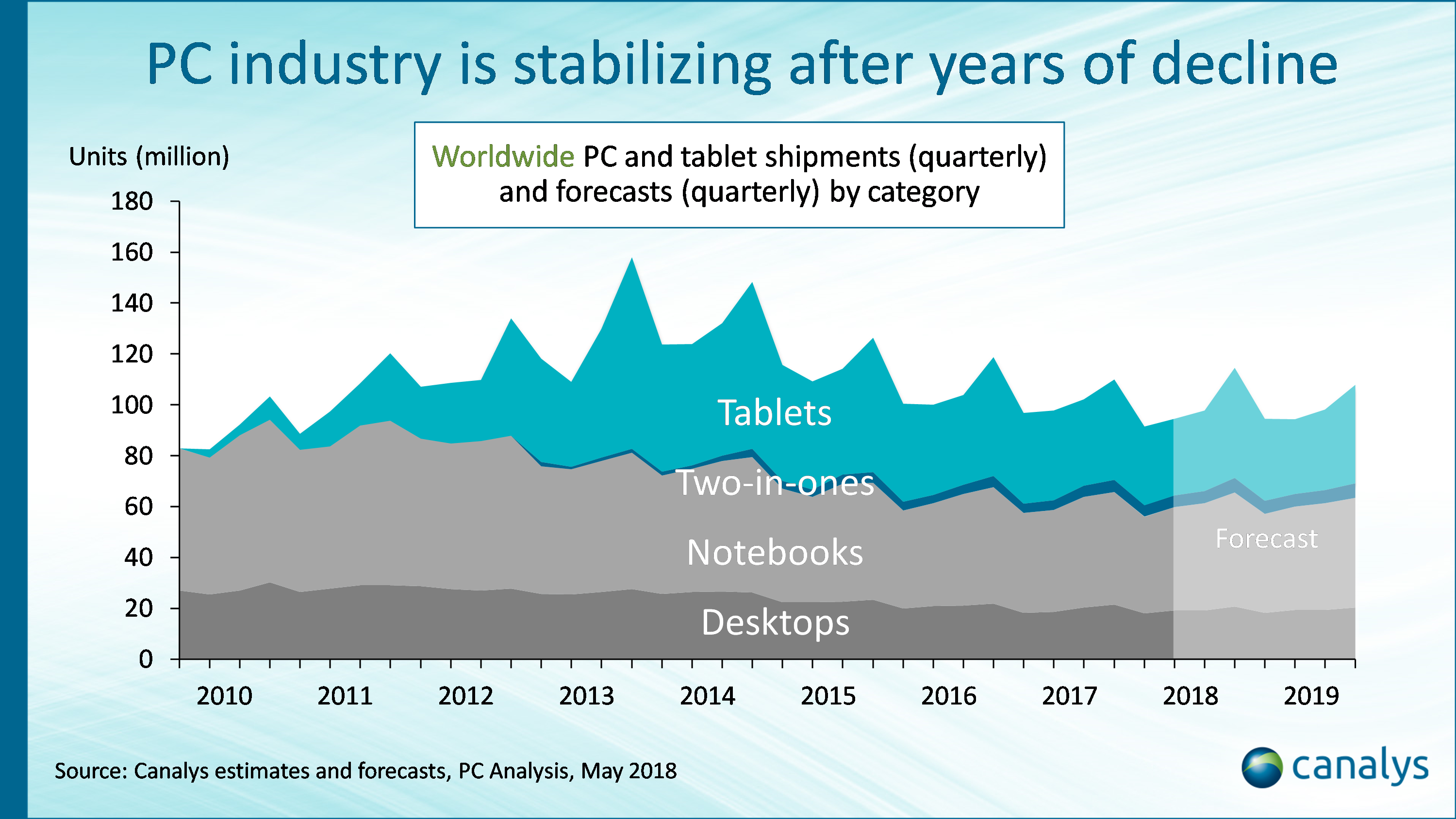

Tablets and PCs set for modest 2.1% decline in 2018 as the industry finally starts to stabilize

Palo Alto, Shanghai, Singapore and Reading (UK) – Thursday, May 24 2018

Worldwide tablet and PC shipments will fall by 2.1% to 398 million units in 2018. But this represents the smallest decline of the past four years and sets the tone for an era of stability.

Consumer refresh cycles have finally started to stabilize, and the largest PC vendors have focused on new, fast-growing categories, such as gaming PCs, Chromebooks and convertibles. On the commercial side, Windows 10 migration remains a driver for hardware refresh, as businesses are forced to move from Intel Skylake-generation microarchitectures to newer processor technologies.

