India to surpass 15 million PC shipments in 2025 with AI and education tailwinds

Monday, 15 September 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

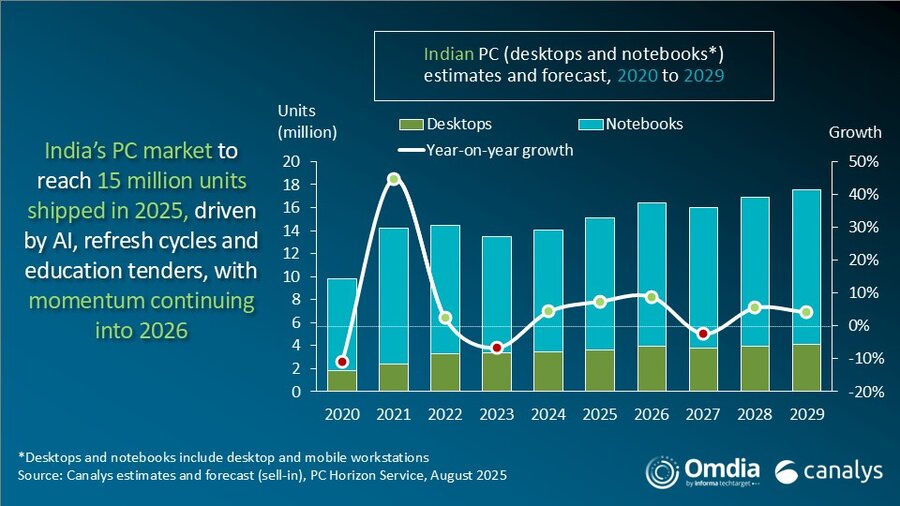

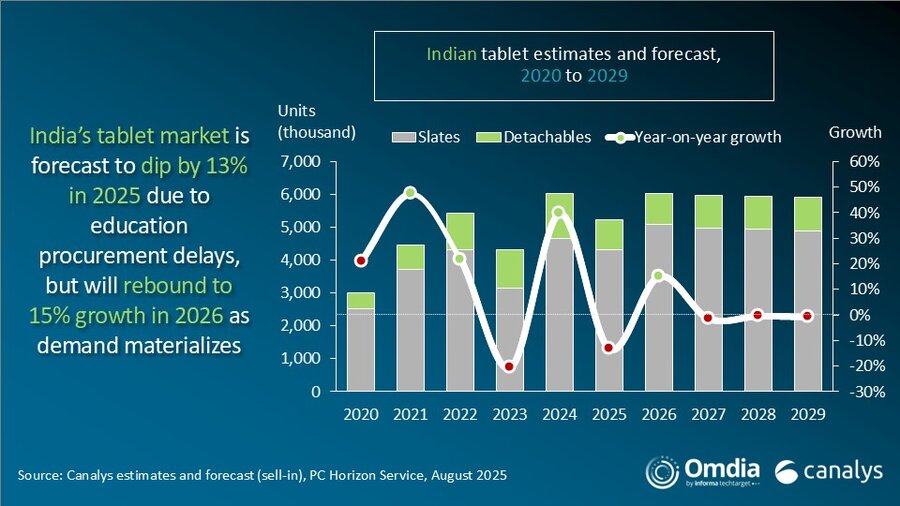

According to Canalys (part of Omdia), India’s PC market (excluding tablets) grew 6% year on year in Q2 2025, reaching 3.6 million units. Notebook shipments led the growth, rising 8% to 2.7 million units, driven by strong enterprises and AI-ready devices. Desktop shipments were stable, edging up 1% to 861,000 units. However, the tablet market fell sharply, down 27% to 1.2 million units due to weaker government procurement.

For the full year 2025, India’s PC market is forecast to grow 7% to 15.1 million units, while tablets are predicted to contract 13% to 5.2 million units. In 2026, PC market growth is expected to hold steady on the back of further refresh demand and growing AI adoption. India’s tablet market is set for 15% growth in 2026, driven by government-funded education tenders.

“Enterprise-led demand remained the backbone of India’s notebook growth in Q2 2025,” said Ashweej Aithal, Senior Analyst at Canalys (part of Omdia). “AI-capable notebook shipments nearly tripled year on year as organizations moved quickly to adopt AI-ready infrastructure for productivity, automation and futureproofing.” Device refresh, including upgrades tied to the Windows 11 transition, also played a critical role, with enterprise PC shipments rising more than 11% during Q2 2025. Demand for workstations led to an impressive 41% growth for the category, highlighting the need for high-performance devices in engineering, design and content creation.

“For consumers, growth was powered by stronger retail momentum and rising digital adoption,” added Aithal. “Aggressive campaigns by vendors, especially around Republic Day and quarter-end promotions, combined with robust ecommerce traction, provided a meaningful lift to consumer notebook shipments, which grew by 12% year on year.”

