Canalys 2023 sustainability survey: rounding up trends in the circular economy

12 June 2023

This blog explores vendors' challenges in the True Wireless Stereo (TWS) market, including declining shipments and fierce competition. It offers insights into successful strategies to offer the right products and finding niche segments within this market.

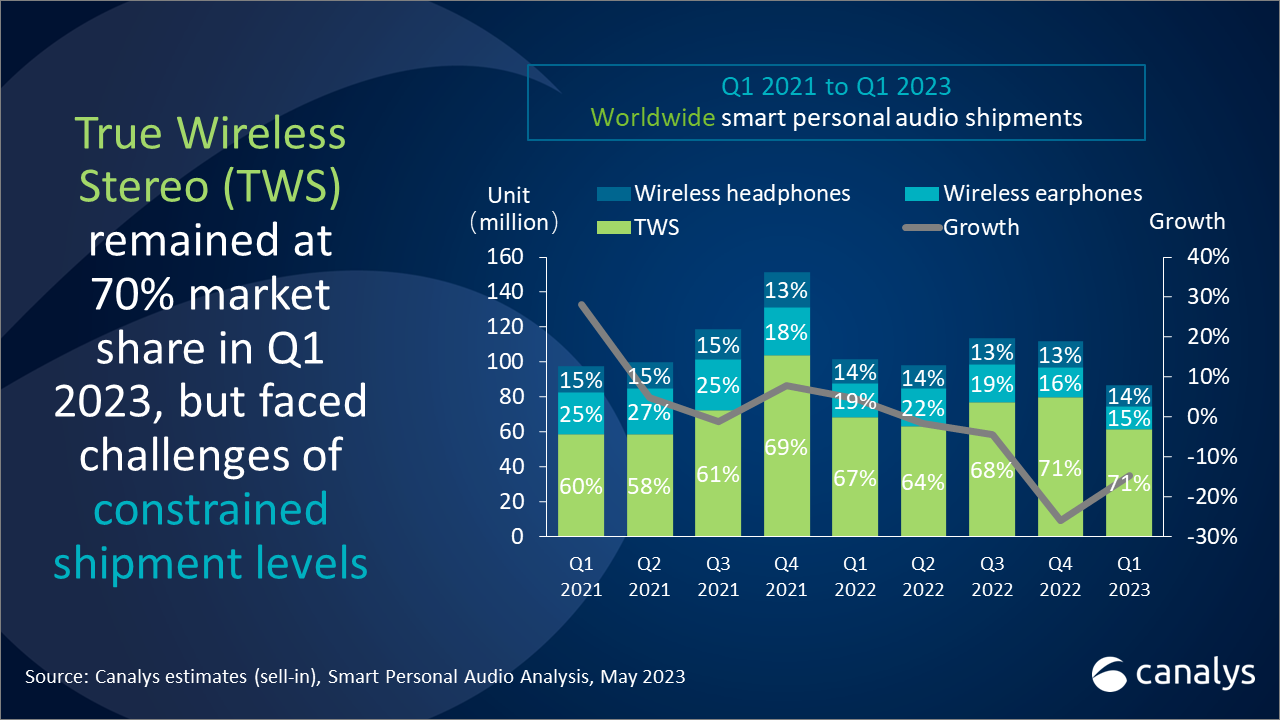

The personal audio market has been growing exponentially over the past few years, with True Wireless Stereo (TWS) emerging as the dominant category, accounting for over 70% of the personal audio market over the consecutive two quarters.

However, during these recent two quarters, the TWS segment shipments declined significantly, attributed to the economic downturn and saturation of the market after a strong year in 2022. Vendors are facing fierce competition and are struggling to differentiate from their rivals. Some of them have resorted to cutting corners on quality or slashing prices to stay afloat.

There are, however, best practices and best strategies that some leading vendors implemented to remain competitive within the TWS market.

One proven effective strategy is offering the right products for the right markets. Vendors study consumer habits and preferences in various countries and regions to create tailored strategies. For instance, in India, local vendors introduced a wide variety of affordable TWS options for consumers transitioning from neckband headphones, resulting in a surge in shipments. In Latin America, partnerships with carriers has become crucial for rapid expansion, as seen with Skullcandy's successful regional growth. Vendors in Western Europe and North America have focused on noise-canceling features to meet the demand for high-quality audio. In Southeast Asia, vendors have utilized platforms like TikTok to expand their market presence with improved sales models, logistics and network communication.

Instead of catering for everyone, some vendors have chosen to focus on specific niche markets where they excel. They have allocated their resources to their strongest areas and leveraged their brand advantage to create compelling marketing strategies that ensure profitability, even during market downturns. For example, Shokz has successfully associated its brand with outdoor activities through collaborations with sports influencers, establishing a solid presence in the sports market. Xiaomi partnered with renowned intellectual property brands and have utilized cross-industry channels to offer unique and irresistible experiences, maintaining their brands and product attractiveness. iFlytek have targeted business conferences with its complete TWS product line, providing automatic recording and transcription features, effectively carving out its niche.

Some big players in the market aren't just chasing short-term gains but are focusing on long-term success. They are more willing to invest in research and development to help build their brand and reputation within the audio category. For example, Huawei have added temperature and heart rate monitoring features to their TWS headphones. These additional health features, targeting health-conscious users, have justified the product's high-end positioning. Apple is always developing something new to impress tech geeks, whether it is spatial audio or adaptive noise-canceling technology. Jabra uses its expertise in audiology to provide scientifically personalized volume control for its products. These audio experts are always searching for new market demands and ways to stand out with audio quality.

The TWS market is polarizing as vendors are separating into two groups of players. While there are players focusing on the low-end price-conscious segment competing with white labels, leading brands are more committed to the sector despite the market headwind. In addition to investing in new products, they bring innovative solutions and ecosystems to sustain their growth in this segment.