Global smartphone market Q2 2020

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Friday, 31 July 2020

The global smartphone market plummeted 14% in Q2 2020, with Apple the only top vendor to grow. It shipped 45.1 million iPhones globally, a growth of 25% compared to the previous year. The smartphone market worldwide fell to 285 million units, a second consecutive quarter of freefall, as lockdown orders caused by the COVID-19 pandemic persisted through April and May. In addition, market share leadership rankings changed as Huawei toppled Samsung (see Canalys press release: Huawei trumps Samsung for first time in worldwide smartphone market in Q2 2020). Huawei shipped 55.8 million units, compared to Samsung’s 53.7 million in Q2 2020. Xiaomi came fourth, shipping 28.8 million units, which was down 10%, and Oppo reclaimed fifth place from Vivo, shipping 25.8 million units with a 16% decline.

“Apple defied expectations in Q2. Its new iPhone SE was critical in the quarter, accounting for around 28% of its global volume, while iPhone 11 remained a strong best-seller at nearly 40%. iPhone SE will remain crucial to prop up volume this year, amid delays to Apple’s next flagship release,” said Canalys Analyst, Vincent Thielke. “In China, it had blockbuster results, growing 35% to reach 7.7 million units. It is unusual for Apple’s Q2 shipments to increase sequentially. As well as the new iPhone SE, Apple is also demonstrating skills in new user acquisition. It adapted quickly to the pandemic, doubling down on the digital customer experience as stay-at-home measures drive more customers to online channels.”

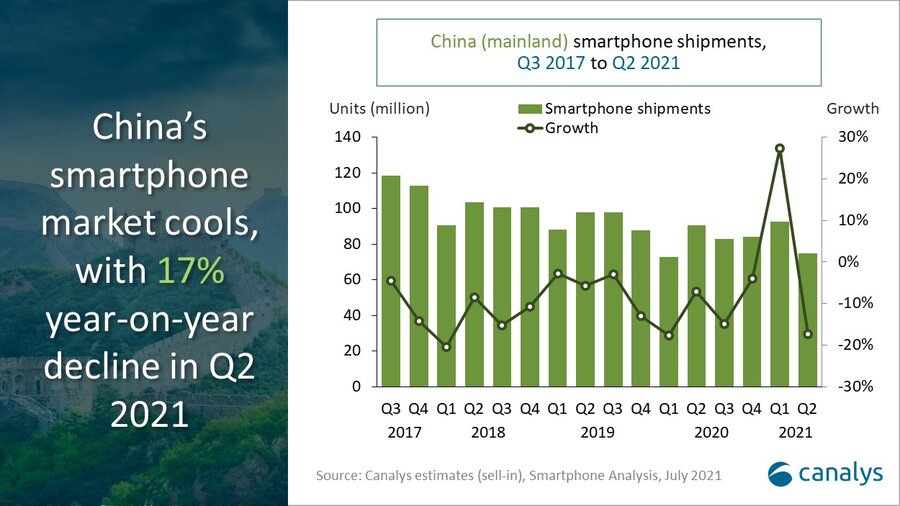

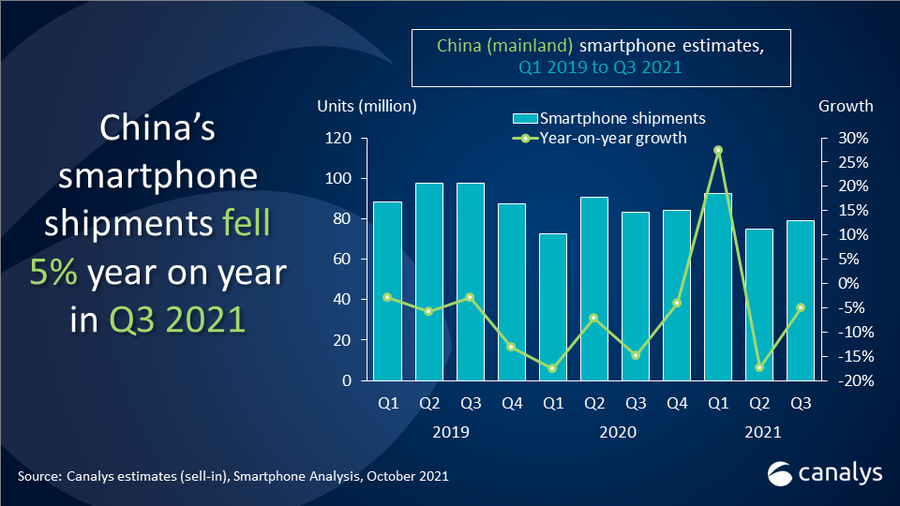

The world’s largest smartphone market, China, declined 7% in Q2 2020, but its economy is gathering momentum amid successful virus suppression. Huawei was the clear market leader in China, taking 44% market share. The US was the second-largest market. Apple, its longstanding leader, showed double-digit growth in the quarter. India, the world’s third-largest market, shrank 48% to 17.3 million units amid a strict lockdown (see Canalys press release: India smartphone market shrinks by nearly 50% in Q2 2020).

“Smartphone companies need to adapt rapidly to the ‘new normal’ of the pandemic,” said Senior Analyst, Ben Stanton. “As lockdowns ease, many countries allowed offline retail stores to reopen, but footfall remained low. Going forwards, vendors will need to switch channel focus at short notice, to adapt to second-wave outbreaks. In addition, geopolitical uncertainty also hangs over the global smartphone market. Countries are becoming polarized between the interests of the US and China. In India, for example, Chinese companies now face a wave of negative sentiment. Smartphone vendors need to act, and many are already directing funds to brand marketing to highlight their positive impact in a local region.”

“So far, consumer purchasing power in major markets has remained relatively stable” continued Stanton. “Governments have undertaken extraordinary stimulus initiatives to prop up their economies. However, the real test will be in the coming months, as stimulus money is tapered off, and furlough schemes withdrawn.”

|

Worldwide smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q2 2020 |

|||||

|

Vendor |

Q2 2020 shipments (million) |

Q2 2020 Market share |

Q2 2019 shipments (million) |

Q2 2019 Market share |

Annual |

|

Huawei |

55.8 |

19.6% |

58.7 |

18.7% |

-5% |

|

Samsung |

53.7 |

18.9% |

76.9 |

23.2% |

-30% |

|

Apple |

45.1 |

15.8% |

36.0 |

10.8% |

+25% |

|

Xiaomi |

28.8 |

10.1% |

32.1 |

9.7% |

-10% |

|

Oppo |

25.8 |

9.1% |

30.6 |

9.2% |

-16% |

|

Others |

75.5 |

26.5% |

97.5 |

29.4% |

-23% |

|

Total |

284.7 |

100.0% |

331.8 |

100.0% |

-14% |

|

Note: percentages may not add up to 100% due to rounding Source: Canalys estimates (sell-in shipments), Smartphone Analysis, July 2020 |

|||||

For more information, please contact:

Canalys China

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Louis Liu: louis_liu@canalys.com +86 136 2177 7745

Canalys India

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Adwait Mardikar: adwait_mardikar@canalys.com +91 96651 38668

Canalys Singapore

Shengtao Jin: shengtao_jin@canalys.com +65 6657 9303

Matthew Xie: matthew_xie@canalys.com +65 8319 8343

Canalys UK

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Mo Jia: mo_jia@canalys.com +33 785 683 766

Canalys USA

Vincent Thielke: vincent_thielke@canalys.com +1 650 644 9970

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2020. All rights reserved.