Global 5G smartphone forecast Q2 2020

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Wednesday, 09 September 2020

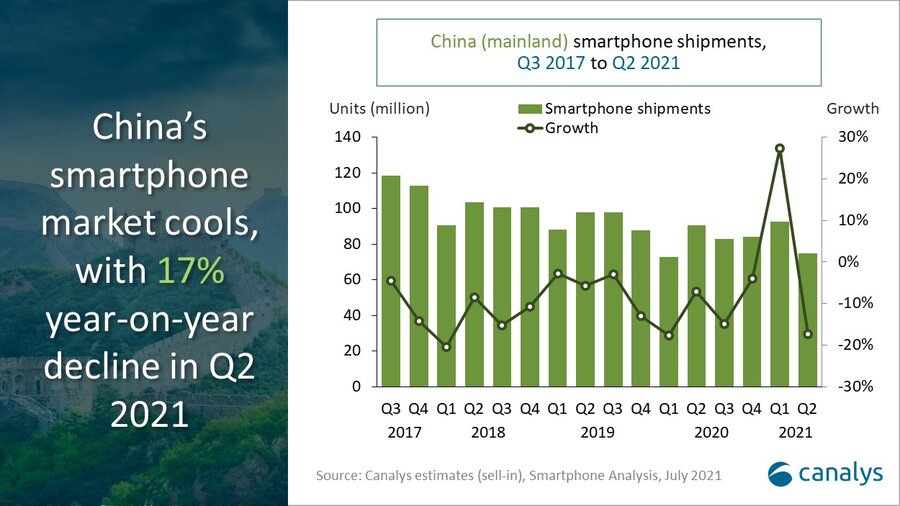

In its latest forecast release, Canalys projects global 5G smartphone shipments will reach nearly 280 million units in 2020, with 62% of these in Greater China, followed by North America and EMEA. Overall smartphone volumes are projected to decline 10.7% in 2020 compared with 2019, while a rebound of 9.9% is expected in 2021, with the market to exceed 1.3 billion units.

“Global smartphone shipments are rebounding rapidly in many markets ahead of the economic and retail consumption recovery,” said Canalys Senior Analyst, Ben Stanton. “Smartphone vendors have relentlessly pushed new product launches, as well as online marketing and sales during the post-lockdown period, generating strong consumer interest for the latest gadgets. Gradual reopening of offline stores, improving logistics and production have provided necessary uplift for most markets to move into a more stabilized second half of 2020. And with the holiday season about to kick off, there is no doubt 5G is about to be thrust into spotlight.”

Canalys sees the rapid commoditization of 5G smartphones in mainland China as a critical factor behind the huge 5G smartphone shipments this year.

“As Realme launched its V3 in September, the first sub-US$150 (RMB999) 5G smartphone in China, 5G officially becomes a feature for entry-level smartphones,” said Canalys Analyst, Shengtao Jin. “This milestone has arrived three months earlier than expected and will have a significant ripple effect in other regions, such as Southeast Asia, EMEA, and even Latin America where Chinese vendors are expanding.

“The economies of scale provided by the China market will allow vendors to launch more affordable 5G smartphones in other countries, even if 5G infrastructure in those markets is not fully ready. It is expected that by 2021, nearly 60% of 5G smartphone shipments in China will be cheaper than US$400, while 5G penetration in China will reach 83% in the next 12 months,” commented Jin.

Europe will be the third largest region behind Greater China and North America in terms of 5G penetration in 2020 and 2021, driven by multiple forces.

“Fairly aggressively-priced 5G devices are already available in Europe, such as the Motorola G 5G Plus, and the Xiaomi Mi 10 Lite 5G. But with many Apple-centric markets, such as the UK, there is a large base of customers willing to wait for an iPhone with 5G. Another headache for mobile operators in Europe is the ongoing uncertainty around Huawei, as it looks increasingly likely that supply chain constraints will hinder its volume potential. Huawei was long-expected to play a major role in 5G smartphone adoption, and other brands such as Xiaomi, Oppo and TCL are already positioning themselves to fill any vacuum as it appears.” commented Stanton.

ASP of 5G in Europe is expected to come down, but more steadily, considering Apple and Samsung’s share in this region, reaching at US$765 in 2021 and US$477 in 2024.

|

Worldwide 5G enabled smartphone shipment forecasts (market share and annual growth) |

|||||

|

Region |

2020 |

2020 |

2021 (million) |

2021 |

Annual |

|

Greater China |

172 |

62% |

305 |

56% |

77% |

|

North America |

42 |

15% |

92 |

17% |

118% |

|

Europe, Middle East & Africa |

31 |

11% |

76 |

14% |

141% |

|

Asia Pacific (excludes Greater China) |

29 |

11% |

57 |

11% |

95% |

|

Latin America |

3 |

1% |

13 |

2% |

342% |

|

Total |

278 |

100% |

544 |

100% |

95% |

|

Note: percentages may not add up to 100% due to rounding Source: Canalys Smartphone Analysis, (sell-in shipment forecasts), September 2020 |

|||||

For more information, please contact:

Canalys China

Jason Low: jason_low@canalys.com +86 159 2128 2971

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Canalys India

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Adwait Mardikar: adwait_mardikar@canalys.com +91 96651 38668

Canalys Singapore

Ishan Dutt: ishan_dutt@canalys.com +65 8399 0487

Shengtao Jin: shengtao_jin@canalys.com +65 6657 9303

Canalys UK

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Mo Jia: mo_jia@canalys.com +33 785 683 766

Canalys USA

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Vincent Thielke: vincent_thielke@canalys.com +1 650 644 9970

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2020. All rights reserved.