Media alert: Security-as-a-Service grows 21% in 2017, but vendors struggle to adjust to new revenue models

Palo Alto, Shanghai, Singapore and Reading (UK) – Thursday, 22 March 2018

2017 has seen a steep increase in adoption of Security-as-a-Service (SaaS), thanks to its multiple advantages compared to software licensing. However, this fast change in revenue stream is creating headaches for vendors who have to rework forecasts for 2018 to not disappoint investors.

Security-as-a-service (SaaS) registered strong growth in 2017 at 21% to US$4 billion, following the rise in adoption of cloud solutions for enterprises. This growth was double the pace compared to the rest of the security market with software and hardware growing respectively 5% and 10% year-on-year to reach $27 billion combined. Canalys estimates the total security market was US$31 billion in 2017, up 10% overall.

“In the past year, Vendors like Cisco, McAfee and Trend Micro have strengthened their cloud portfolio, which now includes a wider range of products and almost the same array of functionalities that get delivered when clients purchase a software license.” Said Claudio Stahnke, Canalys research analyst. “The ability to buy these products from public cloud providers and channel partners (eg, AWS marketplace) has also reduced the complexities of deploying security products and, at the same time, provided a more flexible billing process, as the customer can add and remove seats monthly.”

Canalys expects SaaS growth to continue strongly through 2018 and 19, as vendors keep improving their portfolios and delivery method.

This swift shift towards a subscription-based revenue stream is posing challenges for vendors in the industry, especially when it comes to report their results to shareholders. Symantec, for instance, missed its Q4 2017 revenue target because it underestimated the adoption of its SaaS products. Claudio Stahnke, Canalys research analyst said: “Investors still get spooked when vendors like Symantec miss the mark, but we are not seeing the kind of panic witnessed a few years back when Adobe’s stock crashed after it switched to subscriptions for its software suite. Investors are learning subscription-based revenues are not a bad thing, but are where the market is going”.

Despite the strong growth of SaaS, hardware and software will keep growing in 2018 and they will still represent the biggest share of the security market.

For more information, please contact:

Canalys EMEA: +44 118 984 0520

Claudio Stahnke: claudio_stahnke@canalys.com +447881934784

Matthew Ball: matthew_ball@canalys.com +447887950505

Canalys APAC (Shanghai): +86 21 2225 2888

Daniel Liu: daniel_liu@canalys.com +8615800756471

Canalys APAC (Singapore): +65 6671 9399

Jordan De Leon: jordan_mari_deleon@canalys.com +6597127835

Sharon Hiu: sharon_hiu@canalys.com +6597779015

Canalys Americas: +1 650 681 4488

Alex Smith: alex_smith@canalys.com +16507994483

Ketaki Borade: ketaki_borade@canalys.com +16503875389

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please complete the contact form on our web site.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).

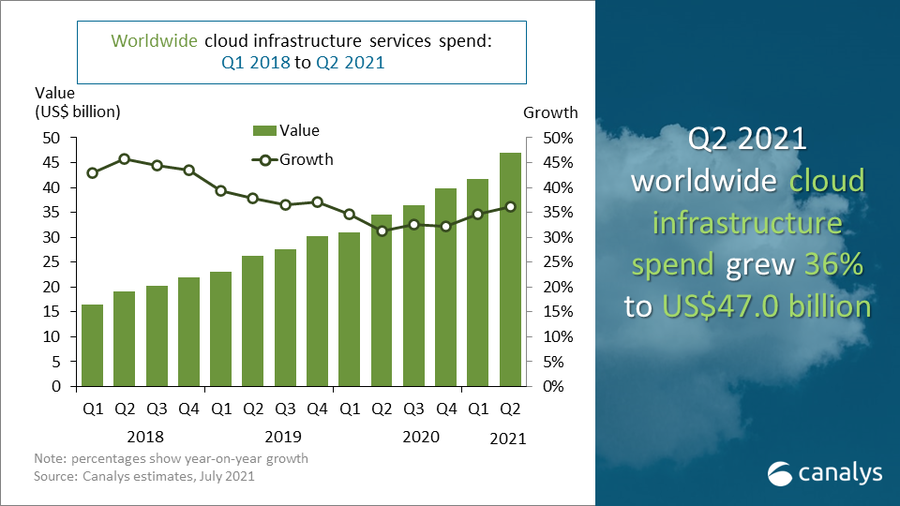

Global cloud services spending exceeded US$47 billion in Q2 2021