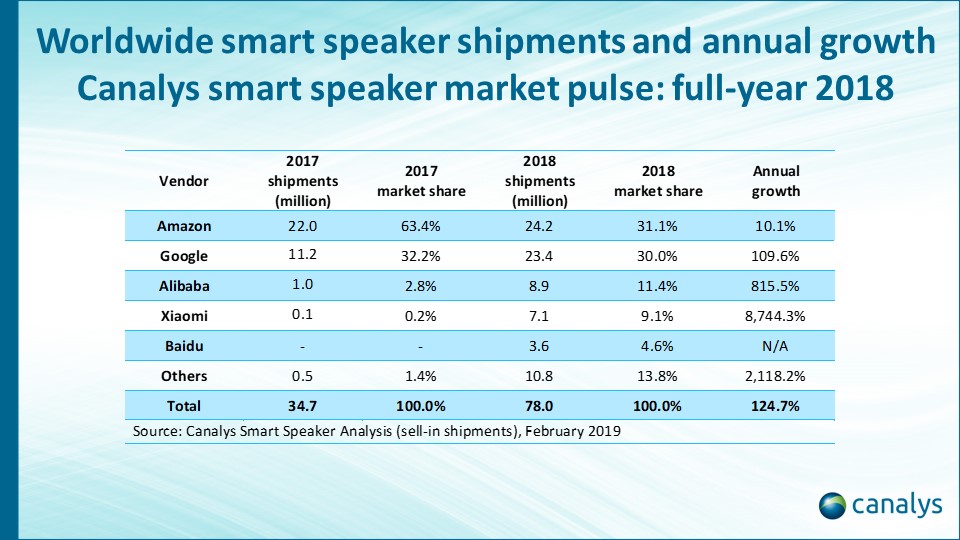

Smart speaker market booms in 2018, driven by Google, Alibaba and Xiaomi

Palo Alto, Shanghai, Singapore and Reading (UK) – Monday, February 25 2019

Smart speaker shipments reached 78.0 million units worldwide in 2018, up 125% from 34.7 million in 2017. After an intense battle between Amazon and Google throughout the year, Amazon emerged as the top-shipping vendor, but only by one percentage point. It shipped 24.2 million of its Echo devices, while Google shipped 23.4 million of its Home speakers. Chinese vendors Alibaba, Xiaomi and Baidu, which only ship in China, rounded out the top five.

Amazon’s well-timed Echo lineup refresh, focusing on improved sound and aesthetics, proved popular during the holiday season, and helped Amazon grow 31% in Q4. “With the updated Echo range already in place for 2019, Amazon is expected to switch gears to extend Alexa’s reach into areas such as automobiles via developers and ecosystem device vendors,” said Canalys Senior Analyst Jason Low. “Third parties that support Alexa are eagerly pursuing money-making and growth opportunities. If Amazon fails to support these companies, it could lead to waning commitment, which will be detrimental to the platform.”

In Q4 2018, the Home Hub smart display became a highlight for Google. “Undercutting other smart displays at US$149, the Google Home Hub has a short-term advantage,” said Low. “Google quickly became the second largest smart display vendor in 2018 with just one quarter’s shipments reaching 2.2 million units.” Canalys estimates that, overall, smart display shipments reached 6.4 million units in 2018, accounting for 8.3% of the total smart speaker market. “The smart display category is relatively new. While its success is still far from proven, Chinese vendors will jump on the trend. But the category needs clear and strong use-cases beyond low prices to drive demand.”

Canalys estimates that around 80% of the global smart speaker market is dominated by Internet service providers and software companies. “Leading smart device vendors, such as Samsung, Huawei and Apple, have failed to capitalize on the growth of smart assistants for home use. They will risk further loss of control, not only over the smart home segment, but in other areas, such as in-car and at-work scenarios, where smart assistant use and voice enablement are expected to increase in penetration and adoption rates. Hardware vendors must quickly pick the right user scenarios and form smart assistant strategies aimed at creating new use-cases for the intended scenarios. First-mover advantage is vital in the world of smart assistants, and the first to establish a user base in an important area will secure long-term success,” said Low.

Smart speaker quarterly estimate and forecast data is taken from Canalys’ Smart Speaker Analysis service.

For more information, please contact:

Canalys EMEA: +44 118 984 0520

Ben Stanton: ben_stanton@canalys.com +44 118 984 0525

Kelly Wheeler: kelly_wheeler@canalys.com +44 118 984 0529

Canalys APAC (Shanghai): +86 21 2225 2888

Jason Low: jason_low@canalys.com +86 21 2225 2816

Nicole Peng: nicole_peng@canalys.com +86 21 2225 2815

Canalys APAC (Singapore): +65 6671 9399

Rushabh Doshi: rushabh_doshi@canalys.com +65 6671 9387

Ishan Dutt: ishan_dutt@canalys.com +65 6671 9396

Canalys Americas: +1 650 681 4488

Vincent Thielke: vincent_thielke@canalys.com +1 650 656 9016

Marcy Ryan: marcy_ryan@canalys.com +1 650 681 4487

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

Americas: Suite 317, 855 El Camino Real, Palo Alto, CA 94301, US | tel: +1 650 681 4488

APAC: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China | tel: +86 21 2225 2888

APAC: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535 | tel: +65 6671 9399

EMEA: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK | tel: +44 118 984 0520

email: inquiry@canalys.com | web: www.canalys.com