Media alert: Smart phone shipments hit 355 million units as market braces for Note7 fallout

Palo Alto, Shanghai, Singapore and Reading (UK) – Thursday, 27 October 2016

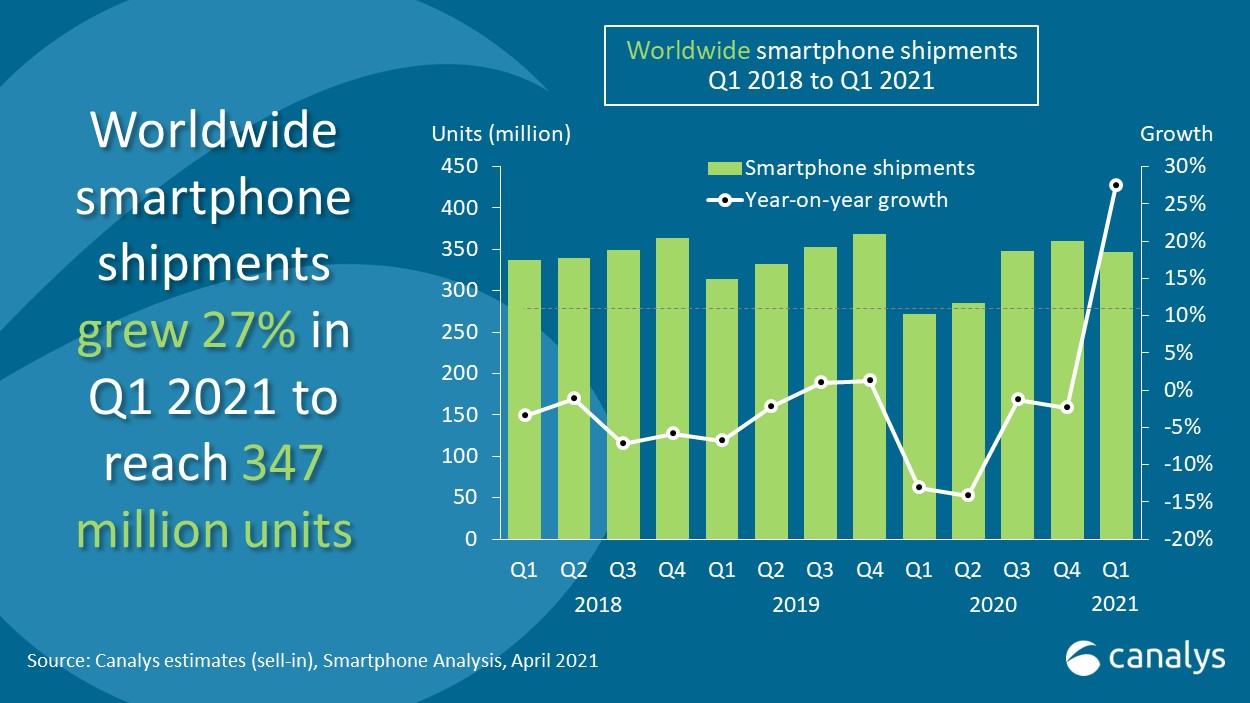

Worldwide smart phone shipments were up annually for the second quarter in a row, growing around 6% with 355 million units shipping. Samsung continued to lead the market, but its issues with the Note7 are starting to affect its business. It shipped just over 76 million units (excluding all Note7s), down 9% on the same quarter a year ago. In second place, Apple’s iPhone shipments also suffered an annual decline, falling 5% to just over 45 million units. Again, it was the Chinese vendors that grew the market. Huawei, Oppo and Vivo rounded out the top five respectively, with their shipments growing 60% collectively. The standout performer was Oppo, which had a stellar quarter, taking hold of the Chinese market from under the noses of its rivals. Its smart phone shipments grew around 40% sequentially and 140% year on year. Tough competition in China has affected Huawei’s global position, with it now looking increasingly unlikely that it will reach its annual shipment target of 140 million units.

‘Halting sales of the Note7 had an impact on Samsung’s shipments in Q3, but even a smooth launch would not have delivered year-on-year growth. With the recall commencing midway through September, it was too late in the quarter to have a positive effect on the competition,’ said Tim Coulling, Canalys Senior Analyst. ‘The Note is a relatively niche product in Samsung’s portfolio, and the lack of competing products with a stylus means it’s too early to identify potential winners. The danger for Samsung is that the Note7 recall affects sales of other models in its portfolio. In this case, several vendors, including Apple and Huawei, will see higher than expected demand in Q4. But with Apple raising questions about meeting iPhone 7 demand and Huawei currently shipping below target, the advantage may rest with the latter.’

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. Our customer-driven analysis and consulting services empower businesses to make informed decisions and generate sales. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To view the chart(s) from this media alert, and others from Canalys, download the new Insight @Canalys app today from the Apple App Store, the Google Play store or as an HTML 5 web app.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please complete the contact form on our web site.

Alternatively, you can e-mail press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).