“Commercial customers will be a vital driver for PC shipments in 2018,” said Canalys Research Analyst Ishan Dutt. “Vendors now have several strategic options for achieving growth. Firstly, several vendors are now tracking their customers that are still running Windows 7 and will specifically target these accounts with sales teams. Secondly, vendors will invest further in Device as a Service (DaaS) offerings, which lock-in PC refresh cycles. But shifting from a transactional to contractual model is a major operational challenge for customers and channel partners, and this will prevent DaaS becoming a major revenue stream in the near-term. And finally, several vendors will invest to grow the Chrome OS platform outside of the United States this year, with a specific focus on the education sector.”

“Consumer demand will remain weak overall,” said Dutt. “Components such as DRAM will remain constrained in the short-term, and vendors will pass most of the increased costs onto customers, driving up ASPs. But dedicated gaming PCs have emerged as a genuine hotspot in large markets, such as the United States, China, Russia, Japan and South Korea, where eSports has helped to generate an appetite among younger consumers with disposable incomes who are willing to spend top prices for high performance. The consumer market is also more likely to see new brands challenging the likes of HP, Lenovo and Dell. Despite the sector’s weak performance, there are lower barriers to entry from a channel perspective compared with the commercial sector. Huawei and Xiaomi are already attempting to disrupt selected markets, but nether yet has a range of products or channel partners to trouble the incumbents.”

Despite a recent rise in iPad shipments, the tablet category remains in decline as consumers show a preference for smartphones as their primary mobile devices and rely on traditional PCs for more compute-intensive tasks. The category is expected to contract by almost 3% per year on average from 2017 to 2022, down almost 150 million units from the market peak in 2014.

“Once a consumer-centric product, tablets are rapidly shifting in a commercial direction,” said Canalys Analyst Robin Ody. “The connectivity, portability and display size of cheaper slate tablets deliver a solid value proposition to important verticals, such as education, healthcare and retail. Often, these devices are locked to a single application for a specific business function, such as point of sale. But knowledge workers need more, and corporate resellers are now pitching detachable tablet devices, such as the iPad Pro and Surface Pro, to businesses as part of workforce transformation initiatives. But these devices represent a very small proportion of the commercial PC market, as IT managers still face constraints, such as price, number of ports, compatibility with peripherals and the prospect of managing an ecosystem of multiple operating systems.”

Quarterly estimates and forecast data are taken from Canalys’ PC Analysis service.

For more information, please contact:

Canalys EMEA: +44 118 984 0520

Ben Stanton: ben_stanton@canalys.com +44 118 984 0525

Robin Ody: robin_ody@canalys.com +44 118 984 0552

Canalys APAC (Shanghai): +86 21 2225 2888

Jason Low: jason_low@canalys.com +86 21 2225 2816

Mo Jia: mo_jia@canalys.com +86 21 2225 2812

Canalys APAC (Singapore): +65 6671 9399

Rushabh Doshi: rushabh_doshi@canalys.com +65 6671 9387

Ishan Dutt: ishan_dutt@canalys.com +65 6671 9396

Canalys Americas: +1 650 681 4488

Vincent Thielke: vincent_thielke@canalys.com +1 650 656 9016

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please complete the contact form on our web site.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).

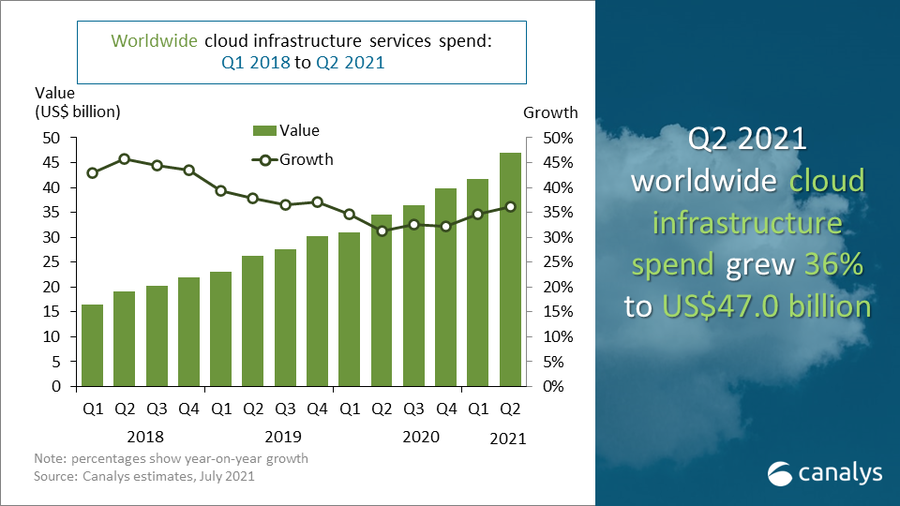

Global cloud services spending exceeded US$47 billion in Q2 2021