India’s tablet market contracted 27% year on year in Q2 2025, with shipments falling to 1.2 million units. This drop was attributed to a 64% decline in commercial shipments, as government and education orders slowed after strong procurement last year. In contrast, the consumer segment grew 35%, supported by online promotions, affordable devices and growing demand for entertainment and home learning use cases. However, the market continues to face pressure from entry-level saturation and rising competition from budget notebooks and large-screen smartphones, leaving premium and education-focused tablets as the only bright spots.

“For the remainder of 2025, consumer demand for notebooks will be healthy, supported by competitive pricing, a preference for mobile form factors and government preference for locally made devices,” said Aithal. “Desktops will remain relatively niche, with growth focused in the gaming and high-performance segments. This momentum is expected to be carried into 2026, as PC penetration gains traction in smaller cities and from multi-device ownership. On the commercial side, AI-capable PCs and Windows 11 refresh cycles will dominate procurement, while education tenders like Tamil Nadu’s Elcot project signal a return of large-scale deployments. These schemes may stretch into 2026, creating a spillover effect alongside strong enterprise refresh cycles.”

Tablets will remain under pressure through 2025, but the Uttar Pradesh education scheme, expected to start by year-end, could revive volumes. Local manufacturing preferences will add some support. By 2026, future tablet market performance will depend on how education demand scales and whether vendors can reposition them beyond secondary use.

The Indian PC market is entering a decisive phase where AI adoption, education tenders and local manufacturing will define growth. “2025 is laying the foundation, but 2026 will test its sustainability and set the stage for what could become the next long-term growth cycle in a key market for the PC industry,” concluded Aithal.

|

India desktop and notebook forecast Canalys PC forecast: 2024 to 2026 |

|||||

|

Segment |

2024 |

2025 |

2026 |

2025 |

2026 |

|

Consumer |

6,026 |

6,350 |

6,699 |

5.4% |

5.5% |

|

Commercial |

7,197 |

7,667 |

8,499 |

6.5% |

10.9% |

|

Government |

262 |

271 |

317 |

3.7% |

16.8% |

|

Education |

592 |

819 |

912 |

38.4% |

11.4% |

|

Total |

14,077 |

15,107 |

16,428 |

7.3% |

8.7% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

India tablet forecast Canalys PC forecast: 2024 to 2026 |

|||||

|

Segment |

2024 |

2025 |

2026 |

2025 |

2026 |

|

Consumer |

2,830 |

3,050 |

3,158 |

7.8% |

3.5% |

|

Commercial |

559 |

495 |

561 |

-11.5% |

13.4% |

|

Government |

165 |

112 |

175 |

-32.0% |

56.0% |

|

Education |

2,475 |

1,583 |

2,140 |

-36.1% |

35.2% |

|

Total |

6,028 |

5,239 |

6,034 |

-13.1% |

15.2% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

India desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q2 2025 |

|||||

|

Vendor |

Q2 2025 |

Q2 2025 |

Q2 2024 |

Q2 2024 |

Annual |

|

HP |

1,077 |

30.2% |

1,075 |

32.0% |

0.2% |

|

Lenovo |

710 |

19.9% |

595 |

17.7% |

19.3% |

|

Acer |

518 |

14.5% |

497 |

14.8% |

4.2% |

|

Dell |

398 |

11.1% |

425 |

12.7% |

-6.3% |

|

Asus |

267 |

7.5% |

238 |

7.1% |

12.4% |

|

Others |

602 |

16.8% |

526 |

15.7% |

14.4% |

|

Total |

3,573 |

100.0% |

3,356 |

100.0% |

6.5% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Horizon Service (sell-in shipments), August 2025 |

|

||||

|

India tablet shipments (market share and annual growth) Canalys PC market pulse: Q2 2025 |

|||||

|

Vendor |

Q2 2025 |

Q2 2025 |

Q2 2024 |

Q2 2024 |

Annual |

|

Samsung |

345 |

28.9% |

581 |

35.4% |

-40.7% |

|

Apple |

233 |

19.6% |

165 |

10.1% |

41.1% |

|

Xiaomi |

159 |

13.4% |

93 |

5.6% |

71.9% |

|

Lenovo |

139 |

11.7% |

127 |

7.7% |

9.6% |

|

Acer |

100 |

8.4% |

437 |

26.6% |

-77.1% |

|

Others |

216 |

18.1% |

238 |

14.5% |

-9.3% |

|

Total |

1,192 |

100.0% |

1,640 |

100.0% |

-27.3% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Ashweej Aithal: ashweej_aithal@canalys.com

Ishan Dutt: ishan_dutt@canalys.com

The worldwide PC Horizon service from Canalys (part of Omdia) provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, quarterly forecasts are published to help better understand the future trajectory and changing landscape of the PC industry.

Canalys, part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.