Cybersecurity market grows 9% in 2018 to reach US$37 billion

Palo Alto, Shanghai, Singapore and Reading (UK) – Monday, 8 April 2019

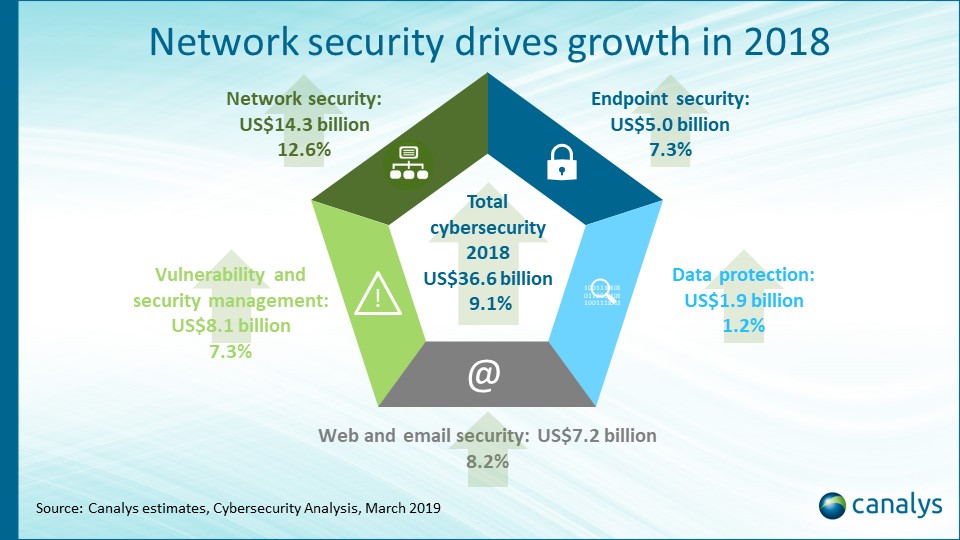

Industry analyst firm Canalys estimates that worldwide cybersecurity technology spending reached US$37 billion in 2018, up 9.1% from 2017. The standout segment was network security, which was up 12.6% year on year, thanks to the creation of hybrid and complex environments.

Web and email security products grew 8.2%, followed by endpoint security, and vulnerability and security management solutions, both growing 7.3%. Growth rates within the different regions were similar, ranging from 7.0% in APAC to 10.5% in EMEA, with Latin America at 9.2% and North America 8.9%.

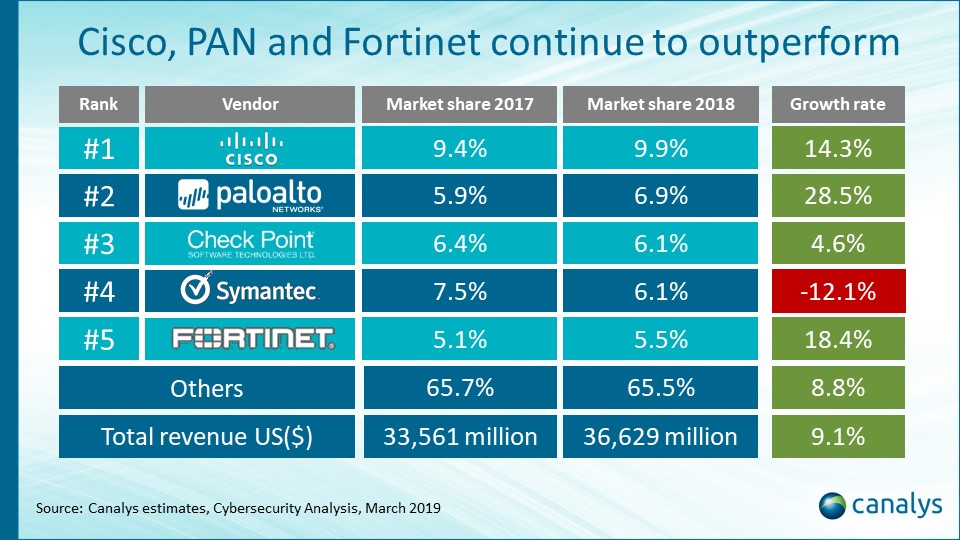

Cisco, Palo Alto Networks and Fortinet, all with a strong focus on network security products, outperformed the market, recording strong double-digit growth. “The fast adoption of multiple cloud services by enterprises, which often keep on-premises infrastructure as well, has created hybrid environments, complex to define and protect. This is driving growth for network security products, especially those solutions that enable the creation of a perimeterless architecture, favoring vendors with a wide array of tools in their portfolios,” said Canalys Research Analyst Claudio Stahnke.

