Canalys: Global PC market posts record growth in 7 years, shipments up 4.7% in Q3 2019

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 10 October 2019

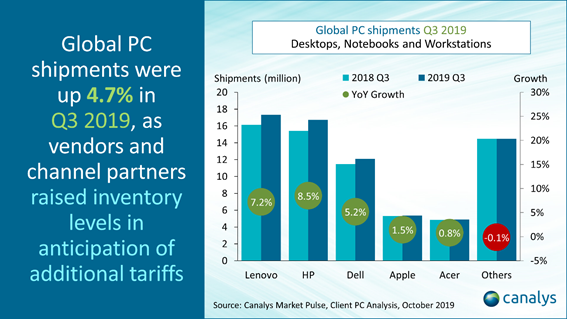

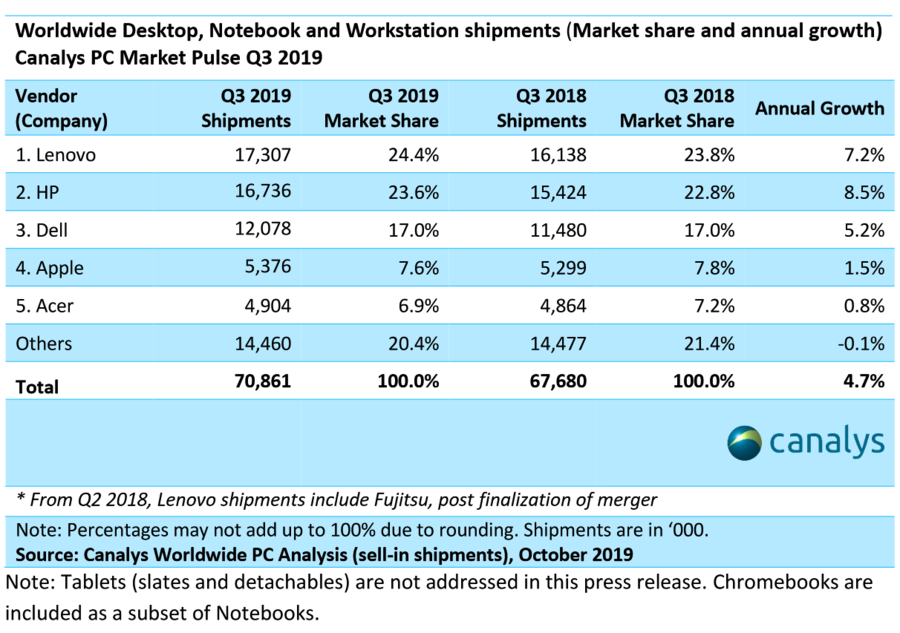

The global PC market, inclusive of desktops, notebooks and workstations, grew 4.7% in Q3 2019 to 70.9 million units, the best growth performance for the segment since Q1 2012, when shipments grew 5.4%. Lenovo and HP placed first and second, with impressive performances particularly in Japan and the United States. Lenovo shipped a total of 17.3 million units while HP shipped 16.7 million units. Third-placed Dell also grew in line with the market at 5.2% and shipped 12.1 million PCs this quarter. Apple and Acer rounded the top five, taking fourth and fifth places respectively, also growing shipments albeit by 1.5% and 0.8%. Canalys however warns that this is a short-term boost, effects of which could wear off as early as Q1 2020.

Multiple factors continued to contribute to demand in PC sales, including upgrades to Windows 10, and seasonal inventory stocking for the holidays, but the market was given further impetus by macroeconomic conditions.

In volatile regions, PC vendors and channels were forced to take precautionary measures to hedge against future disruption. In the US, for example, another round of tariffs is scheduled to take effect on US$37 billion worth of Chinese made notebooks and tablets. As a result, leading PC vendors are pumping up production orders, and channel partners are building inventory ahead of the 15 December deadline. This impact will not last forever, but in the short term it has benefitted the PC supply chain, which saw a positive performance that is likely to extend into Q4.

