Expanded Scale and Leadership in B2B: From R&D to ROI

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

SIs will account for US$43 billion of telco services TAM as strategic partnerships drive growth – executive summary

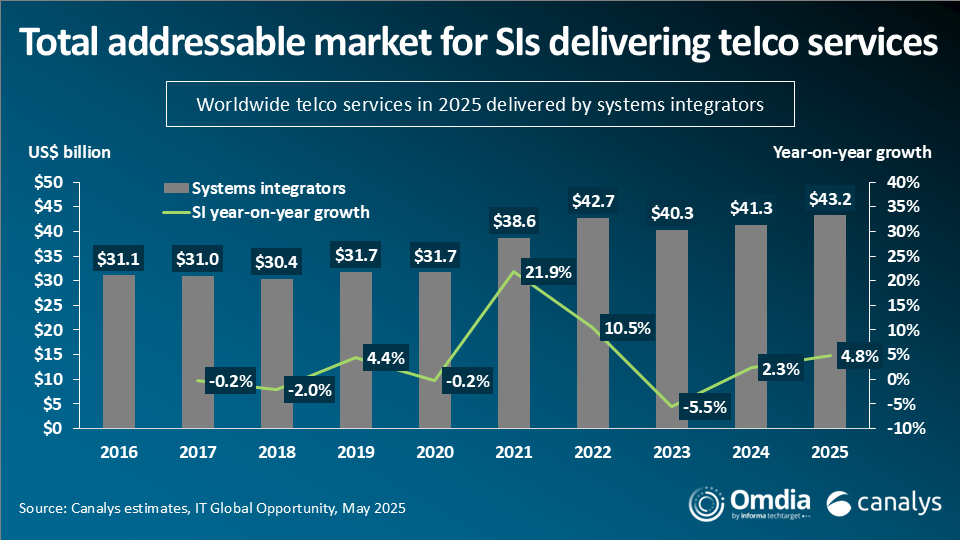

Telco services delivered by SIs are on the rise, transforming the industry with 5G, cloud, edge computing and AI technologies. Strategic partnerships between telcos and GSIs are essential for meeting enterprise needs, with a projected US$43.2 billion market in 2025. By fostering co-innovation, co-selling and co-marketing practices with partners, telcos can enhance their offerings and create a comprehensive channel ecosystem to drive growth in the evolving digital landscape.

Introduction: telco services delivered by SIs are on the rise

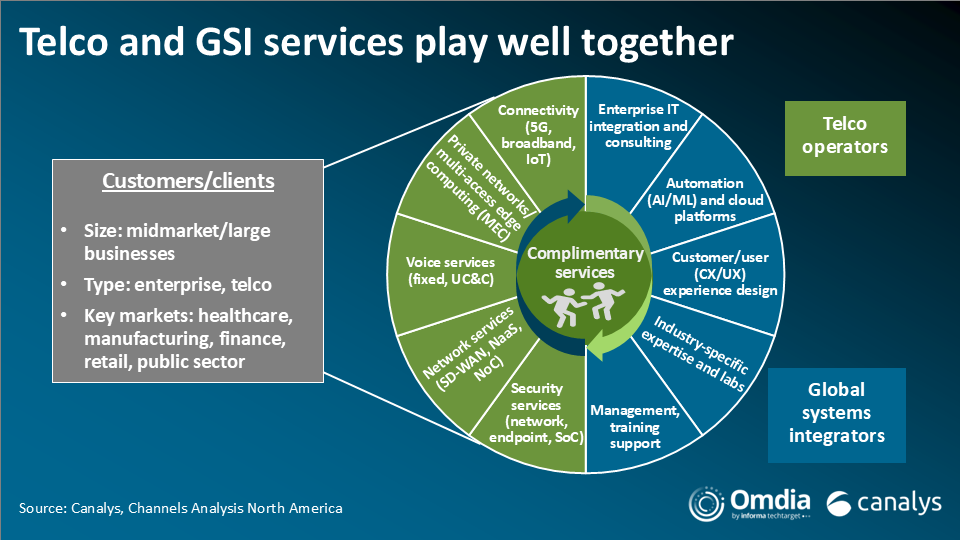

The rise of telco-GSI partnerships is driving innovation, growth and digital transformation for key clients, particularly mid-market and large enterprises, across various industries. As enterprises increasingly demand integrated solutions combining connectivity, IT services and emerging technologies, telcos and GSIs are forming strategic alliances to address these needs.

These partnerships are essential for deploying next-generation solutions, such as 5G, edge computing, AI and IoT, which are increasingly important for enterprise operations. They are also fueling growth in the telco services market.

