Apple. By contrast, Samsung and other Android vendors often allow Galaxy Buds or other TWS to be bundled free or discounted, usually at vendor or channel expense. This drives volume share but dilutes profitability. Chinese OEMs rely on bundling affordable TWS to push mid-tier attach, trading margin for penetration.

For telcos and distributors, audio should become a gateway: integrating earbuds with devices and services to lift ARPU. Specialist brands, such as JBL and Sony, face mounting pressure unless they align with operators or co-brand with smartphone vendors.

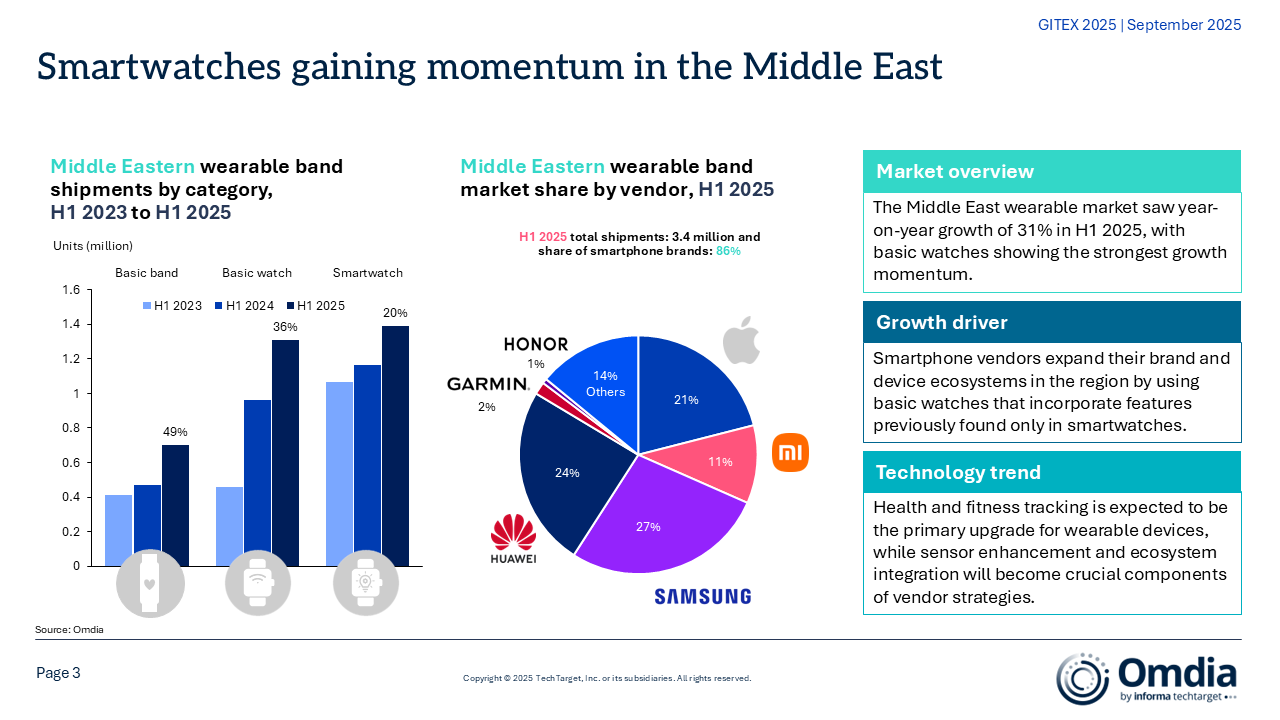

Smartwatches are accelerating in the Middle East: Despite global momentum cooling, smartwatch shipments grew 31% year on year in H1 2025, with “basic watches” bridging bands and full smartwatches. Health and fitness remain the core trigger, amplified by ecosystem integration. For Apple, Samsung and Huawei, the goal is sustained natural demand, not reliance on promotions, by leaning into advanced sensors, ecosystem integration, and lifestyle positioning. For Xiaomi, OPPO and HONOR, the play is affordable, long-battery basic watches cross-sold into phone bases.

For telcos and retailers, the opportunity lies in service-led bundling, but monetization models must evolve. Unlike Korea, where operators own app stores and capture downstream spend, Middle Eastern players have little lock-in once a device leaves the store. To capture value, they need new levers: SPIFF incentives for premium subscriptions (Samsung Care+, Apple Fitness+, insurance tie-ins), or packaging watches with connectivity and lifestyle services to create recurring ARPU. Without stronger partnerships, wearables risk remaining one-off hardware sales.

PCs and tablets are small but strategic attach levers: Though smaller in scale, PCs and tablets are becoming key ecosystem levers. Vendors are experimenting with cross-category bundles: Huawei’s Super Device in Saudi Arabia and the UAE links laptops, tablets, and phones; Apple drives stickiness by positioning MacBooks and iPads with iPhones and Watches in education and productivity. Samsung has leaned on telco partnerships to promote Galaxy Tabs with data bundles.

For vendors, the opportunity is to push PCs and tablets beyond standalone devices into lifestyle bundles for family, education, and hybrid work. For telcos and distributors, integrating AI PCs and tablets into cloud services, 5G plans, and trade-in programs will unlock incremental ARPU while reinforcing ecosystems. By treating PCs and tablets as multipliers, stakeholders capture new spending streams and balance stagnation in smartphone refresh cycles.