“The PC market high is refreshing. However, there is a limit to how quickly leading vendors can ramp production,” said Rushabh Doshi, Research Director of Canalys’ Mobility services. “Intel remains a key bottleneck, with pressure on its 14nm CPU supply not likely to see improvement until Q1 2020. However, the Intel CPU shortage provided leading PC vendors an advantage over smaller rivals drove HP and Lenovo to their best Q3 performance to-date. Going forward, leading vendors will have an opportunity to further consolidate the market and squeeze smaller vendors’ market share, if the Intel supply is not able to satisfy the spike in orders.”

The top five vendors consolidated their market share to 79.6% of the total PC market in Q3 2019, with market leaders HP and Lenovo taking a lion’s share of 48% together.

Regional highlights:

Japan continued to be a stand-out growth market, with businesses complying with deadlines for the end of Windows 7 extended support, and more importantly, a ramping up of IT infrastructure spend ahead of the Tokyo Olympics in 2020, driving up demand for PCs. Additionally, Japan is set to increase its consumption tax from 8% to 10% in October 2019, which is accelerating refresh timelines across the country, driving up sell-in. The top three vendors increased market share, with Lenovo, HP and Dell posting excellent growths of 61%, 83% and 104% year-on-year respectively, achieving personal bests for all three vendors in Japan. Total desktop, workstation and notebook shipments in Q3 2019 were 4.5 million versus 2.7 million a year ago, an enviable growth of 63% over last year.

PC shipments in the United States in Q3 benefitted from tail-end back-to-school season demand and front loading of shipments into the channel ahead of expected disruption from tariffs in the crucial holiday spending period from November to January. Shipments were up 3.0% year-on-year, with Apple and HP growing faster than the market average. HP continued to see a healthy sell-in of Chromebooks, with shipments over the million mark.

In Europe, uncertainty over Brexit and its outcome restrained demand for PCs, as businesses are apprehensive about investments for the long-term. Shipments grew about 2% in EMEA, below the global average. Apple was the only vendor in the top five to not see shipment growth in the region.

For more information, please contact:

Canalys China

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Jason Low: jason_low@canalys.com +86 136 2177 7745

Canalys India

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Varun Kannan: varun_kannan@canalys.com +91 92053 98246

Canalys Singapore

Ishan Dutt: ishan_dutt@canalys.com +65 8399 0487

Matthew Xie: matthew_xie@canalys.com +65 8223 4730

Canalys EMEA

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Mo Jia: mo_jia@canalys.com +86 158 0076 4291

Canalys USA

Vincent Thielke: vincent_thielke@canalys.com +1 650 644 9970

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

China: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China

India: 43 Residency Road, Bengaluru, Karnataka 560025, India

Singapore: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535

UK: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK

USA: 319 SW Washington #1175, Portland, OR 97204 USA

email: contact@canalys.com | web: www.canalys.com

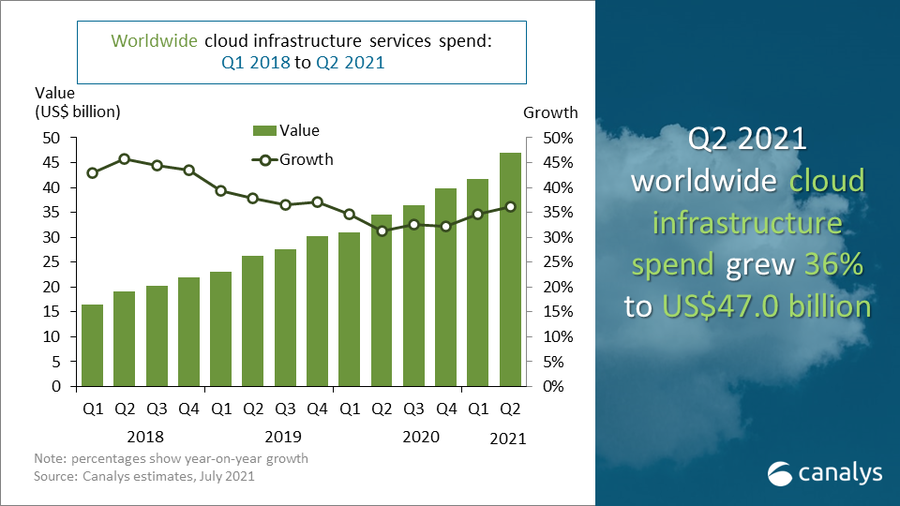

Global cloud services spending exceeded US$47 billion in Q2 2021