Are cloud marketplaces worth the hype?

17 September 2021

Canalys’ review and insight of H1 2021 global 5G market

Since the start of 2020, when the COVID-19 outbreak began, the way people work, live and learn has changed significantly and irreversibly, reshaping the global mobile market.

Over the past year, smartphone vendors have increased their investment significantly to capture the accelerated organic growth of the smartphone and 5G upgrade market.

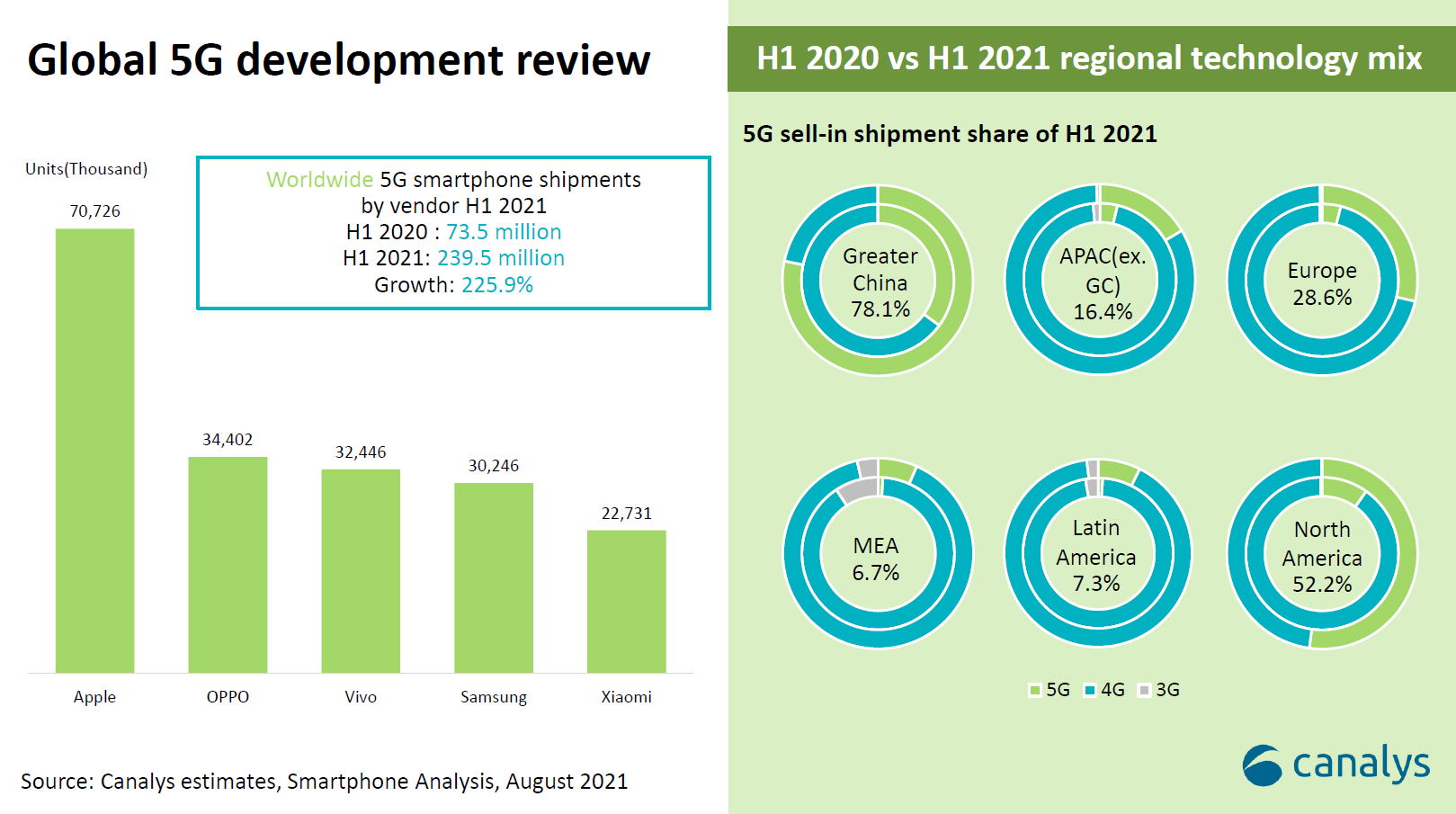

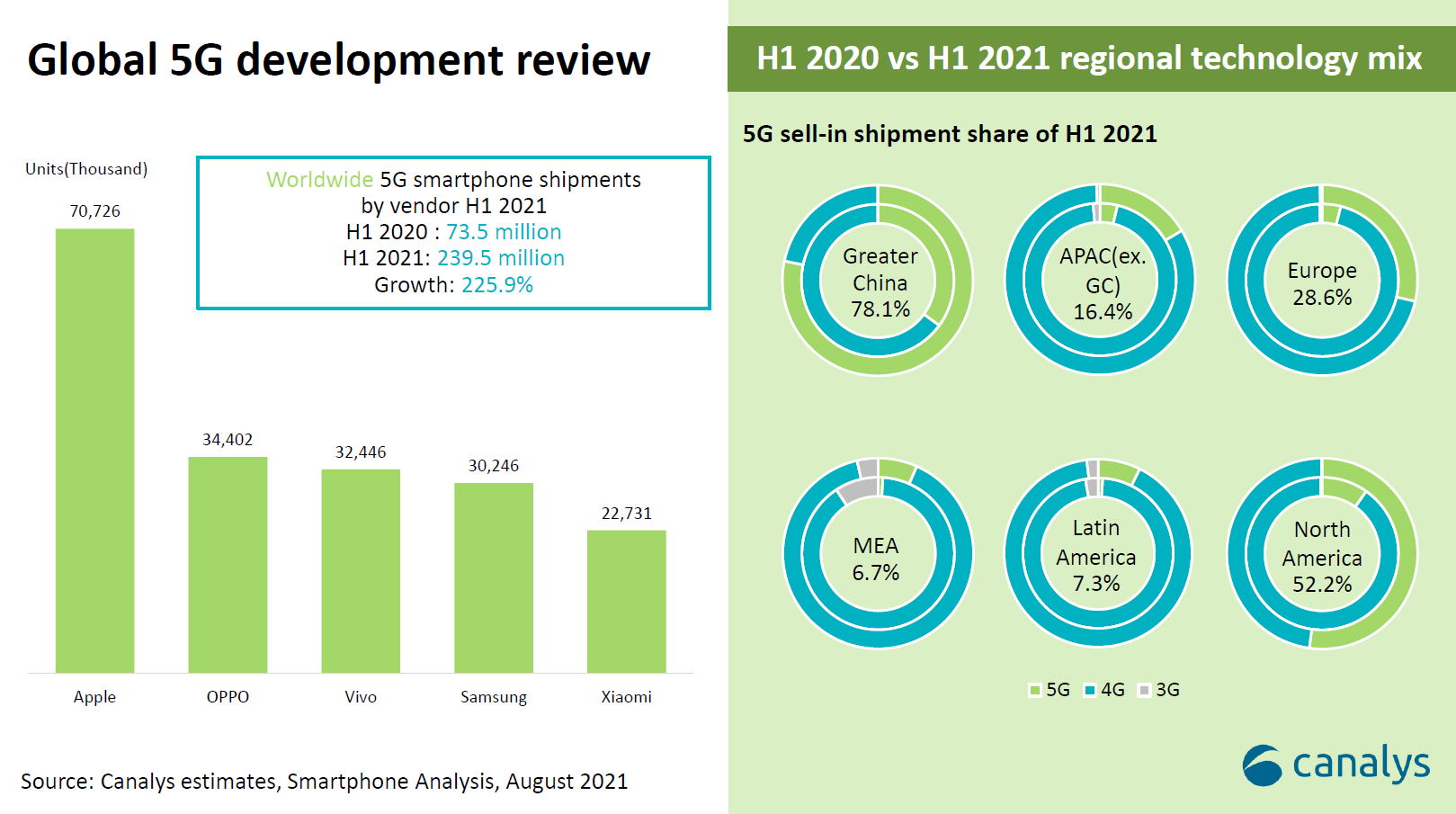

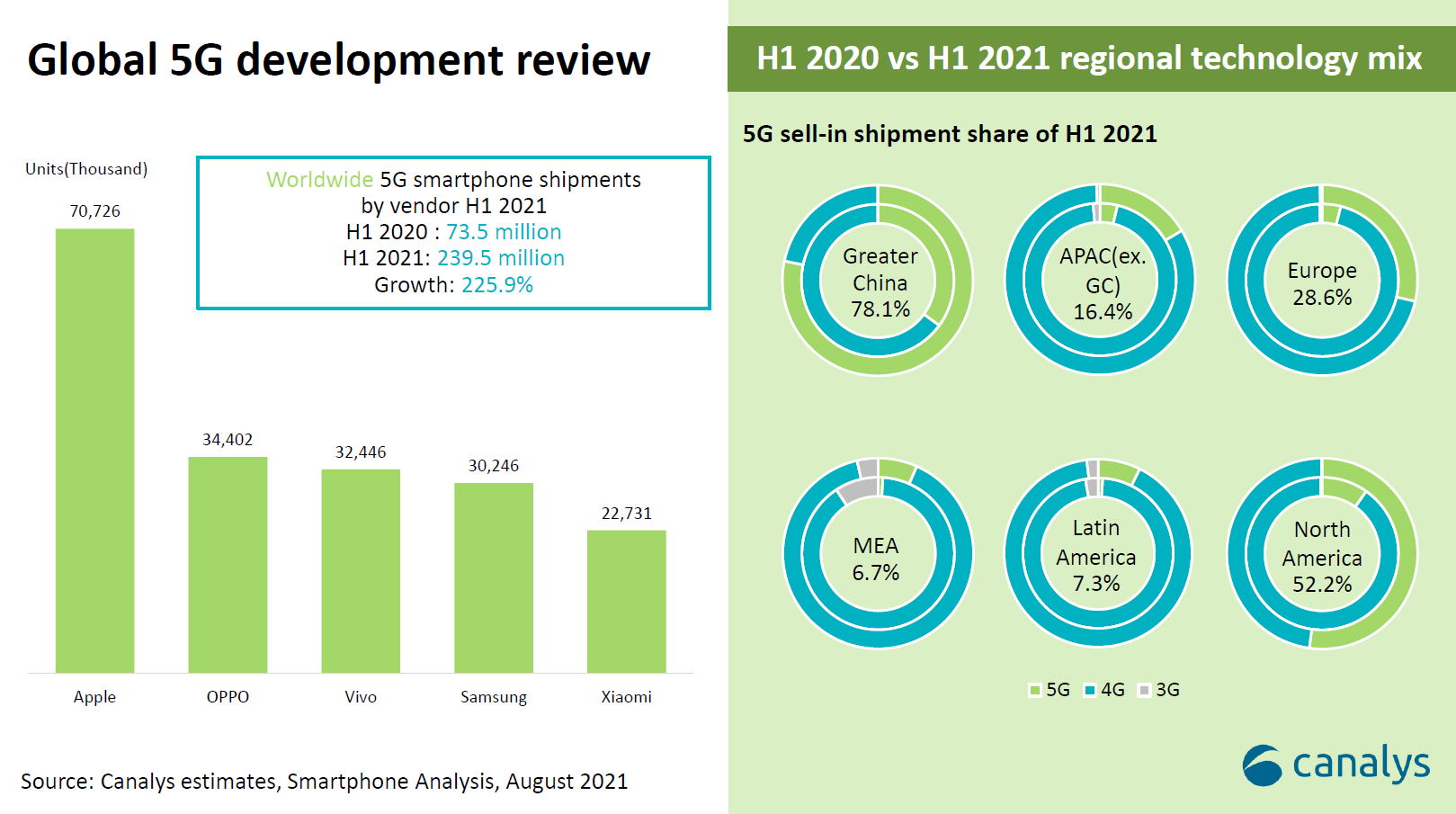

Driven by the leading vendors, worldwide 5G smartphone shipments reached 239.5 million in the first half of 2021, accounting for 36.1% of overall shipments. The majority of shipments were from Apple, with OPPO leading among the Android players. Thanks to this, consumers have an extensive range of affordable 5G smartphones to choose from.