- Telco services revenue is projected to reach US$1.3 trillion globally by 2025, with US$43.2 billion delivered by systems integrators (SIs).

- Year-on-year growth rates for SI-delivered telco services are expected to double, from 2.3% in 2024 to 4.8% in 2025.

- The global edge ICT services market is projected to grow from US$165 billion in 2025 to US$336 billion by 2029 – a compound annual growth rate (CAGR) of 19.5%. Systems integrators are expected to maintain the largest market share at 30.3% in 2029, while the telco share will be 20.9%.

AI will fuel the next big wave of telco-GSI partnerships

Telco edge solutions are poised to become key components for agentic AI platforms deployed by GSIs. By using telco edge infrastructure consisting of 5G and edge computing, GSIs can deliver low-latency, high-performing and secure agentic AI platforms, where data is processed closer to the source for industry-specific use cases. Telco edge networks are positioned to address rising agentic AI demand by offering robust connectivity, integrated cybersecurity and seamless integration with GSI platforms. Collaborations between telcos and GSIs allow the latter to focus on developing custom, industry-focused AI solutions while telcos provide strategically located AI edge computing, creating a symbiotic relationship that accelerates agentic AI adoption.

Complementary partners provide comprehensive client services

Telcos and GSIs are frequent collaborators on various enterprise client and internal projects, which include solutions such as 5G/IoT/edge computing and innovation labs that showcase their strong partnerships via co-developed industry-specific use cases.

Examples of telco-GSI partnerships

Innovation labs

- Verizon and Deloitte: Smart Factory at Wichita integrates Verizon’s private 5G network with Deloitte’s consulting expertise to create advanced manufacturing solutions.

Digital transformation initiatives

- Deutsche Telekom-Capgemini: Redesigned operations support architecture using cloud-based microservices.

5G, edge computing and IoT solutions

- Orange and NTT DATA: Enhancing passenger experiences through their smart station project, which uses AI and private 5G technologies.

Joint ventures

- Vodafone-Accenture: Accenture jointly agreed to scale and make commercially available Vodafone’s shared services unit – Vodafone Intelligent Solutions (VOIS). Vodafone retained a majority interest and Accenture contributed its technology expertise and invested around €150 million (US$175 million) for a minority stake.

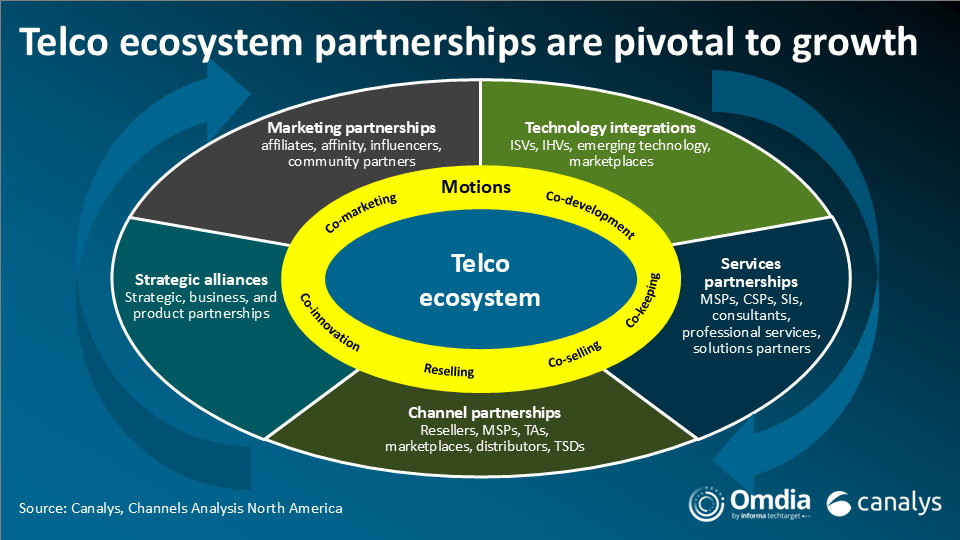

Conclusion: modeling telco-GSI best practices throughout the ecosystem

To optimize success and achieve the desired double-digit growth rates, telcos must enact a holistic ecosystem approach with other partners modeled after their GSIs partnerships, which focus on co-developing solutions, bundling IT and connectivity services via integrated platforms, and launching targeted co-marketing campaigns. Just adding new solutions to the stack isn’t enough – enablement is critical as well. This includes providing training, tools and the resources to empower channel partners to cross-sell and upsell services effectively.

Telco-GSI partnerships are setting the standard for enterprise digital transformation. By leveraging these alliances, telcos can evolve into techcos, delivering innovative solutions that address complex enterprise needs while achieving sustainable growth.