India smartphone market share Q221

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 22 July 2021

India's smartphone market falls 13% sequentially in Q2 amid second COVID wave

Smartphone shipments in India fell 13% between Q1 and Q2 2021, to 32.4 million units, due to the second wave of COVID-19, which stifled demand. But because of Q2 2020’s two-month shutdown, the year-on-year comparison was extremely favorable, with shipments up 87%. Xiaomi remained the market leader, shipping 9.5 million units for a 29% share. Samsung stayed in second place, shipping 5.5 million units for a 17% share. Vivo came in third with 5.4 million units shipped, while Realme overtook Oppo for fourth place, shipping 4.9 million units against Oppo’s 3.8 million.

A surge in COVID-19 cases prompted regional restrictions and economic disruption, which limited consumers’ disposable income.

“India was taken by surprise by its second wave, as the new COVID variant emerged and took hold quickly,” said Canalys Analyst Sanyam Chaurasia. “For smartphone vendors, this was a wake-up call, and shows the importance of bolstering both online and offline presences equally. Smartphone vendors in India had assumed COVID-19 would not return, and several planned to invest in infrastructure for branded stores and partnerships with third-party offline channels. But once again they were quickly compelled to pivot to an online strategy.”

Brands that succeeded in the online space were the ones to carry the most momentum in Q2. “Xiaomi, despite its overall sequential decline, actually grew its online business, primarily thanks to the Redmi Note 10 series,” said Jash Shah, Canalys Research Analyst. “Realme also saw online momentum, particularly with its Narzo 30 series, as it used price cuts during ‘brand-focused days’ to overtake Oppo. Oppo entered the direct online channel in May, and though it may not be as profitable as third-party retail, it will allow Oppo to conduct more effective product marketing and increase cross-selling opportunities.”

Signs of a recovery did emerge by the end of Q2, however, as consumer confidence was boosted by vaccination programs in key localities.

“India will rebound in the second half of 2021, aided by accelerated vaccinations, as well as brands expanding promotional activities and new product releases,” said Chaurasia. “But the second half will not see a surge in pent-up demand like last year. The threat of a third wave still looms in India, but as citizen behavior and industrial operations continue to adapt to pandemic conditions, its impact should be minimal. Increasing costs will be challenging, amid limited component supply, rising shipping charges and a tough macroeconomic environment. In the short term, vendors will bear the impact of supply chain disruption, and will be conservative about raising prices. But the component shortage also brings another risk – regional deprioritization – as brands look to allocate their limited supplies of devices to more lucrative markets.”

|

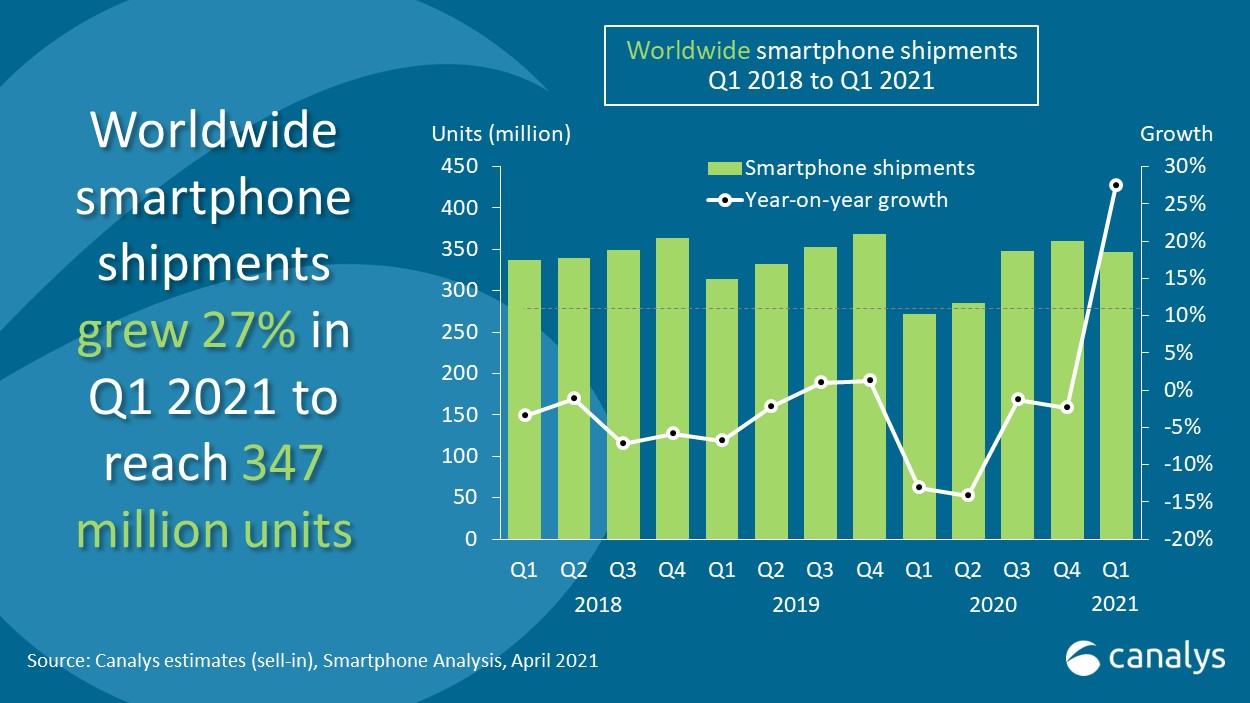

Indian smartphone shipments and annual growth |

|

||||||

|

Canalys Smartphone Market Pulse: Q2 2021 |

|

||||||

|

Vendor |

Q2 2021 shipments (million) |

Q2 2021 Market share |

Q2 2020 shipments (million) |

Q2 2020 Market share |

Annual growth |

|

|

|

Xiaomi |

9.5 |

29% |

5.3 |

31% |

77% |

||

|

Samsung |

5.5 |

17% |

2.9 |

17% |

87% |

||

|

Vivo |

5.4 |

17% |

3.7 |

21% |

45% |

||

|

Realme |

4.9 |

15% |

1.7 |

10% |

181% |

||

|

Oppo |

3.8 |

12% |

2.2 |

13% |

69% |

||

|

Others |

3.4 |

11% |

1.4 |

8% |

144% |

||

|

Total |

32.4 |

100% |

17.3 |

100% |

87% |

||

|

Note: Xiaomi estimates include sub-brand POCO. Percentages may not add up to 100% due to rounding |

|||||||

|

Source: Canalys Smartphone Analysis (sell-in shipments), July 2021 |

|||||||

For more information, please contact:

Canalys China

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Amber Liu: amber_liu@canalys.com +86 136 2177 7745

Canalys India

Sanyam Chaurasia: sanyam_chaurasia@canalys.com +91 89820 33054

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Canalys Singapore

Shengtao Jin: shengtao_jin@canalys.com +65 6657 9303

Le Xuan Chiew: lexuan_chiew@canalys.com +65 9655 6264

Canalys UK

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Runar Bjørhovde: runar_bjorhovde@canalys.com +44 7787 290 115

Canalys USA

Brian Lynch: brian_lynch@canalys.com +1 650 927 5489

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.