But 5G developments vary dramatically between markets and regions. Mainland China leads in terms of 5G smartphone shipments, accounting for nearly 70% of the world’s Android 5G shipments. The success of China’s 5G smartphone market is thanks to its rapid deployment of 5G infrastructure, driven by the government. It is also supported by a strong team of local device vendors and the world’s most committed telecoms operators. 5G subscription numbers are a key performance indicator for Chinese telcos since services launched at the end of 2019. Telecoms operators have been relentlessly driving users to upgrade through nationwide marketing efforts and competitive tariffs (in many places, operators have stopped offering 4G tariffs, forcing 5G upgrades). There have been major efforts to encourage vendors to increase their 5G portfolios since 2020, and some have already stopped launching any new 4G products. The whole industry’s well-orchestrated efforts have accelerated consumer adoption.

But hardware vendors haven’t repeated this success outside of China. There are still concerns that have hindered large-scale 5G product roll-outs.

Firstly, consumers want to strike a balance between demand for 5G services and the total cost of 5G services. 5G tariffs remain out of reach for mass-market consumers in most overseas markets. In addition to the per-gigabyte charge, 5G will also increase data traffic and raise user costs. In Thailand, for example, while operators are cutting 5G tariffs, consumers who have been hit hard by the pandemic have less ability to pay for them. With 4G services able to meet their daily needs, most consumers feel they will only upgrade to 5G if it doesn’t mean paying more for mobile phones and telecommunications. Even in developed markets such as Western Europe, only four of the top 10 Android models sold in the first half of the year were 5G-capable.

