Big insights, big plans and big vendors for channel opportunities in 2023

23 May 2023

The smartphone market has faced numerous challenges in recent years due to factors such as the COVID-19 pandemic and currency fluctuations. But positive signs are emerging, including returning inventory levels and normalizing component costs. Vendors should focus on diversifying their market portfolios, building local partnerships and embracing significant global trends, such as sustainability and data privacy, to succeed in the long term.

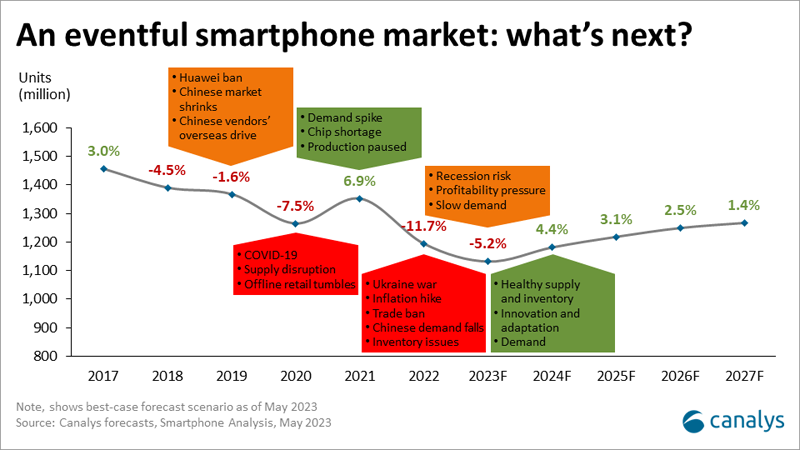

The smartphone market has been through a lot in the last few years. The COVID-19 pandemic, currency fluctuations in emerging markets, emerging local manufacturing requirements, the Russia-Ukraine war and historic high inflation have all taken their toll. We had to cut our market forecasts repeatedly in 2022, and I know that hardware vendors, component providers and channel companies did too. 2022 ended with a 12% fall in shipments, the worst annual drop since Canalys started smartphone market research in 2003.

Our latest smartphone forecast, published to clients on Friday, 19 May 2023, cut 2023 global shipments to 1.2 billion, down another 5.2% on 2022. But some positive signs are emerging in the market for the first time since the start of 2022.

From our conversations with the distributors, frontline sales companies and supply chain businesses, a few things show we are headed in the right direction.

Despite these positive signs, we know the “Grey Swans” are still out there, leading to cautious planning for most smartphone industry players. First, there is still a risk of recession. A recession in the US and Europe and lower demand expectations in China could lead to another wave of disruption in emerging markets’ economic recovery and currency issues.

Second, import restrictions, local regulations and lawsuits could significantly disrupt the supply of critical components or some key vendors’ business operations.

Overall, Canalys forecasts that the smartphone market will return to growth in 2024 at 4.4%. In addition to a well-designed organizational structure and solid financial planning to weather the macroeconomic downturn, vendors should be aware of the many lessons we have learned over the past few years and take steps to avoid the potential pitfalls.

In addition to the above, I want to emphasize the importance of agile planning and independent market insight. In today’s ever-changing market, vendors must adapt to new trends and challenges quickly. This can be achieved by having a well-informed market research team that can provide timely and accurate insights into the market. With this information, vendors can make better growth planning and go-to-market decisions. Do get in touch with me for an exploratory call.