Media alert: iPhone 8 Plus out-ships iPhone 8 in Q3 2017

Palo Alto, Shanghai, Singapore and Reading (UK) – Thursday, 9 November 2017

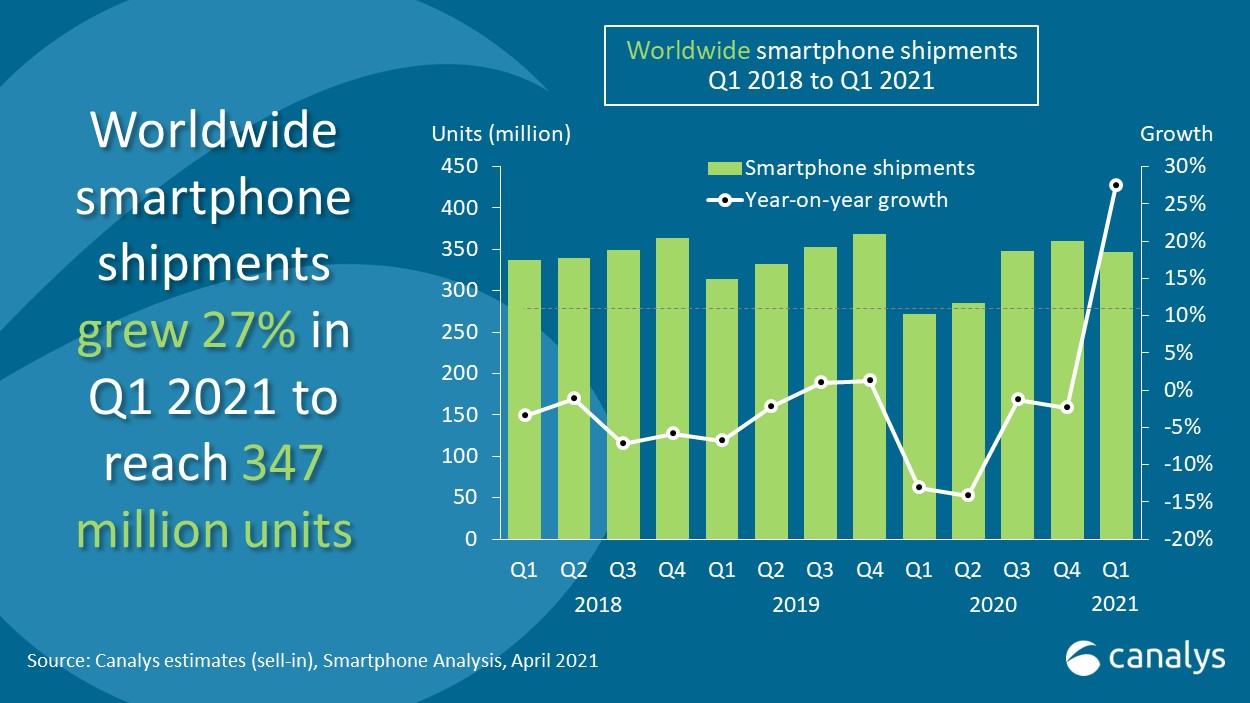

Apple’s iPhone 7 was the world’s best-shipping smartphone in Q3 2017, with 13.0 million units shipped. The iPhone 6s was a distant second, after an uptick that resulted in 7.9 million shipments. Samsung’s Galaxy J2 Prime was third, with 7.8 million shipped, while Oppo took fourth and fifth place, with its A57 and R11 shipping 7.8 million and 7.2 million units respectively. Apple’s iPhone 8, which launched in mid-September, did not make the top five. Worldwide smartphone shipments reached 375.9 million, up 5.9% year on year.

Apple shipped 46.7 million smartphones in Q3 2017. The new iPhone 8 and 8 Plus accounted for 11.8 million of these. This falls well short of its predecessor, the iPhone 7 line, which topped 14 million in its first quarter. But while Apple shipped 5.4 million units of the iPhone 8, it shipped 6.3 million of the larger iPhone 8 Plus. This makes the iPhone 8 Plus the first iPhone Plus model to out-ship its smaller sibling in a single quarter.

“Shipments of older devices, such as the iPhone 6s and SE, saw an uptick in Q3,” said Ben Stanton. “The iPhone 7 also shipped strongly after its price cut in September. Apple grew in Q3, but it was these older, cheaper models that propped up total iPhone shipments. Apple is clearly making a portfolio play here. With the launch of the iPhone X, it now has five tiers of iPhone and delivers iOS at more price bands than ever before. This is a new strategy for Apple. It is aggressively defending its market share, but it will not compromise its rigid margin structure to do so.”

Samsung shipped 82.8 million smartphones in Q3, 8.2% more than in Q3 2016. This was thanks to growth in its J-series, which did particularly well in India and the Middle East. Samsung’s new Galaxy Note8 dispelled any remaining negative sentiment around the Note series, shipping a solid 4.4 million units. For a product line aimed at driving value, not volume, this was a positive result.

“Samsung had a positive quarter,” said Canalys Analyst Ben Stanton. “It discounted the Galaxy S8 in several major countries in Q3, which helped ease inventory buildup from the previous quarter. In total, it shipped 10.3 million devices from its Galaxy S8 range in Q3. But Samsung’s golden period of having a differentiated product has now ended. Apple, Google, Huawei and others have all introduced new smartphones with 18:9 displays and thin bezels. As the battleground at the high end moves toward AI and AR, Samsung is behind, and needs to catch up with competitors such as Huawei and Apple.”

Smartphone quarterly estimates, market share information and forecast data is taken from Canalys’ Smartphone Analysis service.

For more information, please contact:

Canalys EMEA: +44 118 984 0520

Ben Stanton: ben_stanton@canalys.com +44 118 984 0525

Canalys APAC (Shanghai): +86 21 2225 2888

Mo Jia: mo_jia@canalys.com +86 21 2225 2812

Hattie He: hattie_he@canalys.com +86 21 2225 2814

Canalys APAC (Singapore): +65 6671 9399

Rushabh Doshi: rushabh_doshi@canalys.com +65 6671 9387

Lucio Chen: lucio_chen@canalys.com +65 6657 9301

Canalys Americas: +1 650 681 4488

Vincent Thielke: vincent_thielke@canalys.com +1 650 656 9016

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please complete the contact form on our web site.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).