Secondly, vendors want to control costs and risks. Component and marketing costs are critical bottlenecks in the price of 5G smartphones. In terms of component cost negotiation, procurement volumes can improve a supplier’s bargaining power on the supply side, so in a mature 5G market, such as China, achieving considerable importance is a strategic priority decision. In addition, there are hidden costs to the overseas roll-out of 5G smartphones. Differences in the entry standards for 5G smartphones in various countries can lead to additional costs, such as market entry verification and portfolio management costs.

Finally, 5G services provided by many local networks are still at an early stage, which leads to a poor consumer experience, hurting the brands and reputations of hardware manufacturers.

Among the world’s top 10 vendors, the most aggressive vendor in 5G product pricing is Realme, which has a global 5G smartphone ASP of only US$297. But for mass-market players, aggressive 5G strategies mean more significant risk. As leading players such as Samsung have yet to push for more mass-market 5G smartphones, it is reasonable and sensible for other Chinese manufacturers to take a more conservative approach in overseas markets.

Canalys expects 5G shipments to account for 87% of Mainland China’s smartphone market in 2021. The 4G installed base in the Chinese market will not be entirely replaced by 5G in the short term. 5G shipments overseas will account for only 27% in 2021 though will exceed 80% by 2025. Most overseas markets are not ready for significant uptake of 5G smartphones this year. In the post-pandemic world, mobile users and hardware vendors need more incentives from local operators to create more favorable 5G market conditions.

与2020年上半年疫情刚刚爆发时相比,人们的工作、生活、学习方式在过去的一年中发生了重大、不可逆的改变,这也重塑了全球移动市场的格局。

在过去的一年中,智能手机市场的加速有机增长和现有4G换机用户往5G产品升级,成为厂商们争相追逐和投入的增长点。

5G智能手机在各大主流厂商的推动下,上半年全球出货239.5m,占整体出货36.1%。出货由苹果引领,安卓厂商中OPPO 的表现最为强劲。消费者也有了越来越多价格相宜的5G智能手机可供选择。

与此同时,5G智能手机的渗透率在不同区域之间发展极不平衡。中国在5G基础设施的铺设和5G用户渗透率增速上一枝独秀,是目前全球最大的安卓5G手机市场,消化了全球68.2%的安卓5G手机。那么中国市场到底有怎样得天独厚的5G市场环境呢?除了本土厂商技术优势和基础设施覆盖,运营商的投入是不可忽视的——中国运营商把5G用户数目作为重要的KPI,持续通过各种营销活动、优惠资费鼓励数据用户升级5G,为厂商出货奠定了坚实的用户基础。由于国内成熟的市场环境,手机厂商也敢于激进提高5G 产品内占比,加速了中国市场5G产品价格下探。

然而,我们却没有看到厂商通过国内5G市场的繁荣,被迅速复制到海外市场。这是因为厂商在海外推动5G产品和价格下探时,除了网络覆盖率之外,仍有诸多顾虑和限制因素。

首先是消费者希望在5G服务的刚性需求与成本之间不断取得平衡。5G的资费在大部分海外市场依然十分高昂。除了每GB资费,5G也会增加数据流量,提高用户使用成本。例如泰国,尽管每个季度运营商都在下调5G资费,在店铺和线下渠道做宣传,但刚刚经历过疫情严重打击的消费者支付能力尚未恢复,4G服务可以满足日常需求的情况下,大部分的消费者认为没有额外支付更多的手机和电信费用从而升级5G的必要。即使在西欧这样的成熟市场,上半年销量前十的安卓机型中5G也仅占四席。

其次是成本及风险的管控。硬件成本和市场导入成本是5G智能手机的价格下探的重要瓶颈。在资材议价方面,采购量可以提高厂商在供应侧的议价能力,因此在中国这样的5G成熟市场先做到可观的体量是策略性的优先级决策。此外,5G智能手机的海外推广存在隐形成本。各国对于5G智能手机的入网标准差异导致产品的验证和管理上也会有额外的成本。

最后是手机品牌的风险。5G在当地市场网络基础设施不够完善时,会造成消费者使用体验差,给硬件厂商带来产品口碑上的风险。

在全球前十大厂商中,5G产品价格下探最激进的厂商是Realme,其上半年5G产品的均价为297美金。但对于大众市场的玩家来说,激进的5G策略意味着更大的风险。因此,在诸如三星这样的领先厂商尚未推进大规模5G上量和价格下探时,其他中国厂商保持观望的态度是当下合理和明智的选择。

根据Canalys的最新预测,2021全年中国市场5G出货占比为86.9%。而中国市场的4G手机保有量短期不会被5G完全替代; 2021年海外(中国以外)市场5G出货占比仅为27.1%,预料到2025年将会超过80%,达到83.1%。

总体来说,海外市场还没有做好迎接5G全面爆发的准备,尚且需要头部厂商的带动和运营商的投入来培养更成熟的环境土壤。