Cloud services spend in China hit US$7.8 billion in Q3 2022

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Monday, 12 December 2022

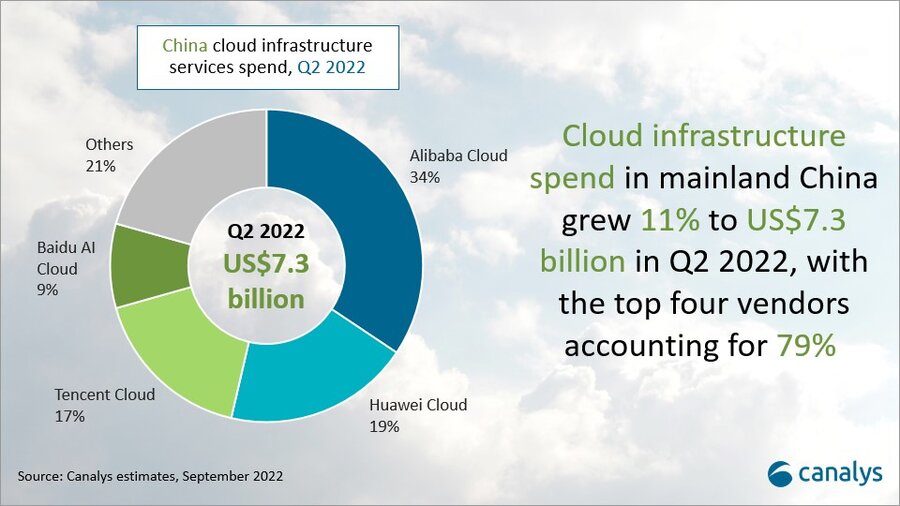

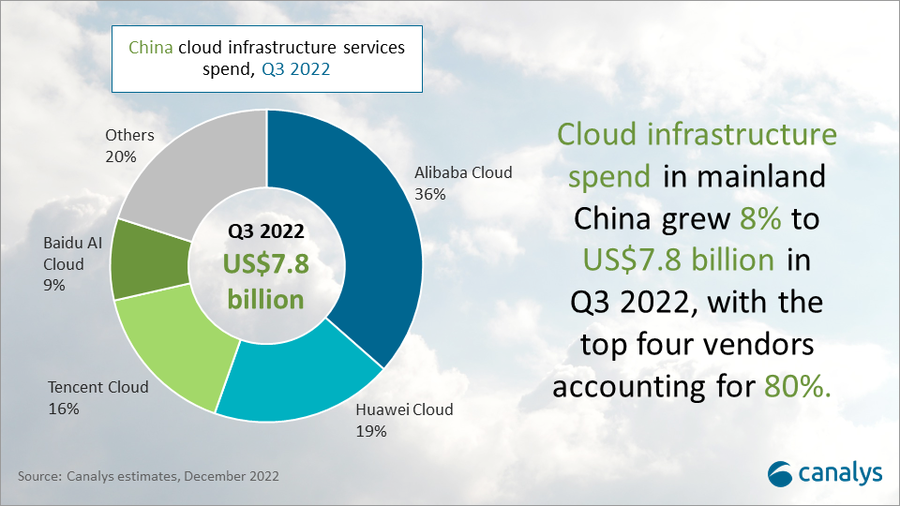

Cloud infrastructure services expenditure in mainland China grew 8% year-on-year in Q3 2022, reaching US$7.8 billion and accounting for 12% of overall global cloud spend. The annual growth rate has slowed for three consecutive quarters, now, for the first time, falling below 10%. Despite business activities resuming recently, operations have still been impacted by the COVID-19 pandemic, leading enterprise customers to scale back on IT services to reduce their operational risks. The top four players in China's cloud market this quarter continued to be Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu AI Cloud. Together, they accounted for 80% of overall spending after growing 8%.

The aftermath of the COVID-19 pandemic continues to linger in the Chinese market, and cost reduction remains a priority for enterprises. Even digitally-rooted customers with high cloud usage rates downsized their cloud consumption in Q3. And increasing cloud demand from traditional verticals (which historically have less digital consumption) failed to make up for the slowdown.

The overall China cloud market is entering a new era. Significant changes are taking place in the competitive landscape and customer structure. Carriers like China Telecom are making investments and gaining share in the cloud services market by taking advantage of infrastructure costs and breadth of coverage.

“Around 60% of the top three cloud vendors’ customers in the global cloud services market come from traditional verticals,” said Canalys Research Analyst Yi Zhang. “In the next phase, we predict the Chinese cloud market will be driven by enterprise customers from traditional verticals. However, Chinese cloud vendors struggle to convince traditional sectors to migrate to the cloud, especially those with lower digitalization levels.”

Alibaba Cloud led the cloud infrastructure services market in Q3 2022. It accounted for 36% of total spend after growing 4% year-on-year. It is the first time Alibaba Cloud fell to single-digit growth. Growth was mainly driven by renewal execution, but the cloud consumption and deal sizes were lower than expected, especially for customers from the Internet and retail industries. Alibaba Cloud is seeking new business opportunities to drive growth. Customer demand from the automotive and electronic industries showed strong growth momentum. In July 2022, Alibaba Cloud launched a service center in Portugal, the first outside China, to capitalize on the growing digitalization in EMEA. There are two other service centers planned to be launched in Mexico and Kuala Lumpur to penetrate the North American and Southeast Asian markets.

Huawei Cloud accounted for 19% of the market and was the second-largest cloud service provider in Q3 2022. Its growth rate exceeded the overall growth of the cloud services spend in China this quarter, resulting in share gains. Huawei Cloud launched some small-scale general solutions, targeting SMB customers with low IT budgets and cloud consumption. The model was scalable, driving significant growth in revenue from SMBs. Huawei Cloud’s new partner program announced in April brought a large number of partners into Huawei Cloud’s channel ecosystem. The cumulative number has reached 41000 in this quarter. In terms of overseas activities, Huawei Cloud launched new data centers in Indonesia and Ireland and announced a €150 million (around US$145 million) investment in Ireland, its first data center in Europe.

Tencent Cloud captured 16% of the Chinese cloud market in Q3 2022. Tencent Cloud remained committed to scaling back loss-making projects and focusing on profitability. Its cloud business is still in a phase of adjustment, but revenue growth is slowly returning. It continues to have an advantage in the financial industry because of its database products. Tencent Cloud recently announced a joint venture with China Unicom, engaging CDN business and edge cloud business. This initiative may have limited economic benefits in the short-term, but is bullish on long-term growth prospects.

Baidu AI Cloud ranked fourth, taking 9% of the market and growing by 12% yearly. It has continued to grow at a faster pace compared to the overall Chinese cloud market for three quarters. Notwithstanding the smaller existing base, the steady growth stemmed from Baidu AI Cloud's cross-industry customer structure, making it less reliant on key customers. It gained a foothold in some traditional industry verticals, namely manufacturing, energy, and transportation. Its smart mobility solution has been adopted by 63 cities, a significant increase in coverage, compared to just 24 cities a year ago. Baidu merging its cloud and AI technologies has shown some success, making the adoption of cloud solutions more accessible and versatile. This also allows for scale through the replication of solutions across industries.

Canalys defines cloud infrastructure services as services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services being consumed to host and operate them.

For more information, please contact:

Yi Zhang (China): yi_zhang@canalys.com

Alex Smith (US): alex_smith@canalys.com

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.