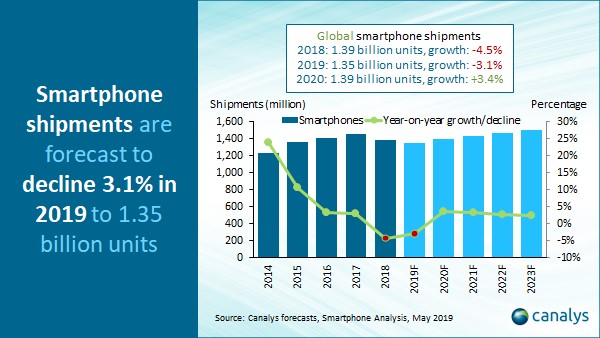

Canalys: Smartphone shipment forecast cut to 1.35 billion for 2019 as uncertainty prevails

Palo Alto, Shanghai, Singapore and Reading (UK) – Monday, 3 June 2019

Canalys released its updated global smartphone forecasts on 28 May 2019. The latest numbers show that smartphone shipments will reach 1.35 billion units in 2019, a year-on-year decline of 3.1%. Due to the many uncertainties surrounding the US/China trade talks, the US Executive Order signed on 15 May and subsequent developments, Canalys has lowered its forecasts to reflect an uncertain future.

Canalys’ base assumption is that restrictions will be imposed stringently on Huawei, once the 90-day reprieve expires, having a significant impact on its ability to roll-out new devices in the short term, especially outside of China. Canalys anticipates that Huawei is taking steps to mitigate the effect of component and service supply issues, but its overseas potential will be hampered for some time. The US and China may eventually reach a trade deal to alleviate the pressure on Huawei, but if and when this will happen is far from clear.

Canalys’ published forecasts reflect what will happen should there be no major political changes. “It is important to note that market uncertainty is clearly prompting vendors to accelerate certain strategies to minimize the short- and long-term impact in a challenging business environment, for example, shifting manufacturing to different countries to hedge against the risk of tariffs. But with recent US announcements on tariffs on goods from more countries, the industry will be dealing with turmoil for some time,” said Nicole Peng, VP, Mobility.

“We expect the other major smartphone vendors will have short-term opportunities while Huawei struggles. Samsung will be the biggest winner, thanks to its aggressive device strategy and its ability to quickly ramp up production, through the Korean firm may struggle to entirely fill the shortfall,” said Rushabh Doshi, Research Director, Canalys. “It will take other vendors until late 2019 to react to the new opportunities. Samsung’s control over component supply gives it a major advantage.”

Moving into 2020, most of the major mobile supply chain and channel will have active contingency plans to mitigate Huawei’s decline and be ready for 5G device roll-out in many markets. Canalys anticipates that 5G and other hardware innovations will be positive drivers for consumer demand and smartphone shipments globally are expected to return to soft growth in 2020, rising 3.4% to 1.39 billion. There will be subtle variations that will allow some regions to recover faster than others.

“Smartphone fatigue and a lack of meaningful innovation are still major market forces. Consumers are holding onto phones for longer. But as device lifecycles move toward a new equilibrium point, the rate of quarterly shipment decline will ease,” added Doshi.

For more information, please contact:

Canalys EMEA

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Kelly Wheeler: kelly_wheeler@canalys.com +44 7919 563 270

Canalys APAC (Shanghai)

Mo Jia: mo_jia@canalys.com +86 158 0076 4291

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Canalys APAC (Singapore)

Rushabh Doshi: rushabh_doshi@canalys.com +65 9820 0071

Shengtao Jin: shengtao_jin@canalys.com +65 6657 9303

Canalys Americas

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Vincent Thielke: vincent_thielke@canalys.com +1 650 644 9970

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us or email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

Americas: Suite 317, 855 El Camino Real, Palo Alto, CA 94301, US

APAC: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China

APAC: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535

EMEA: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK

email: inquiry@canalys.com | web: www.canalys.com