Expanded Scale and Leadership in B2B: From R&D to ROI

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

What’s next for technology distribution?

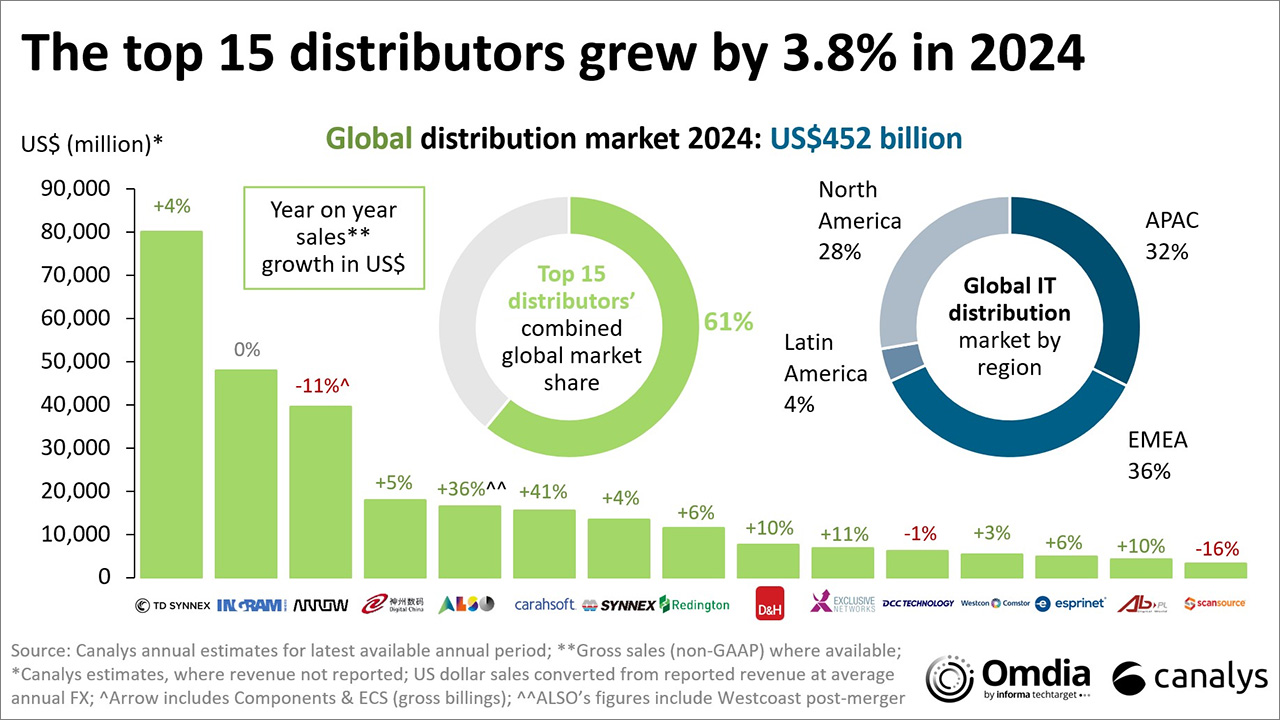

Canalys (part of Omdia) estimates that the global IT distribution market stood at US$452 billion in 2024. The top 15 distributors commanded 61% of the global two-tier market and collectively grew by 3.8% year on year in the face of challenging economic conditions. This blog explores the future of IT distribution models.

Canalys (part of Omdia) estimates that the global IT distribution market stood at US$452 billion in 2024. The sector is increasingly concentrated, with the top 15 distributors generating sales of US$276 billion, commanding 61% of the total and growing by 3.8% year on year in the face of challenging economic conditions. The top three – TD Synnex, Ingram Micro and Arrow (ECS and electrical components) – generated gross sales of nearly US$170 billion, more than a third of the total. Market leader TD Synnex’s scale is tremendous, with 2024 gross billings of US$80.1 billion making it larger than the vast majority of the vendors it distributes. It spans almost every technology segment, and with an advanced solutions arm generating US$47 billion gross sales, it is by far the world’s largest specialist distributor, growing in high single digits and contributing to group 2024 non-GAAP operating profits of US$1.6 billion (over 2% of gross sales).

But while scale is important, sales are only one way to evaluate the market. Beyond the top three (and even as consolidation continues), the industry remains dependent on a host of specialized and regional players around the world, which can outpace the growth and profitability of some of the largest players. And despite continued macroeconomic uncertainty and geopolitical turbulence, distribution is set for a stronger 2025, as the recovery in PCs and infrastructure gathers pace, while high-growth segments, such as cybersecurity, cloud and software, see increased momentum through the two-tier channel. But in the face of transformational dynamics across the IT industry, distribution is undergoing a profound shift.

