Global smartphone market Q4 and full year 2019

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 30 January 2020

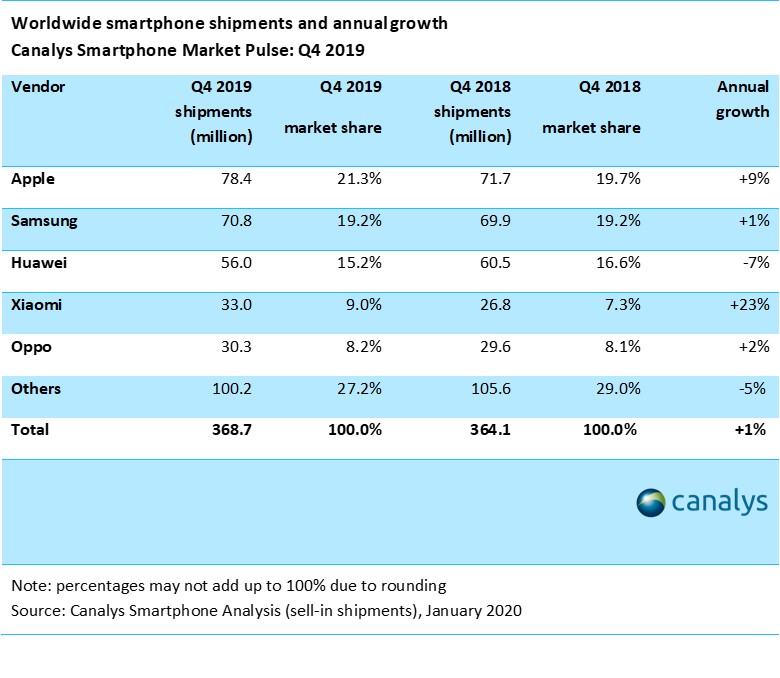

Global smartphone shipments grew 1% in Q4 2019, the second consecutive quarter of growth, as the market hit 369 million units. Apple led the market, exploiting strong demand for iPhone 11 models to increase 9% to 78 million units. Samsung shipped 71 million units to maintain its positive momentum, growing 1%. Huawei took third place, but declined 7% amid its ongoing US Entity List saga, as its overseas business offset growth in China. Xiaomi took fourth place, growing 23% to 33 million units, while Oppo took fifth growing 2% to 30 million units.

“This is an industry-wide success - eight of the top ten vendors grew in Q4,” said Canalys Senior Analyst Ben Stanton. “When we saw the first declines in global volume a couple of years ago, Canalys stated that the industry was moving from the growth era to the cyclical era. This is it. This growth spurt will not last forever but will be one of a series of peaks and troughs, as the customer refresh rate for smartphones reaches its new equilibrium point.”

One of the success stories in Q4 came from emerging markets. “Chinese vendors were particularly diligent in developing regions over the past quarter,” said Research Analyst Shengtao Jin. “Smartphones under US$100 have been a major focus, as vendors targeted the installed base of users still using feature phones. Vivo, for example, had exceptional success with the cheap Y91C in Indonesia this quarter. Apple also saw success in emerging regions as the cheaper iPhone 11 tempted a broader base of customers than it is used to.”

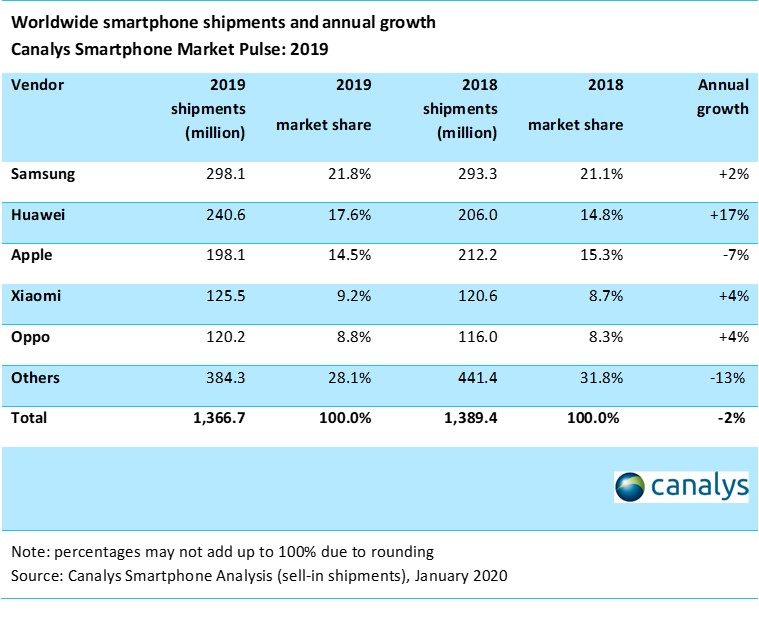

In 2019 the worldwide smartphone market fell by 2% to 1.37 billion units, compared to 2018. This was despite global market growth in Q3 and Q4.

“The fortunes of Huawei and Samsung are the story of the year,” said Canalys analyst, Mo Jia. “2018 saw Huawei take huge chunks of Samsung’s market share. And 2019 was meant to be the year Huawei challenged Samsung for the #1 spot. Samsung knew this and was ready for all-out war. It drastically increased its portfolio, and slashed operating margin. But the battle never came, as Huawei’s placement on the US Entity List in May stifled it overseas.”

Ultimately Samsung retained the lead in the 2019 smartphone market with 21.8% share and 298.1 million units, growing 2%. Huawei was second with 17.6%, followed by Apple with 14.5% of the global smartphone market in 2019.

“As Huawei prepares to launch its next wave of devices without Google Mobile Services (GMS), its objectives are now very different. It must maintain as much channel support as it can in key markets like Western Europe. It must curate a developer ecosystem to support HMS. And most importantly, it must maintain scale. If it loses scale, it loses developer interest,” commented Jia.

What is clear going in to 2020 is the smartphone is more important than ever. Declines do not mean people are using smartphones less. In fact, the population is more addicted to phones than ever.

For more information, please contact:

Canalys China

Louis Liu: louis_liu@canalys.com +86 136 2177 7745

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Canalys India

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Adwait Mardikar: adwait_mardikar@canalys.com +91 96651 38668

Canalys Singapore

Matthew Xie: matthew_xie@canalys.com +65 8223 4730

Shengtao Jin: shengtao_jin@canalys.com +65 9113 7976

Canalys EMEA

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Mo Jia: mo_jia@canalys.com +33 785 683 766

Canalys USA

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Vincent Thielke: vincent_thielke@canalys.com +1 650 644 9970

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2020. All rights reserved.

China: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China

India: 150/1 Infantry Road, Workafella Business Centre, Bengaluru, Karnataka 560001, India

Singapore: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535

UK: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK

USA: 319 SW Washington #1175, Portland, OR 97204 USA

email: contact@canalys.com | web: www.canalys.com