Check Point was in third place, growing 5% thanks to its cloud security offering, which was recently expanded in identity management and web security with the acquisitions of Dome9 and ForceNock respectively. Finally, Symantec is expected to rebound this year after declining 12% in 2018, closing a difficult period after the fallout from an internal probe affected sales.*

“We have seen many acquisitions in the cybersecurity space in 2018 as vendors are expanding their offerings to profit from the complexities that end users are facing,” Stahnke added. “This will not stop in 2019 as the market remains highly fragmented and new threats force incumbents to further expand their platforms.”

Cybersecurity quarterly estimate data is taken from Canalys’ Cybersecurity Analysis service. Estimates include technologies across network security, endpoint security, web and email security, data security, and vulnerability and analytics security. The subscription service tracks the transition of deployment options from hardware and software to services, public cloud workloads and virtual appliances/agents by channel and end-user size.

* (31/05/2019) Symantec’s negative growth rate is the result of the divestiture of its WSS/PKI business.

For more information, please contact:

Canalys EMEA: +44 118 984 0520

Claudio Stahnke: claudio_stahnke@canalys.com +44 7881 934 784

Matthew Ball: matthew_ball@canalys.com +44 7887 950 505

Canalys APAC (Shanghai): +86 21 2225 2888

Daniel Liu: daniel_liu@canalys.com +86 158 0075 6471

Canalys APAC (Singapore): +65 6671 9399

Sharon Hiu: sharon_hiu@canalys.com +65 9777 9015

Canalys Americas: +1 650 681 4488

Ketaki Borade: ketaki_borade@canalys.com +1 650 387 5389

Alex Smith: alex_smith@canalys.com +1 650 799 4483

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

Americas: Suite 317, 855 El Camino Real, Palo Alto, CA 94301, US | tel: +1 650 681 4488

APAC: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China | tel: +86 21 2225 2888

APAC: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535 | tel: +65 6671 9399

EMEA: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK | tel: +44 118 984 0520

email: inquiry@canalys.com | web: www.canalys.com

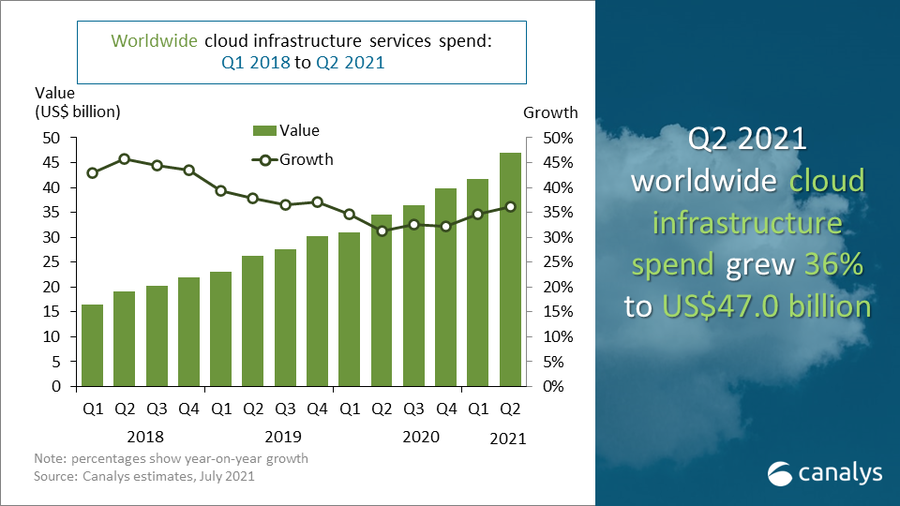

Global cloud services spending exceeded US$47 billion in Q2 2021