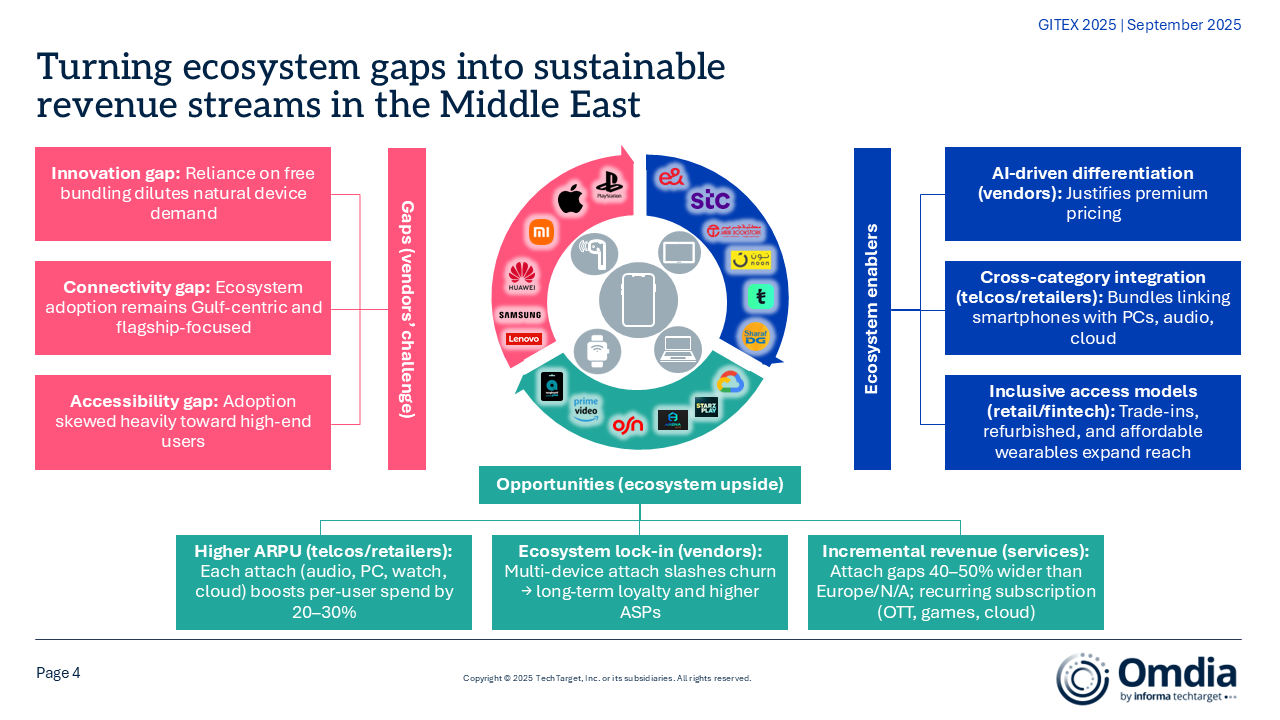

The next frontier of Middle East profitability: The Middle East consumer tech market is at an inflection point: hardware growth has plateaued, but ecosystem revenue is only beginning to scale. The gaps are clear; innovation is diluted by a reliance on bundling, adoption is still Gulf-centric, and accessibility is skewed toward affluent users. Yet these gaps represent the biggest opportunities. Closing them will require embedding AI-driven features to create natural demand, enabling seamless cross-device integration through telco partnerships, and scaling adoption via trade-ins, refurbished programs, and affordable mid-tier devices.

What ecosystem attachment delivers for the value chain:

- Vendors (Apple, Samsung, Huawei, Xiaomi, Lenovo): Devices remain the anchor. Each attach raises revenue, defends share, and locks in loyalty. Bundles also extend vendor-native services (iCloud, Care+, AppGallery) into recurring revenue.

- Telcos (STC, Etisalat, du, Ooredoo): Bundling is their strongest ARPU lever. Pairing devices with OTT, gaming, and cloud subscriptions shifts them from pure connectivity to digital lifestyle platforms.

- Retailers and e-retailers (Sharaf DG, Noon, Amazon, Carrefour): Multi-device bundles and channel promotions lift basket size and accelerate refresh cycles.

- Fintech and channel partners: Financing, trade-ins, and refurbished programs expand affordability, moving ecosystems beyond affluent Gulf users to mass-market segments.

- Content and service providers (Prime Video, StarzPlay, OSN, eLife, gaming platforms): Deeper reach by embedding services into telco and retail bundles.

The implication is clear: every smartphone or PC must become the entry point to a broader ecosystem relationship. Brands that close attach-rate gaps and build inclusive, service-led ecosystems will lift ARPU by 20% to 30%, deepen loyalty, and unlock multi-billion-dollar revenue. Those that don’t will be left competing in a flat hardware market.

Join us at “In Conversation with Omdia at GITEX 2025”

Ecosystem revenue will define the next wave of profitability in the region. At our upcoming event, Omdia analysts will share deeper insights, best practices, and opportunities to engage with industry leaders driving this transformation.