HONOR takes the crown in China after smartphone market correction in Q1 2022

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) –Friday, 29 April 2022

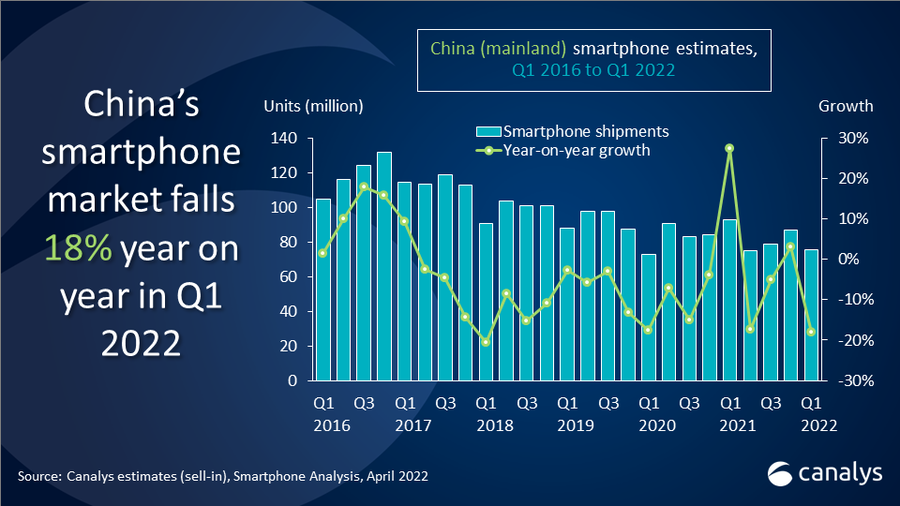

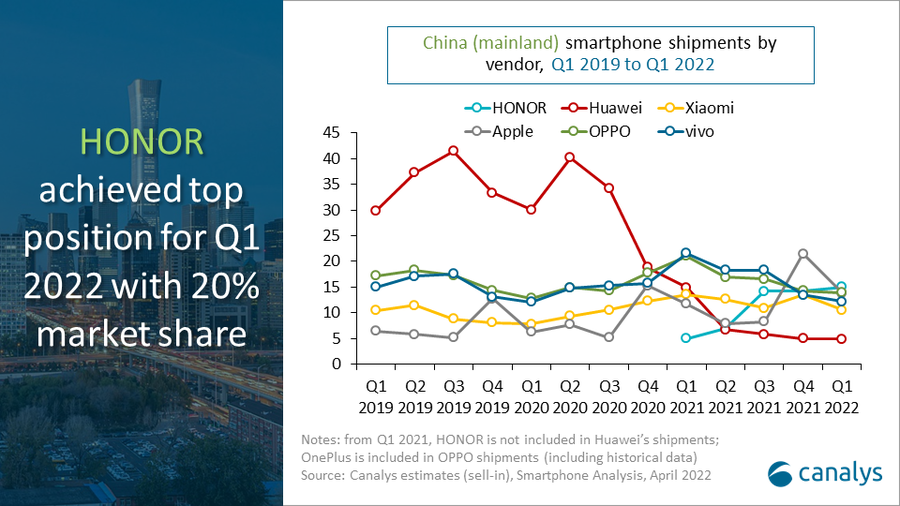

The smartphone market in Mainland China in Q1 2022 continued to underperform compared with the global market, with shipments falling 18% year on year and 13% sequentially to 75.6 million units. Though a sharp decline, this represents a market correction to typical seasonal trends after an abnormal first quarter in 2021. HONOR reached the top for the first time, shipping 15.0 million units with stellar growth of 205%. OPPO (including OnePlus) stayed in second place with 13.9 million units shipped as it continued its brand transition. Apple remained in the top three after a strong Q4 last year. Vivo and Xiaomi completed the top five, shipping 12.2 million and 10.6 million units respectively.

“The market correction is no surprise after a lackluster Q4 last year,” said Canalys Analyst Amber Liu. “There is usually a sequential decline in demand and production in Q1, though China’s smartphone market has been underperforming for nearly three years. Competition among the top five vendors has been extremely tight as Huawei faded in recent quarters. While most leading vendors eased off on new launches in Q1, HONOR grew sequentially by 6%. Its new 60 and X30 series contributed to its solid performance as it continued to grow in offline channels.”

“The outbreak of the Omicron COVID-19 variant and strict lockdowns in major cities from February cast a shadow over the consumer market, which has yet to recover from last year’s weakness. In response to the sudden retail closures and logistics delays, vendors must adopt a more cautious approach to stock allocation, which will inevitably affect sell-in in the short term,” said Canalys Analyst Toby Zhu. “Increasing macroeconomic uncertainties affected by domestic and overseas demand will further damage the job market and consumer confidence, especially affecting the low end. Domestic players have little choice but to keep increasing their investment in the mid-to-high-end market this year to hedge against the risk of slowdown in mass-market device sales.”

“Vendors should be cautious of cutting back their resources and investments in Chinese markets amid the business uncertainty and ongoing disruptions,” added Zhu. “It is a perfect time for vendors to shift their focus to improving product attractiveness, channel development programs and customer loyalty while supply pressures are easing. Meanwhile, vendors’ performance in the Chinese market is vital to maintain supply chain confidence and, more importantly, capacity allocation to the vendors themselves and the overall smartphone category. As China is home to most technology supply chains, overly pessimistic market sentiment will drive component suppliers away from smartphones to other more profitable categories. The last thing vendors want to deal with is another wave of component shortages while demand rebounds in the second half of 2022 or early 2023.”

|

People’s Republic of China (mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q1 2022 |

|||||

|

Vendor |

Q1 2022 |

Q1 2022 |

Q1 2021 |

Q1 2021 |

Annual |

|

HONOR |

15.0 |

20% |

4.9 |

5% |

205% |

|

OPPO |

13.9 |

18% |

21.0 |

23% |

-34% |

|

Apple |

13.8 |

18% |

11.8 |

13% |

17% |

|

vivo |

12.2 |

16% |

21.6 |

23% |

-44% |

|

Xiaomi |

10.6 |

14% |

13.5 |

15% |

-22% |

|

Others |

10.2 |

13% |

19.7 |

21% |

-48% |

|

Total |

75.6 |

100% |

92.5 |

100% |

-18% |

|

|

|

|

|||

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; OnePlus is included in OPPO shipments; |

|

||||

For more information, please contact:

Toby Zhu: toby_zhu@canalys.com +86 150 2674 3017

Amber Liu: amber_liu@canalys.com +86 136 2177 7745

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.