Canalys: Smart personal audio devices set for strongest year in history, TWS the largest and fastest growing category

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Monday, 30 December 2019

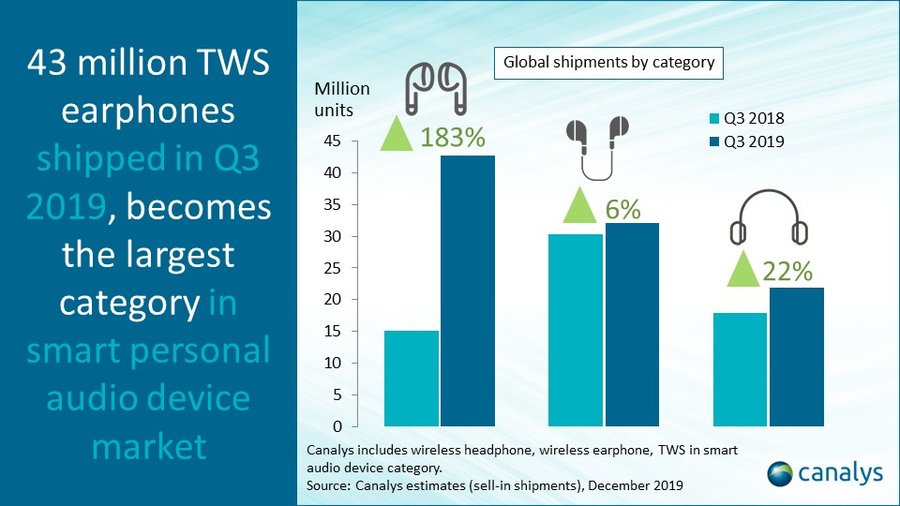

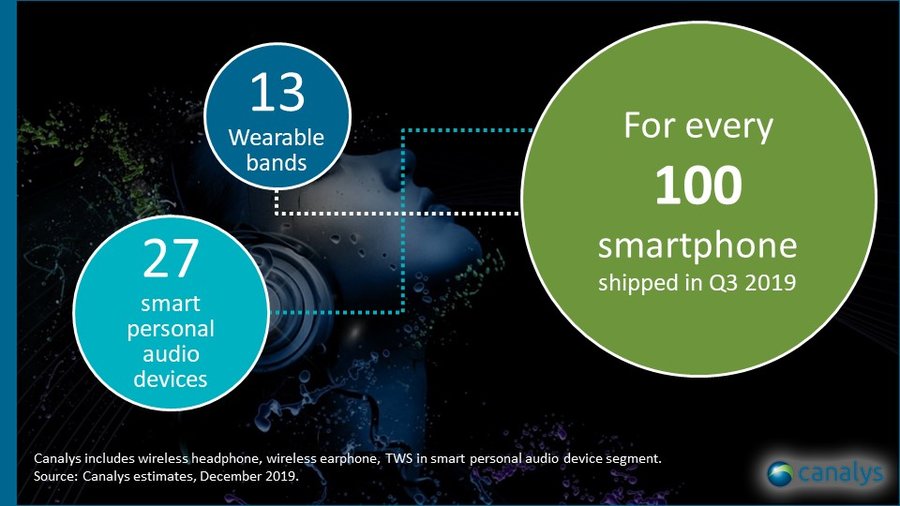

TWS (true wireless stereo), wireless earphones and wireless headphones, which form the smart personal audio device market according to the Canalys definition, will witness its strongest year in history in 2019. In Q3 2019, the worldwide smart personal audio device market grew 53% to reach 96.7 million units. And the segment is expected to break the 100 million unit mark in the final quarter, with potential to exceed 350 million units for the full year. Canalys’ latest research showed the TWS category was not only the fastest growing segment in this market, with a stellar 183% annual growth in Q3 2019, but it also overtook wireless earphones and wireless headphones to become the largest category.

“The rising importance of streaming content, and the rapid uptake in a new form of social media including short videos, resulted in profound changes in mobile users’ audio consumption and these changes will accelerate in the next five years while technology advancements like machine learning and smart assistants will bring more radical innovations in areas such as audio content discovery and ambient computing,” said Nicole Peng, VP of Mobility at Canalys.

