India’s EV market grows 223% to 48,000 units in 2022

Monday, 6 February 2023

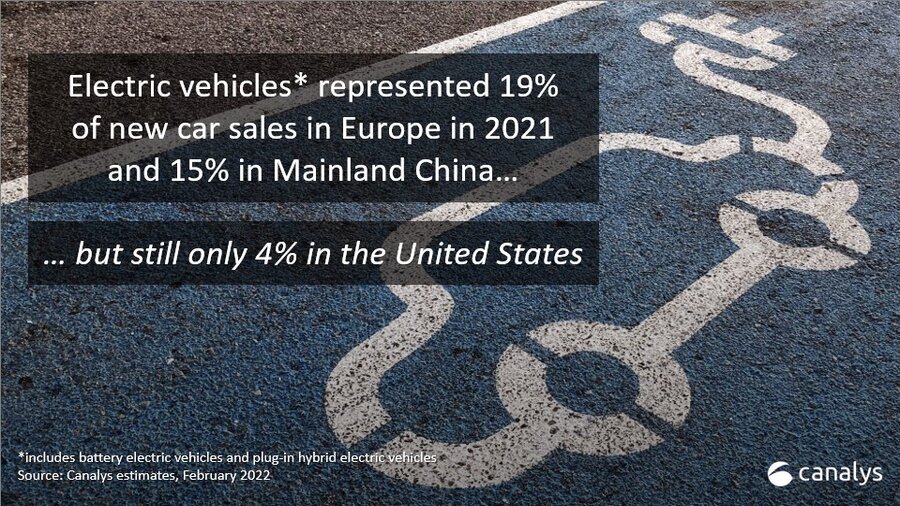

The latest Canalys Automotive Analysis data shows that India’s light vehicle market grew by 23% in 2022 to 3.8 million units. Initially, electric vehicles (EVs) occupied 1.3% of the Indian market share but the market grew by a phenomenal 223% in 2022 by adding 48,000 EVs.

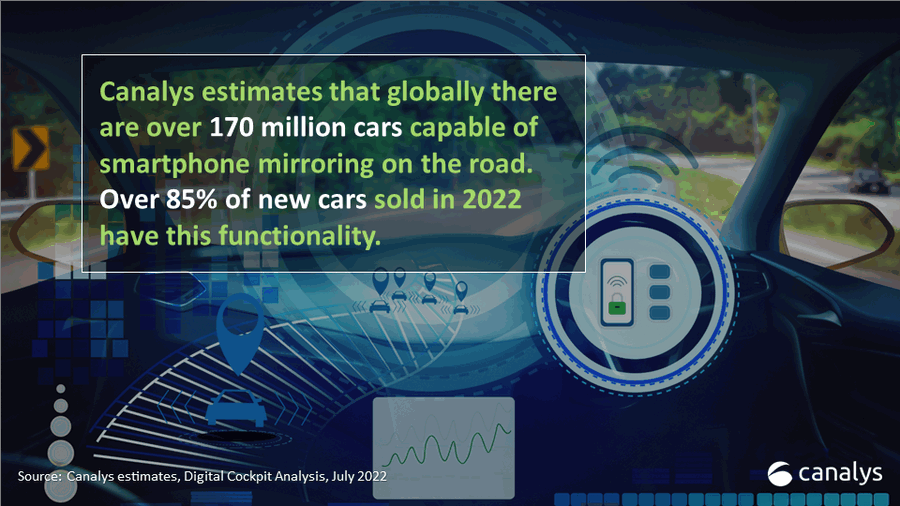

“The overall sentiment around the auto industry remained strong in India during 2022, propelled by pent-up demand and rising consumer buying power,” said Canalys Automotive Analyst, Ashwin Amberkar. “It is exciting times in the Indian market. New cars have premium infotainment, connectivity and driver assistance features, and there is a good appetite for new technology amongst premium buyers, despite potential economic headwinds.”

