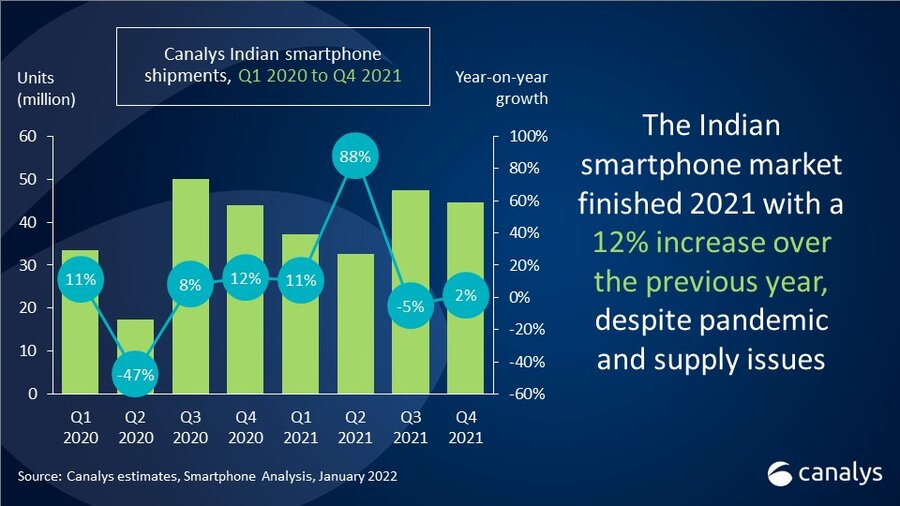

India's smartphone market overcame pandemic problems and supply constraints to grow 12% in 2021

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Monday, 24 January 2022

The smartphone market in India achieved a record 162 million shipments in 2021, growing 12% on 2020. After a tough start to the year, due to the second wave of COVID-19, India recovered strongly in the second half. Following a strong comeback in Q3, smartphone vendors shipped 44.5 million devices in Q4 for 2% growth, despite a challenging supply chain. Xiaomi was the leader, shipping 9.3 million units and maintained its 21% market share. Samsung came second with 8.5 million units for 19% share. For the first time realme climbed to third place in India, with a 49% year-on-year increase in volume that reached 7.6 million shipments. Fourth and fifth place were taken by vivo and OPPO, with 5.6 million and 4.9 million units respectively.

“India smartphone market dynamics shifted every quarter in 2021,” said Canalys Analyst Sanyam Chaurasia. “COVID-19 crises, volatile consumer demand and supply chain disruptions plagued the market this year. Vendors adapted to the changing environment by focusing on omnichannel, diversifying their supply chains, and expanding their product mix. For example, vendors like realme and Samsung diversified chipset configurations to effectively manage supply. realme’s record shipment total was made possible by innovations in planning and stock management which led to good supply of mass-market smartphones such as Narzo 50A and C11. At the same time, thanks to the vaccination rollout, market reopening and pent-up demand, smartphone shipments reached all-time highs for the full-year. Growth is expected to continue in 2022, driven by both replacement demand and new customers migrating to smartphones.”

As new players emerge in the low-end segment, competition for market share is heating up.

“In Q4, low-end players gained momentum,” added Chaurasia. “For example, JioPhone Next, which aims to upgrade feature-phone users via disruptive financing options, made a strong start with several million units sold. And on Amazon and Flipkart, Infinix and Tecno efficiently leveraged brand promotional campaigns. They also increased brand recognition on social media platforms. Infinix promoted Esports among India’s youth to highlight its key features, while Tecno used social media influencers.

“India will see a vast digital transformation this year,” added Chaurasia. “2022 will bring 5G spectrum auctions with new radio frequency ranges, and 5G will become significantly more accessible in terms of coverage and price. Smartphones capable of 5G will fall further in price amid fierce vendor rivalry, but shipments will be stifled in H1 2022 before the component shortage eases. Overall, India will see upward momentum towards future-proof technologies, with smartphones being at the core of the digital ecosystem and growing ever-more essential to the daily lives of Indian citizens.”

|

Indian smartphone shipments and annual growth |

|||||

|

Vendor |

Q4 2021 shipments (million) |

Q4 2021 |

Q4 2020 |

Q4 2020 |

Annual |

|

Xiaomi |

9.3 |

21% |

12.0 |

27% |

-22% |

|

Samsung |

8.5 |

19% |

9.2 |

21% |

-7% |

|

realme |

7.6 |

17% |

5.1 |

12% |

49% |

|

vivo |

5.6 |

13% |

7.7 |

18% |

-27% |

|

OPPO |

4.9 |

11% |

6.1 |

14% |

-19% |

|

Others |

8.5 |

19% |

3.8 |

9% |

126% |

|

Total |

44.5 |

100% |

43.8 |

100% |

2% |

|

Note: Xiaomi estimates include sub-brand POCO and OPPO includes OnePlus. |

|

||||

|

Indian smartphone shipments and annual growth |

|||||

|

Vendor |

2021 shipments (million) |

2021 |

2020 |

2020 |

Annual |

|

Xiaomi |

40.5 |

25% |

40.7 |

28% |

0% |

|

Samsung |

30.1 |

19% |

28.6 |

20% |

5% |

|

vivo |

25.7 |

16% |

26.9 |

19% |

-4% |

|

realme |

24.2 |

15% |

19.5 |

13% |

25% |

|

OPPO |

20.1 |

12% |

19.0 |

13% |

6% |

|

Others |

21.2 |

13% |

10.0 |

7% |

111% |

|

Total |

162.0 |

100% |

144.7 |

100% |

12% |

|

Note: Xiaomi estimates include sub-brand POCO and OPPO includes OnePlus. |

|

||||

For more information, please contact:

Sanyam Chaurasia: sanyam_chaurasia@canalys.com +91 89820 33054

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.