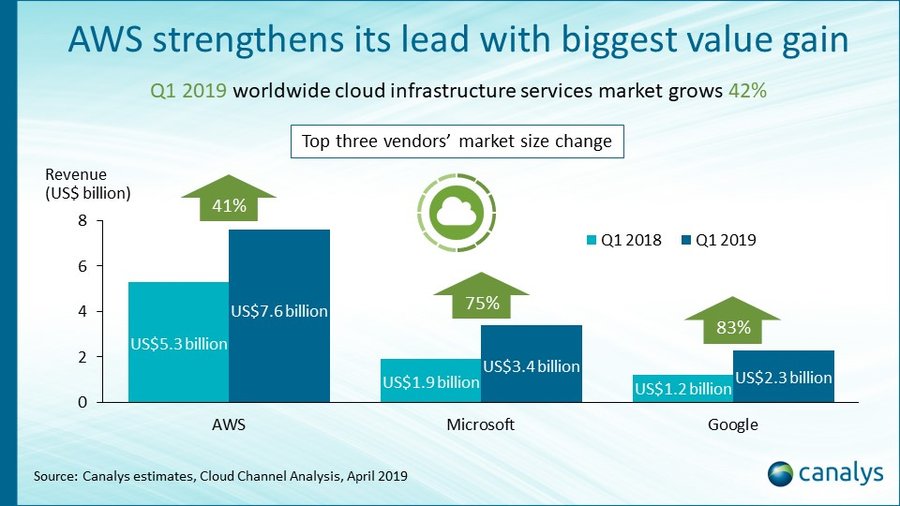

Canalys: battle for enterprise cloud customers intensifies as spending grows 42% in Q1 2019

Palo Alto, Shanghai, Singapore and Reading (UK) – Tuesday, 30 April 2019

The global cloud infrastructure services market started 2019 with a bang, growing 42% year on year in Q1. In dollar terms, market leader AWS achieved by far the biggest gain, with sales up by US$2.3 billion (41%) on Q1 2018, further extending its leadership and market share. That put it even further ahead of second-placed Microsoft, which was up US$1.5 billion (75%). Google was the fastest growing of the top three in percentage terms, up 83% from US$1.2 billion to US$2.3 billion.

In 2019, the battle for enterprise customers will intensify between the leading cloud service providers as they seek to maintain high growth rates. “The cloud infrastructure market is moving into a new phase of hybrid IT adoption, with businesses demanding cloud services that can be more easily integrated with their on-premises environments,” said Canalys Chief Analyst Alastair Edwards. “As enterprises become more selective about which workloads are moved to the cloud, and which remain in their own data centers, cloud service providers must develop new strategies that ensure their continued relevance. Most cloud service providers are now looking at ways to enter customers’ existing data centers, either through their own products or via partnerships.”

AWS will start shipping its first appliance, Outposts, later this year, marking its opening move to deliver hardware into customer data centers. This is primarily to address latency issues, as it seeks to extend AWS cloud from virtual to physical environments. Its partnership with VMware on AWS is an important step to meet customers’ hybrid demands. Google this month launched Anthos, an application management platform that supports multiple clouds, including rivals AWS and Microsoft Azure, as well as its own Google Cloud Platform. Google will hope to use this as a way to penetrate new enterprise customers where it has lacked presence and is developing hardware partnerships with server vendors to accelerate this move. Alibaba, the number four cloud infrastructure provider worldwide (thanks to its leadership in China), is increasing its focus on driving business transformation for enterprise customers. It is offering VMware’s Software Defined Data Center (SDDC) cloud software stack on its cloud infrastructure and, like Google, is working with hardware partners to deliver its Apsara stack on-premises. These initiatives increase the competitive pressure on Microsoft, which has taken an early lead in hybrid IT with its Azure Stack, and continues to enhance its Azure Stack family, with partnerships with multiple hardware partners to deliver Azure Stack HCI. It most recently announced support for VMware on Azure, marking a major shift in its strategy.

As cloud service providers develop strategies to address hybrid IT, their ability to engage with channel partners will also play an increasingly important role in their success. Canalys Research Analyst Daniel Liu said, “Enterprise customers will rely on highly skilled partners that understand their application and workload requirements and can help them define the right hybrid models to meet their business goals, as well as managing and securing these hybrid environments. Canalys expects that a growing proportion of cloud sales will be delivered through indirect partners in 2019 and beyond. The winning cloud providers will be those that invest in their programs, channel engagement and training, as well as use their alliance partners’ channel partner ecosystems.”

For more information, please contact:

Canalys EMEA: +44 118 984 0520

Matthew Ball: matthew_ball@canalys.com +44 7887 950 505

Alastair Edwards: alastair_edwards@canalys.com +44 7901 915 991

Canalys APAC (Shanghai): +86 21 2225 2888

Daniel Liu: daniel_liu@canalys.com +86 158 0075 6471

Canalys APAC (Singapore): +65 6671 9399

Sharon Hiu: sharon_hiu@canalys.com +65 9777 9015

Canalys Americas: +1 650 681 4488

Alex Smith: alex_smith@canalys.com +1 650 799 4483

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

Americas: Suite 317, 855 El Camino Real, Palo Alto, CA 94301, US | tel: +1 650 681 4488

APAC: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China | tel: +86 21 2225 2888

APAC: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535 | tel: +65 6671 9399

EMEA: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK | tel: +44 118 984 0520

email: inquiry@canalys.com | web: www.canalys.com