Transformational pressures are reshaping the industry

Distributors remain core to the success of global IT supply chains, particularly as macroeconomic turbulence and trade complexity increase, and vendors and channel partners navigate tariffs, taxation and geopolitical pressures around the world. As the hardware market stages a recovery, vendors are turning to distributors to support the need for localized inventory, along with the scale, efficiency and channel reach that vendors themselves struggle to achieve. Meanwhile, channel partners rely on distributors not just for access to products but as an aggregation point for solutions and services, as well as to reduce transaction friction and provide vital credit and financing services. The shift to OpEx, SaaS and subscriptions adds to this need, given the pressure on cash flow and working capital that these models can bring for partners. In complex, high-value technologies, such as cybersecurity, data management, analytics and cloud, distributors provide unparalleled value, through deep domain expertise, technical services, channel management, training and support. But as the IT industry rapidly evolves, the competitive battleground is fast moving toward digital platforms, next-generation technologies, new business models and services.

Platform capability as competitive advantage

The winners in this transformation will be those that lead in platform capability, underpinned by digital innovation. Distributors are evolving into data-led organizations, with platforms powered by AI and analytics to support e-commerce, subscription and cloud models, integrated with vendors, partners and hyperscaler marketplaces to deliver automation at scale. Data becomes a powerful asset, as distributors seek to position themselves as orchestrators at the center of an expanding digital ecosystem of partners, MSPs, ISVs, cloud providers, SIs, agents, hyperscaler marketplaces and even end users.

The largest players have the advantage of financial resources to build these platforms. Ingram Micro’s Xvantage platform, TD Synnex’s StreamOne, Arrow’s ArrowSphere and ALSO’s Cloud Marketplace are examples. However, the largest players are not necessarily guaranteed to lead in this digital world, if they are hampered by established processes and legacy business models. Specialist players can be at an advantage, such as Pax8 and Sherweb, which are built on marketplace-first models. At the same time, human engagement – driving personal relationships – remains a fundamental differentiator for distribution, even with the shift to platform-based automation.

Hyperscaler marketplace competition

The rise of hyperscaler marketplaces is dramatically reshaping the dynamics for distribution. AWS, Google Cloud and Microsoft are seeing tremendous growth in channel partner private offers for third-party vendors selling through their marketplaces, themselves becoming de facto distributors. AWS Marketplace is now, by this definition, a top 10 global IT distributor. As this competition intensifies, distributors must redefine their value propositions and reinforce their differentiation, through partner recruitment and management, training, financing services and channel reach. Their value comes from integrating tightly with all the hyperscaler marketplaces, and removing the complexity of selling (for vendors) and sourcing (for partners) through multiple hyperscaler platforms. This is leading to the emergence of new distribution models, such as AWS DSOR and marketplace syndication (mirroring hyperscaler marketplaces on the distributors’ own platforms), which drive their relevance.

Consolidation and M&A gather pace

Consolidation is accelerating, driven by scale and specialization needs (along with margin and profit challenges) and led by some of the largest global players, but also specialist distributors expanding regionally or globally through acquisition. Exclusive Networks, Infinigate, Westcon-Comstor, Sherweb, Climb Global Solutions, Elovade and QBS are all examples of specialists pursuing active acquisition strategies. As a result, the shape of the global distribution landscape is changing rapidly.

Profit pressures and changes to distribution models by major vendors such as Microsoft and VMware are accelerating moves by leading players to expand regional scale and global coverage. Microsoft’s latest move to deauthorize cloud distributors (formerly indirect providers) with less than US$30 million in annual sales by country/region will drive more M&A activity among these players.

The evolution of distribution models

Distributors need to come out of hiding to collectively grow faster than the market and enhance profitability: the distribution model is evolving from a linear past to an interconnected future. The future of distributor value will increasingly be driven by services, typically representing only a small share of revenue but a high share of profits: white-labelled managed services, automated lifecycle services, marketplace and ISV integrations, for example. Distributors must be recognized by end customers (and vendors) for the solution value they bring and participate in the US$6 to US$8 services multipliers that cloud (and now agentic AI) create.

Strategic imperatives for distribution leaders

- Invest in platform capabilities that leverage data, AI and automation while maintaining the human touch where it adds value.

- Develop specialized expertise in high-growth areas such as cybersecurity, cloud services and AI.

- Build ecosystem orchestration capabilities to serve diverse partner types.

- Establish clear differentiation against hyperscaler marketplaces.

- Consider strategic M&A for both scale and specialized capabilities.

- Embrace new business models, including subscriptions, XaaS and marketplace integration.

The distribution landscape is at an inflection point. Those that successfully navigate these changes – balancing traditional strengths with new capabilities – will emerge as the leaders of tomorrow’s IT channel ecosystem.