Global smart speaker shipments grew 187% year on year in Q2 2018, with China the fastest-growing market

Palo Alto, Shanghai, Singapore and Reading (UK) – Thursday, August 16 2018

The worldwide smart speaker market grew 187% in Q2 2018, with shipments reaching 16.8 million units. Google retained its first-place position from the previous quarter, with 5.4 million shipments of its Google Home models. It defended its position against Amazon, which shipped 4.1 million Echo devices in the quarter. While Amazon and Google benefited from international market expansion into Europe and Asia, both rely heavily on the US, which accounted for 68% of Amazon’s global shipments and 58% of Google’s. Despite strong progress in the US, China became the growth engine this quarter, contributing 52% to worldwide volume growth, against 16% from the US. Alibaba and Xiaomi ranked third and fourth overall, shipping 3.0 million and 2.0 million smart speakers respectively.

Alibaba maintained a market share of over 50% in China, securing the top spot in the country with 3.0 million shipments of its Tmall Genie speakers in Q2 2018. Xiaomi has been scaling up quickly with the release of its Xiaoai Mini AI smart speaker, sparking 228% sequential growth to ship a total of 2.0 million units in the country. The top two together accounted for nearly 90% of the market. “China’s smart speaker market has quickly become a battlefield for only the big names, and it will be hard for the smaller players to catch up in terms of market share,” said Hattie He, Canalys Research Analyst. “Alibaba and Xiaomi have both relied on aggressive price cuts to create demand. Both companies have the financial backing to spend on marketing and hardware subsidies in a bid to quickly build their user bases. Although the real level of user demand for speaker products is currently unproven, China is on its way to overtake the US in the near term. The challenge remains for local vendors to increase user stickiness and generate revenue from the growing installed base of smart speaker users.”

As the worldwide smart speaker market rapidly evolves, use cases for smart speakers are extending beyond just the smart home. “Many players, including Amazon, are integrating smart speakers into verticals, such as hotels, retail, hospitals and other business establishments,” said Jason Low, Senior Analyst at Canalys. “On the other hand, vendors are experimenting with new form factors and functionalities with smart speakers. Network operators in South Korea integrated smart speakers into set-top boxes and can add new lifestyle and entertainment services on top of IPTV, powered by voice and video. Looking ahead, the focus will be on uncovering the full potential of smart assistants, a direction set by Amazon and Google and echoed by many local market leaders. We will soon enter an era where smart assistants will require a new form of hardware medium more effective than speakers to advance further.”

Smart speaker quarterly estimate and forecast data is taken from Canalys’ Smart Speaker Analysis service.

For more information, please contact:

Canalys EMEA: +44 118 984 0520

Ben Stanton: ben_stanton@canalys.com +44 118 984 0525

Canalys APAC (Shanghai): +86 21 2225 2888

Hattie He: hattie_he@canalys.com +86 21 2225 2814

Jason Low: jason_low@canalys.com +86 21 2225 2816

Canalys APAC (Singapore): +65 6671 9399

Rushabh Doshi: rushabh_doshi@canalys.com +65 6671 9387

TuanAnh Nguyen: tuananh_nguyen@canalys.com +65 6657 9384

Canalys Americas: +1 650 681 4488

Vincent Thielke: vincent_thielke@canalys.com +1 650 656 9016

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please complete the contact form on our web site.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).

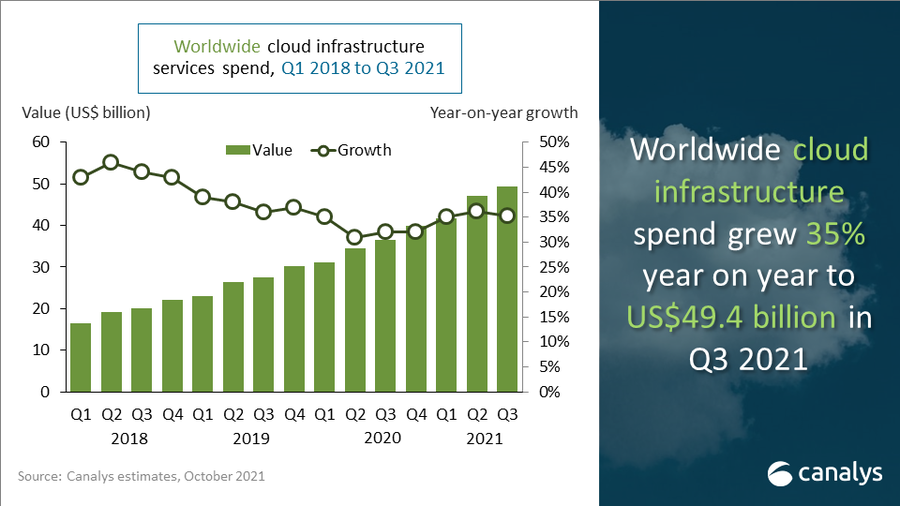

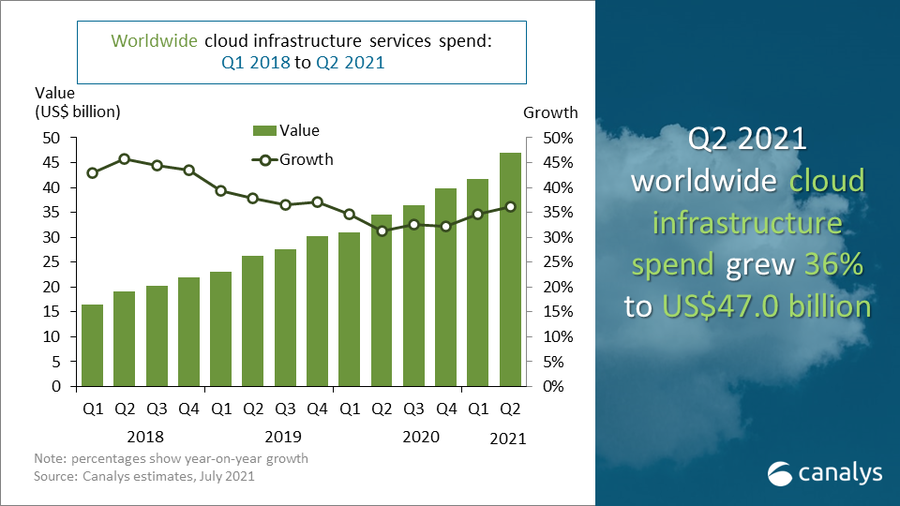

Global cloud services spending exceeded US$47 billion in Q2 2021