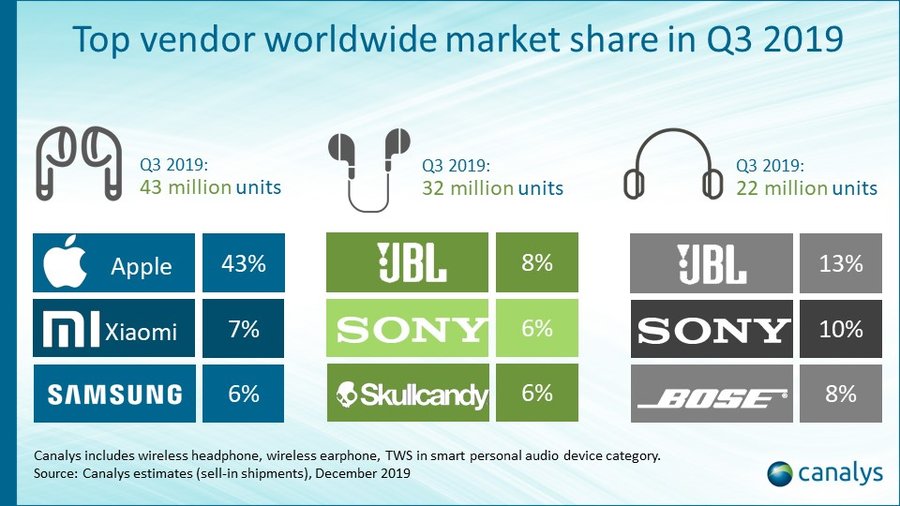

As users adjust their consumption habits, the TWS category enabled smartphone vendors to adapt and differentiate against traditional audio players in the market. With 18.2 million units shipped in Q3 2019, Apple commands 43% of the TWS market share and continues to be the trend setter. “Apple is in clear leadership position and not only on the chipset technology front. The seamless integration with iPhone, unique sizing and noise cancelling features providing top of the class user experience, is where other smartphone vendors such as Samsung, Huawei and Xiaomi are aiming their TWS devices. In the short-term, smart personal audio devices are seen as the best up-selling opportunities for smartphone vendors, compared with wearables and smart home devices,” added Nicole.

Major audio brands such as Bose, Sennheiser, JBL, Sony and others are currently able to stand their ground with their respective audio signatures especially in the earphones and headphones categories.

“Demand for high-fidelity audio will continue to grow. However, the gap between audio players and smartphone vendors is narrowing. Smartphone vendors are developing proprietary technologies to not only catch up in audio quality, but also provide better integration for on-the-move user experiences, connectivity and battery life,” said Canalys Senior Analyst Jason Low. “Traditional audio players must not underestimate the importance of the TWS category. The lack of control over any connected smart devices is the audio players’ biggest weakness. Audio players must come up with an industry standard enabling better integration with smartphones, while allowing developers to tap into the audio features to create new use cases to avoid obsoletion.

“The potential for TWS devices is far from being fully uncovered, and vendors must look beyond TWS as just a way to drive revenue growth. Coupled with information collected from sensors or provided by smart assistants via smartphones, TWS devices will become smarter and serve broader use cases beyond audio entertainments, such as payment, and health and fitness,” added Jason. “Regardless of the form factor, the next challenge will be integrating smarter features and complex services on the smart personal audio platforms. Canalys expects the market of smart personal audio devices to grow exponentially in the next two years and the cake is big enough for many vendors to come in and compete for the top spots as technology leaders and volume leaders.”

To meet our analysts at CES 2020 please contact Marcy Ryan at marcy_ryan@canalys.com

For more information, please contact:

Canalys UK

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Kelly Wheeler: kelly_wheeler@canalys.com +44 7919 563 270

Steven Kiernan: steven_kiernan@canalys.com +44 7464 442 694

Canalys USA

Vincent Thielke: vincent_thielke@canalys.com +1 650 644 9970

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Canalys China

Cynthia Chen: cynthia_chen@canalys.com +86 158 2151 8439

Jason Low: jason_low@canalys.com +86 159 2128 2971

Canalys India

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Adwait Mardikar: adwait_mardikar@canalys.com +91 96651 38668

Canalys Singapore

Shengtao Jin: shengtao_jin@canalys.com +65 6657 9303

Ishan Dutt: ishan_dutt@canalys.com +65 8399 0487

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

China: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China

India: 150/1 Infantry Road, Workafella Business Centre, Bengaluru, Karnataka 560001, India

Singapore: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535

UK: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK

USA: 319 SW Washington #1175, Portland, OR 97204 USA

email: contact@canalys.com | web: www.canalys.com