Global wearable band shipments up 6% as the market shifts to wristwatches

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 2 September 2021

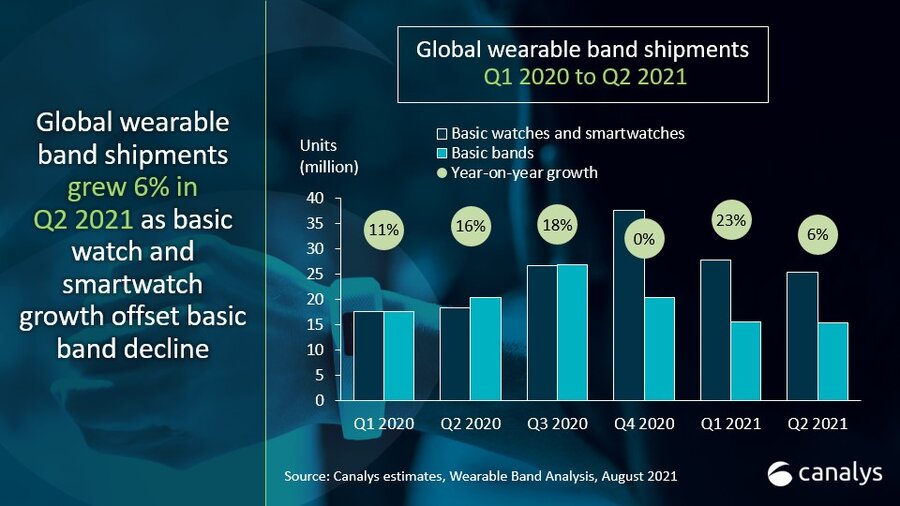

The global wearable band market grew 5.6% year on year with 40.9 million units shipping in Q2 2021. The decline of basic bands, which started in Q4 2020, has extended into Q2 2021. Shipments fell 23.8% to 15.5 million units. But the decline of basic bands is being offset by growth in wristwatches. Shipments of basic watches and smartwatches reached 25.4 million, up 37.9%. Wristwatches now account for 62% of global wearable band shipments.

Wristwatch shipments overtook those of basic bands for the first time in Q4 2020, and this trend has continued since then, with wristwatches accounting for over 60% of all wearable band shipments for three consecutive quarters to date. Canalys expects wristwatches to be the key growth driver for the wearable band category for years to come.

Xiaomi overtook Apple to become the top-shipping wearable band vendor in Q2 2021. Xiaomi’s performance was bolstered by the launch of the Mi Smart Band 6, despite India, one of Xiaomi’s strongholds, not on the initial global launch list. Huawei hung on to third place, mostly relying on China to stay afloat. “Xiaomi made a wise move to hasten the release of the Mi Band 6, which is a more compelling device than its predecessor,” said Canalys Research Analyst Cynthia Chen. “Xiaomi’s quick pivot to basic watches also helped the company boost its wristwatch shipments by 1.3 million units this quarter.”

|

Worldwide wearable band shipments and growth Q2 2021 |

|||||

|

Vendor |

Q2 2021 shipments (million) |

Q2 2021 market share |

Q2 2020 shipments (million) |

Q2 2020 market share |

Annual |

|

Xiaomi |

8.0 |

19.6% |

7.8 |

20.1% |

+2.6% |

|

Apple |

7.9 |

19.3% |

6.1 |

15.8% |

+29.4% |

|

Huawei |

3.7 |

9.2% |

8.1 |

21.0% |

-53.9% |

|

Fitbit |

3.0 |

7.3% |

2.5 |

6.4% |

+20.6% |

|

Samsung |

2.5 |

6.1% |

1.2 |

3.0% |

+114.1% |

|

Others |

15.8 |

38.6% |

13.1 |

33.7% |

+20.7% |

|

Total |

40.9 |

100.0% |

38.7 |

100.0% |

+5.6% |

|

Note: percentages may not add up to 100% due to rounding |

|||||

Apple continues to lead the global wristwatch market, commanding a sizable lead with a 31.1% market share in Q2 2021. Recent vendor movements include Samsung joining forces with Google to develop Wear OS 3, the launch of Samsung’s Galaxy Watch4 series with new biosensors and a 5nm chipset, and challengers such as Oppo, Huami (Zepp) and others developing in-house components and solutions for their watches, marking a major step forward in smartwatch development.

|

Worldwide wristwatch shipments and growth Q2 2021 |

|||||

|

Vendor |

Q2 2021 shipments (million) |

Q2 2021 market share |

Q2 2020 shipments (million) |

Q2 2020 market share |

Annual |

|

Apple |

7.9 |

31.1% |

6.1 |

33.1% |

+29.4% |

|

Huawei |

2.3 |

9.0% |

3.5 |

18.9% |

-33.9% |

|

Garmin |

1.9 |

7.6% |

1.8 |

9.8% |

+7.3% |

|

Samsung |

1.8 |

7.0% |

1.0 |

5.2% |

+84.7% |

|

Xiaomi |

1.5 |

5.7% |

0.4 |

2.1% |

+272.6% |

|

Others |

10.0 |

39.5% |

5.7 |

30.9% |

+76.7% |

|

Total |

25.4 |

100.0% |

18.4 |

100.0% |

+37.9% |

|

Note: wearable wristwatch includes basic watch and smartwatch categories; percentages may not add up to 100% due to rounding |

|||||

“Vendors are attempting to make a big generational leap in smartwatch technologies. To stand out, they are improving the fundamentals, such as user experience and battery life, creating their own distinct UIs and leveraging their respective ecosystems to draw out new and unique use cases,” said Canalys Research Manager Jason Low. “But health tracking is the most prominent use case for smartwatches. The ability to deliver cutting-edge health-tracking features and to offer users meaningful data and actionable health insights will set winners and losers apart.”

“It is vital that vendors invest in next-generation health sensors and developing in-house algorithms and solutions to not only track vital biomarkers, but also to ensure good accuracy and reliability. Vendors should focus on giving users insights into health trends involving data collected over a longer period of time, so that they can understand how their lifestyles are affecting their wellbeing.”

For more information, please contact:

Cynthia Chen (China): cynthia_chen@canalys.com +86 158 2151 8439

Jason Low (China): jason_low@canalys.com +86 159 2128 2971

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.