Global PC market share Q4 2019 and full year 2019

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Friday, 17 January 2020

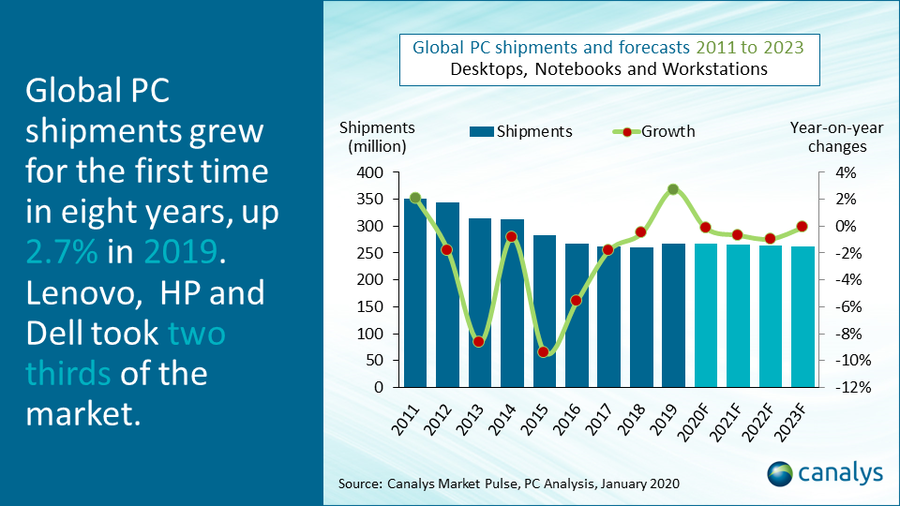

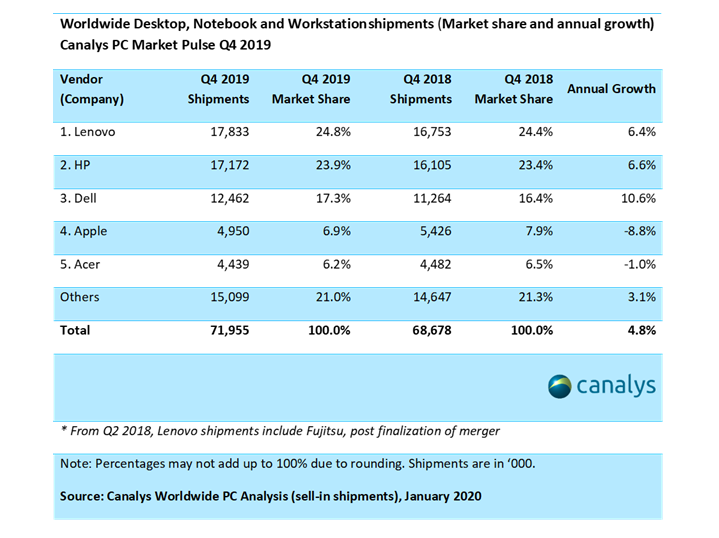

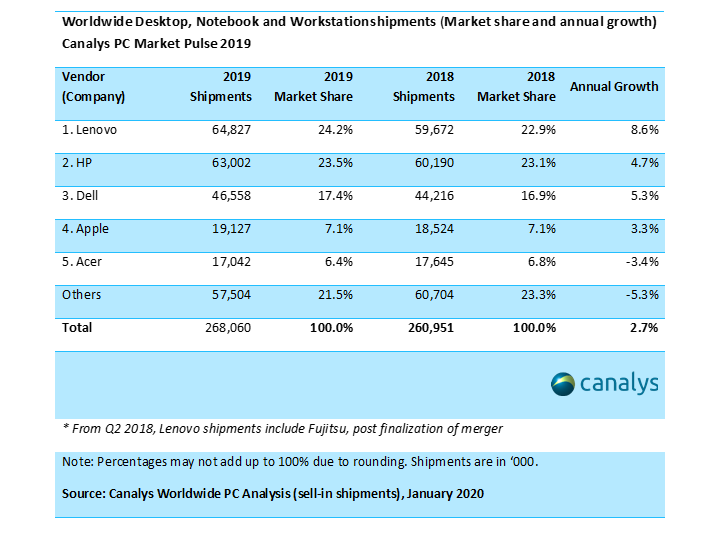

The global PC market recorded its first full year of growth in eight years in 2019. Inclusive of desktops, notebooks and workstations, 268.1 million units were shipped, up 2.7% on 2018. The growth, though, is focused on the largest three vendors, which now account for two-thirds of all shipments. For the whole year, Lenovo leads with 64.8 million units shipped while HP trailed closely at 63.0 million, with stellar 8.6% and 4.7% growth respectively. Third-placed Dell also outpaced the market, with 5.3% growth, and shipped 46.5 million PCs. Apple and Acer maintained fourth and fifth places, though Acer was the only vendor in top five to decline from 2018.

“PCs had a decent holiday quarter,” said Ishan Dutt, Canalys Analyst. “This is impressive given the market registered record growth in Q3. Despite supply chain issues, vendors remain bullish, especially in commercial. Intel’s continued efforts to improve supply will help maintain volume in 2020, but constraints are unlikely to ease quickly. The upshot, however, is the upgrade opportunities OEMs have with SMBs who have delayed refreshes in anticipation of new chipsets.”

Despite an economic slowdown, the United States remained a healthy market for PC shipments, growing 7.0% year-on-year at 17.9 million units in Q4. The Trump administration’s decision to delay proposed tariffs led to stronger than expected spending in the crucial consumer holiday, allowing retailers to absorb additional inventory.

In Europe, Brexit remained a critical issue in Q4. Shipments grew about 2% in EMEA, below the global average. However, UK businesses now at least have short-term certainty, as the UK leaves the EU on 31 January 2020, even if a long-term trade deal is still some way off. PC shipments will likely accelerate as channels build inventory ahead of the UK departure date, as distributors are nervous about subsequent product delays between Northern Ireland and the rest of the UK.

“2020 is unlikely to repeat the success of 2019. Macroeconomic factors continue to influence the PC industry heavily, as key markets like the US, Japan and India are expected to under-perform, for the major part of the year. Adding uncertainty to the market is a possible disruption to HP, which continues to be the target of a hostile takeover by Xerox,” said Rushabh Doshi, Canalys’ Research Director. “5G and foldable displays will bring some excitement to otherwise iterative upgrades. However, vendors remain in an experimental phase for both these features. Foldables suffer from a serious lack of use-cases, and demand is unlikely to grow unless second or third-generation devices can prove durability. 5G on the other hand, needs ecosystem readiness from network operators and cloud providers to justify the value offering of these devices. Mainstream adoption of 5G and foldable displays is still a good two to three years away.”

For more information, please contact:

Canalys China

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Jason Low: jason_low@canalys.com +86 136 2177 7745

Canalys India

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Varun Kannan: varun_kannan@canalys.com +91 92053 98246

Canalys (Singapore)

Ishan Dutt: ishan_dutt@canalys.com +65 8399 0487

Matthew Xie: matthew_xie@canalys.com +65 8223 4730

Canalys EMEA

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Mo Jia: mo_jia@canalys.com +33 785 683 766

Canalys USA

Vincent Thielke: vincent_thielke@canalys.com +1 650 644 9970

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2020. All rights reserved.

China: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China

India: 150/1 Infantry Road, Workafella Business Centre, Bengaluru, Karnataka 560001, India

Singapore: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535

UK: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK

USA: 319 SW Washington #1175, Portland, OR 97204 USA

email: contact@canalys.com | web: www.canalys.com