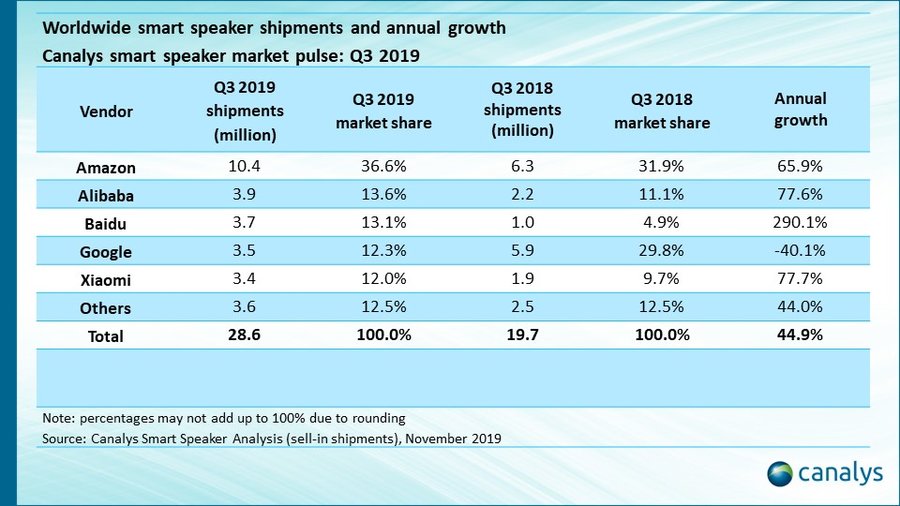

Canalys: Amazon smart speaker shipments crossed 10 million mark in Q3 2019

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Wednesday, 13 November 2019

The global smart speaker market grew 44.9% to reach 28.6 million units in Q3 2019. Amazon pulled ahead of the pack by shipping 10.4 million smart speakers after emerging from a stellar Prime Day performance, closely followed by strong back-to-school and off-to-college shopping campaigns. The Chinese e-commerce giant Alibaba regained top spot in the China market, placing it second globally. Google slipped from third in Q2 to fourth as the company advanced its Nest brand.

The open retail channel, which often offers promotions and discounts, became increasingly challenging for smart speaker vendors to stimulate sales. “Amazon introduced the ‘Echo Upgrade Program’ to entice users to trade-in old Echo or non-Echo Bluetooth speakers to further increase Echo device penetration in the household,” said Jason Low, senior analyst at Canalys. “The challenging retail environment and shipment decline compelled Google to seek more partnerships such as with Spotify, to drive sales through different channels. We are also seeing similar collaboration trends in China where Alibaba leveraged its retail relationship and channel capabilities to run smart speaker collaborations with brands such as Starbucks, Budweiser, Abbott and Oreo among other local and international companies. This has largely increased the consumer appeal of Tmall Genie devices.”

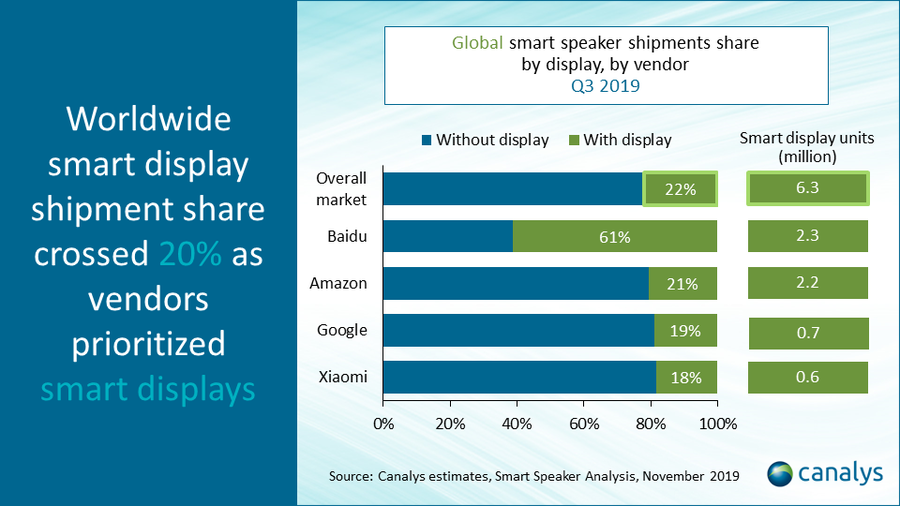

The smart display category grew 500% globally to reach 6.3 million units in Q3 2019, setting itself up as a key category. “The Echo Show 5 smart display contributed significantly to Amazon’s success in Q3, making up 16% of Amazon’s overall global shipments and it became the best shipping smart display of all the brands,” said Canalys research analyst Cynthia Chen. “Despite smart displays gaining importance in vendors’ strategies, consumer price sensitivity and pragmatic use cases remain key challenges to be solved.”

“Low-priced devices are vital growth drivers for smart displays and heated competition ahead of the Q4 shopping season is expected. It is crucial, especially for Chinese vendors, to avoid falling victim to the sunk-cost fallacy, in which they have to stop money-burning to achieve shipment goals, but instead focus on their overall business objectives and to generate revenue soon,” added Low.

For more information, please contact:

Canalys China

Cynthia Chen: cynthia_chen@canalys.com +86 158 2151 8439

Jason Low: jason_low@canalys.com +86 159 2128 2971

Canalys India

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Canalys Singapore

Ishan Dutt: ishan_dutt@canalys.com +65 8399 0487

Shengtao Jin: shengtao_jin@canalys.com +65 6657 9303

Canalys UK

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Kelly Wheeler: kelly_wheeler@canalys.com +44 7919 563 270

Canalys USA

Vincent Thielke: vincent_thielke@canalys.com +1 650 644 9970

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

China: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China

India: 43 Residency Road, Bengaluru, Karnataka 560025, India

Singapore: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535

UK: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK

USA: 319 SW Washington #1175, Portland, OR 97204 USA

email: contact@canalys.com | web: www.canalys.com