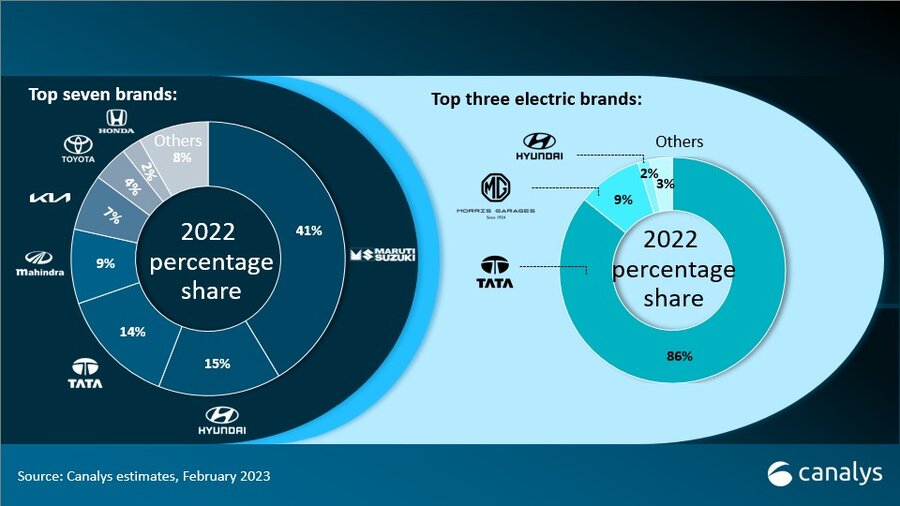

“The Indian electric vehicle market is in its nascent stage,” said Amberkar. “Tata leads in EVs with 86% market share from just two models, the Nexon EV and Tigore EV, followed by MG’s ZS EV and Hyundai’s Kona with 9% and 1.6% respectively. The most successful EVs from Tata are under US$20,000 which is the sweet spot among buyers wanting a second, city commute car. Brands such as MG, Hyundai, KIA and BYD are offering premium EVs costing over US$25,000 which predominantly attracts wealthy eco-conscious professionals and EV enthusiasts.”

Luxury brands such as Audi, BMW and Mercedes-Benz sell globally popular EV models in India, but in small volumes. Luxury brands grew by over 34% in 2022, with total vehicle sales reaching 36,000 units. Mercedes-Benz and BMW posted record sales but represented less than 1% of the total market.

The FAME India Phase II government scheme to promote nationwide rapid adoption of EVs through automakers’ incentives will continue to help establish the market until its expiration on 31 March 2024. Canalys forecasts that the EV market in India will grow to over 300,000 units in 2025, representing over a 6% share of the total light car market, achieving a CAGR of 59%.

In terms of manufacturer momentum, the number one Indian car maker, Maruti Suzuki, will focus on manufacturing hybrids and alternative fuel cars in 2023. It has unveiled its first electric SUV, but it will only launch it in 2025. The late entry to the market means it will lose ground to Tata, which is establishing itself now among the mid-market early EV adopters. Hyundai is second placed in the Indian car market and has already launched its second electric SUV IONIQ 5. Tata meanwhile continues its impressive EV momentum with plans to launch Harrier.EV by 2024 and Sierra.EV by 2025. Other major automakers such as Kia, Mahindra, MG and BYD have launched EVs in the Indian market and announced roadmaps to further proliferate them by 2025. But other brands such as Toyota, Honda, Volkswagen, Škoda, Nissan and Renault, which already have a global presence in the EV market, are yet to launch any in the domestic market. With competition heating up, they might miss out on early adoption loyalty.

More details on the automotive market in India in 2022, including total car and EV market breakdowns, India car market forecasts and outlook for in-vehicle UX and ADAS can be found in our recently released report.

Important definitions:

Light vehicles include passenger cars and light commercial vehicles.

EVs include battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

Webinar:

Join us for an electrifying discussion on the future of the automotive industry! Register now for 'Recharging the Automotive Market in 2023' webinar with Canalys global automotive analysts on February 8th at 8 AM ET. Discover the latest trends, insights and more. Reserve your spot now.

For more information, please contact:

Ashwin Amberkar: ashwin_amberkar@canalys.com

Chris Jones: chris_jones@canalys.com

Canalys tracks innovation in the automotive industry, positioning itself where smart technology intersects with the mobility industry. We track the shift to the new era in our Electric Vehicle Analysis and Autonomous Vehicle Analysis services. Our Automotive Digital Cockpit Analysis service provides qualitative and quantitative insights into the digital cockpit and automotive operating system markets. Canalys automotive research guides technology companies and automotive OEMs to make the right decisions on their solutions’ features, choose the right channel partners, and sell on the appropriate platforms to engage in different markets around the world.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.